The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The Consumer Financial Protection Bureau (CFPB) is a government agency that helps protect the rights of American consumers. The agency’s goal is to “protect consumers from unfair, deceptive or abusive practices and take action against companies that break the law.”

The CFPB produces a report on credit and consumer reporting complaints every year. The agency works with the three largest nationwide consumer reporting agencies (NCRAs)—Experian®, Equifax® and TransUnion®—to collect this data and draw insights about trends and problematic areas that need to be addressed.

While this data is collected through the NCRAs, the report is produced independently of them. Based on the findings of this report, the CFPB can make suggestions about credit reporting and the complaint process, if deemed necessary.

The year 2021 was challenging for many consumers—both financially and with regard to credit reporting issues. The CFPB annual report shows some concerning trends from the previous year that hopefully won’t continue into 2022.

Don’t have time to read the full detailed report? Here are some of the major highlights we think you should know.

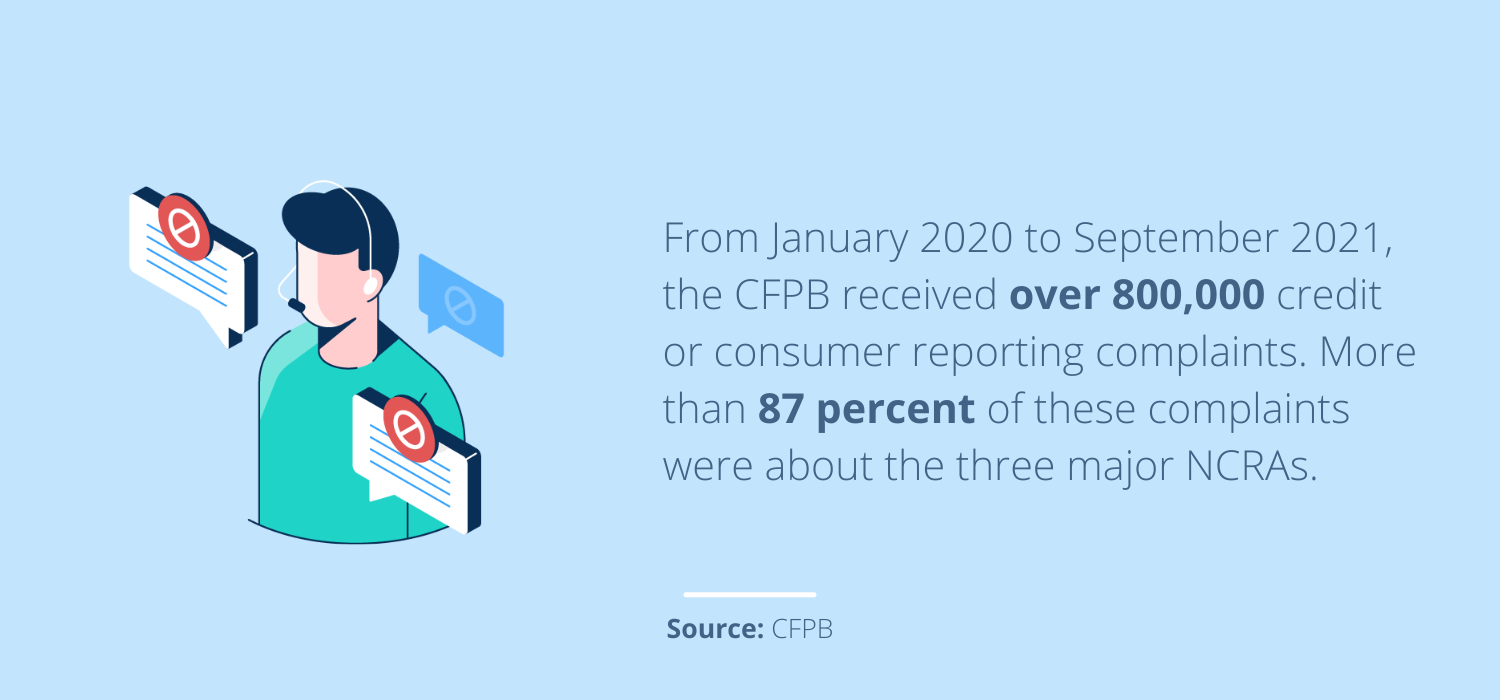

Consumers are increasingly complaining about the NCRAs

From January 2020 to September 2021, the CFPB received over 800,000 credit or consumer reporting complaints. More than 87 percent of these complaints were about the three major NCRAs.

The majority of complaints seem to stem from the following problems:

- The automated system: When consumers find inaccurate information on their credit reports and try to contact the NCRAs to file a dispute, they get caught up in an automated system. This system is largely unhelpful and doesn’t lead to consumer problems being resolved. This is an especially significant issue for consumers who are looking for a quick resolution because they’re going through major life events—such as buying a home or applying for employment.

- A waste of time and money: Many consumers complain about the exorbitant amount of energy put into disputing inaccurate data with the credit bureaus. The time dedicated to addressing these problems can be even more challenging if the consumer is also dealing with other personal issues. In fact, some consumers are driven to pay off debts they don’t believe to be theirs just to get the debt off their credit report and stop it from impacting their credit score further.

- Being caught between data furnishers and NCRAs: When attempting to dispute incorrect information on a credit report, consumers can talk to either the NCRA or the data furnisher (entities like credit card providers and mortgage lenders) about removing the information. However, many consumers report that when they attempt to file a dispute, the NCRA and the data furnisher just point back at each other, which makes it hard for consumers to get any help.

These problems seem to indicate a generally inefficient and broken credit system that’s leaving consumers feeling like they don’t have control over their own credit. Considering how much damage negative items can have on a person’s credit health, it’s incredibly disheartening when consumers can’t easily address inaccurate data that shouldn’t be impacting them.

Consumers have the right to dispute information on their reports

Consumers can (and should!) dispute inaccurate and incomplete information. Some common pieces of information that can be disputed on your credit report are:

- Debts that include the wrong amounts, dates or lender names

- Debts that are marked as open despite you paying them in full

- Debts that are marked twice

- Debts or accounts that don’t belong to you

- Missed or late payments that are incorrect

As noted by the majority of complaints received by the CFPB in 2021, while consumers may have the right to file a dispute, that doesn’t mean it’s easy to do so. It can be challenging to comb through your credit report to find inaccuracies and then handle the dispute with the NCRAs.

Any consumer who doesn’t have the time, energy or patience to take on this task should consider using a credit repair organization. These agencies offer professional credit repair services that work with you to review your report and challenge any unfair, inaccurate and unsubstantiated items.

Consumers also have the right to submit complaints about NCRAs if they feel their disputes aren’t being dealt with fairly. Under the Fair Credit Reporting Act (FCRA), the NCRAs are legally obligated to investigate legitimate credit disputes properly.

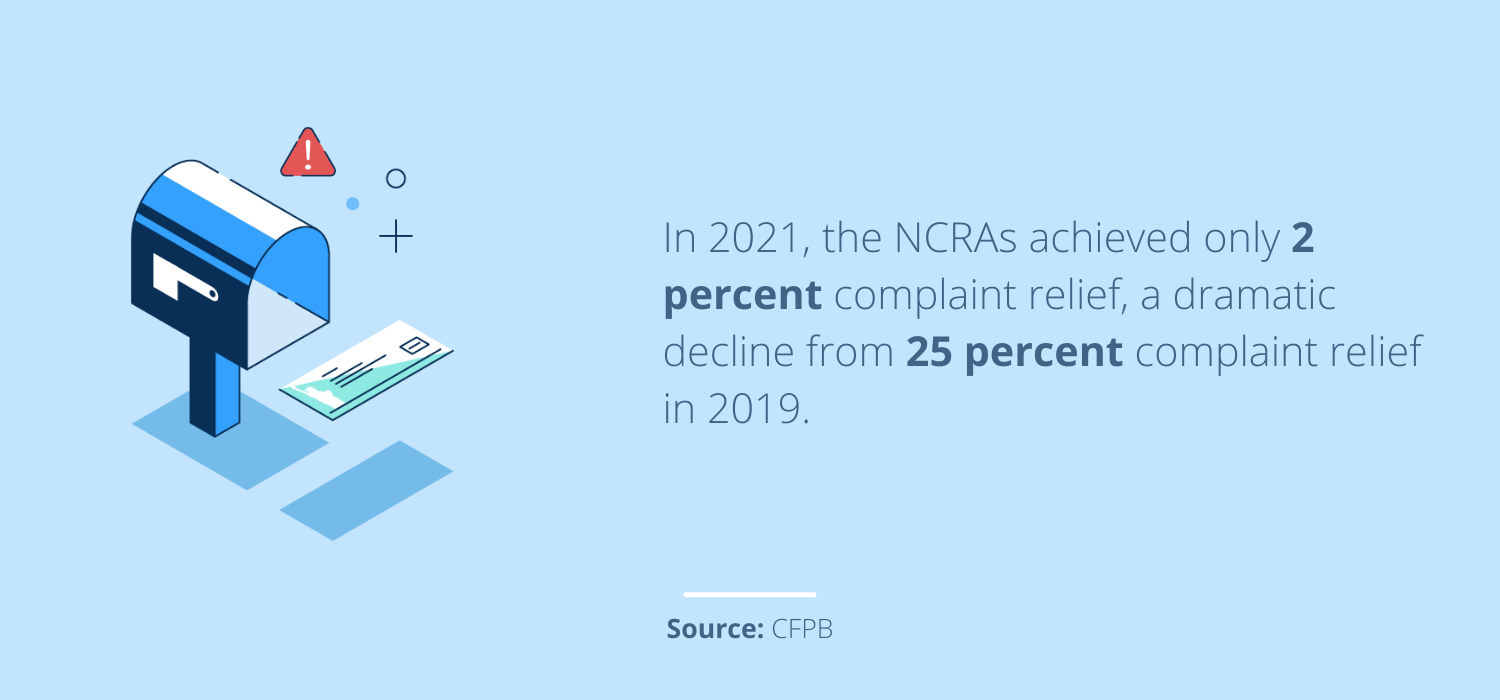

The NCRAs are providing less relief in response to complaints

Despite complaints being higher than ever, the NCRAs had a record low number of complaint resolutions. In 2021, the NCRAs achieved only 2 percent complaint relief, a dramatic decline from 25 percent complaint relief in 2019. The CFPB has found that the NCRAs are closing complaints faster and at lower rates of resolution.

The NCRAs legally have to investigate any disputes they deem legitimate. Additionally, it’s not just the consumers themselves who can file a complaint. Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, consumers’ third-party representatives can also file complaints on their behalf. The CFPB requires that NCRAs treat complaints equally, regardless of whether the consumer or a third-party representative has filed them.

However, according to the CFPB report, that isn’t happening. The NCRAs seem to have a pattern of ignoring complaints when they suspect a third party was involved in submitting them. Of course, there’s no way for the NCRA to know who submitted the complaint, so they’re coming to this conclusion based off of speculation.

As a result of ignoring complaints involving third-party submissions, the NCRAs are leaving many consumers without a response or resolution to their complaints.

Flaws with the credit reporting system can greatly affect consumers’ lives

Errors on credit reports can and do affect consumers, because a person’s quality of life can be greatly impacted by their credit in many ways—both positively and negatively. When someone has inaccurate information on their credit report, it can hurt their ability to secure a mortgage or be approved for a credit card, a car lease and more.

Your credit is even checked by some employers and landlords when you’re putting in an application, so inaccurate credit data can affect your ability to get a job or an apartment.

Lastly, as the CFPB states, these mistakes can also affect the economy as a whole. Credit errors keep people who are actually financially responsible from borrowing according to their true potential, which is a deterrent to our economy’s health.

What does this mean for you?

While systems are in place to help consumers fight incorrect credit data, it’s clear that these systems aren’t perfect. The most important step consumers can take is to understand their rights and advocate for them.

You need to stay educated about your rights (like the right to dispute inaccurate data) and be proactive with your credit. Managing your credit properly includes regularly checking your credit reports and scores so you can work to address anything inaccurate, unfair or unsubstantiated as soon as it appears.

Remember that you don’t have to take on this fight yourself. The CFPB report results show that many consumers felt exhausted when trying to file disputes, so consider going to the professionals within the credit system to get assistance. The credit repair consultants at Lexington Law Firm are here to help you today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.