The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The FICO 10 & 10T scoring system weighs three factors more heavily: personal loans, history of delinquencies and credit utilization ratio.

The Fair Isaac Corporation (FICO) has announced it will be updating its credit scoring system this summer when they roll out the FICO Score 10 and 10T, which together represent the biggest change to the FICO system since 2014.

The new system is designed to help identify high-risk borrowers by incorporating people’s history of credit behavior, paying special attention to those who use personal loans to consolidate debt but do not pay that debt down. FICO has estimated that about 110 million users will see a change in their credit score under the new FICO 10 and FICO 10T systems.

Here we’ve broken down how the new system works, what effect you can expect it to have on your score and what to do differently under the new system.

What’s Different About the New Credit Scoring System?

The new FICO scoring system allows lenders to incorporate “trended data” that shows how responsibly a borrower behaves with regard to credit. It also adjusts how important certain information is when calculating your score.

Credit score factors weighed more heavily in the new FICO scoring model include:

- Personal loans, especially those used to consolidate credit card debt

- Delinquencies, especially those in the past two years

- Credit utilization ratio

Will My Credit Score Change?

Though millions are likely to see their scores change as a result of the switch to the FICO 10, not all of these changes will be significant, and some users could even see their scores receive a boost. FICO representatives estimate that about 40 million—with already high credit scores—could see their credit scores increase by a small amount, with another 40 million seeing a decrease in their scores.

Consider these factors and try to predict how your score may change in the switch to the FICO 10.

You’re likely to see a drop if:

- You’ve had recent delinquencies.

- You consistently carry a balance on your credit cards.

- You took out a personal loan to consolidate credit card debt.

- You’ve maintained a high credit utilization ratio in the past two years.

You’re less likely to see a drop (and your score might even increase) if:

- You’ve stayed current on your payments in the past two years.

- You’ve maintained a healthy credit utilization ratio in the past two years.

- You only put high balances on your credit cards occasionally and pay those balances down quickly.

Note: The FICO 10 will become available in the summer, but that doesn’t mean lenders will start using it right away. Many lenders still use FICO 8 or FICO 9.

What Can a 20-Point Difference Make?

According to FICO, most users whose credit scores change with the new system will see a difference of around 20 points. While that may not seem like much, a 20-point difference can be significant.

Here are three ways a 20-point drop in credit score can impact you:

1. Higher Loan Interest

Depending on where your score started, a 20-point drop can cost you significantly when it comes to taking out a home mortgage or auto loan. For example: On a 30-year fixed rate mortgage of $200,000, someone with a 660 credit score will pay about $18,000 less in interest than someone with a 640.

2. Higher Premiums on Insurance

Credit is also one of the factors that determines the amount you must pay in insurance premiums, and a 20-point difference can be significant there as well. According to insurance comparison site The Zebra, the average difference in annual premiums from “very good” (740 – 799) to “great” (800 – 850) credit is $116.

3. Weaker Loan Applications

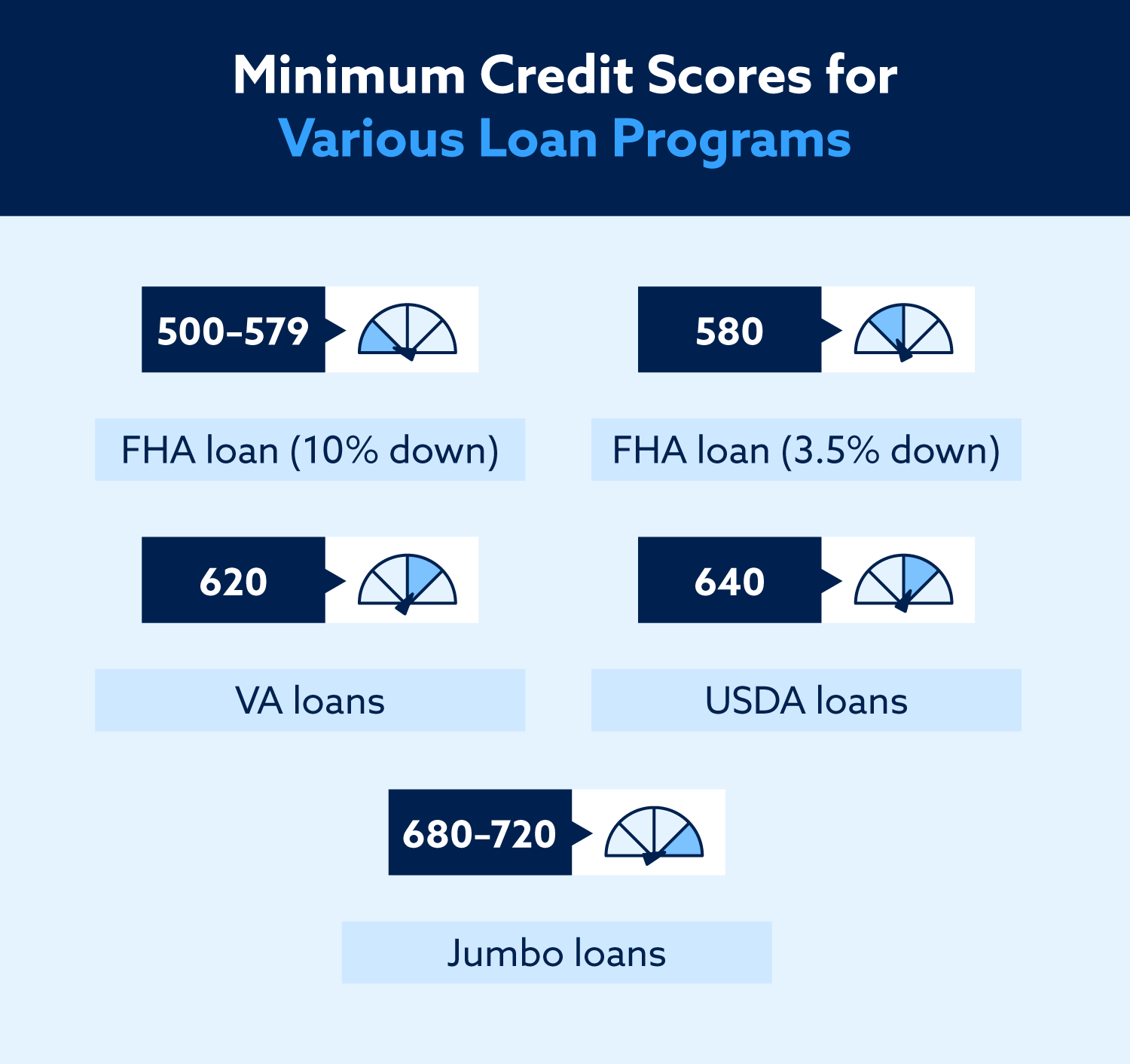

If your credit was already on the low side, a 20-point drop may do more than increase your interest and premiums—it can actually disqualify you for a number of applications. For instance, most low-interest mortgage programs (like FHA, VA and USDA) have strict minimum credit score requirements.

How Can I Keep My New Credit Score Up?

Best practices for keeping your credit score healthy will remain unchanged even after FICO rolls out its new system. However, certain tactics will be more powerful than others using the new FICO calculations.

Here are three key tactics for maximizing your new FICO score:

1. Keep Detailed Financial Records

The new credit scoring system weighs the last two years of debt balances, so it’s important to have accurate records on all of your lines of credit going back at least that far. Keeping pristine records of your debts is the first step to identifying and solving any problems or discrepancies.

2. Pay Credit Balances Early in the Month

Even though it amounts to the same as paying your bill once a month, paying your credit balance twice a month or even once a week can improve your credit score. By preventing your credit balance from ever getting too high throughout the month, you lower your credit utilization score, which is weighed heavily under the new system.

3. Sign Up for Boosted Credit Services

Alternative credit models like UltraFICO and Experian Boost raise users’ credit scores by incorporating “extra” data, like utility bills and rent payments. If you’re not enrolled in one of these services and you’re concerned about your score taking a plunge following the FICO 10 rollout, signing up could offset any negative impact caused by the new model.

Bottom Line: Good Financial Habits Are Always a Good Idea

When it comes down to it, good credit habits are essential, and none of the changes being made as part of the FICO scoring update are revolutionary. The same positive financial behavior that resulted in a great score with the old system will prove successful using the FICO 10 as well.

However, those who stand to be most impacted by a 20-point change in their score—like anyone whose score is currently on the cusp of two different credit categories—may want to use this information to strategize how best to protect their score from changes. There are a number of ways to work on improving your credit health that range from simple tweaks to long-term changes to your financial habits. It’s always a good time to start prioritizing your financial well-being!

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.