The downsides to filing for bankruptcy include losing assets of value, damaging your credit and having difficulties acquiring loans in the future. The upsides include keeping your property, no longer receiving calls from collections and getting an opportunity to regain control of your financial life.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Filing for bankruptcy is an option for both individuals and businesses. Once your bankruptcy is discharged, you’ll typically have debts eliminated.

Although people often ask what the downsides of filing for bankruptcy are, it’s important to know that there are advantages as well. Bankruptcy provides you with a fresh start, and it also puts a stop to collection calls.

We’re here to help you understand the pros and cons of filing for bankruptcy. Knowing how bankruptcies work and when to file bankruptcy can help you make the decision that’s right for you.

Table of contents:

- What are the downsides of filing for bankruptcy?

- What are the advantages of filing for bankruptcy?

- Should I file for bankruptcy?

- What happens when you file for bankruptcy?

- What are the alternatives to filing for bankruptcy?

What are the downsides of filing for bankruptcy?

Filing for bankruptcy has potential downsides, like your credit being damaged or your debts not all being erased. It can be helpful to know what happens when you declare bankruptcy so you can make an informed decision.

You can lose some of your property

You may have to liquidate property in order to have your debts discharged. Some believe that filing for bankruptcy is a court order that tells creditors to erase your debt, but this isn’t the case. It’s more of a compromise. To have some of your debt eliminated, some property may be sold to pay back a portion of what you owe.

Some of the assets you’re at risk of losing during a bankruptcy include:

- Non-retirement account investments

- Expensive cars above your state’s nonexempt threshold

- Jewelry

- Property that is not your primary residence

- Furniture

There are more items you can lose in a bankruptcy, but this varies by state. Each state has exemptions for items that can be seized, and it also depends on the value of the items. During the bankruptcy court process, you’ll meet with a trustee who will advise the court on which assets can and should be seized to pay creditors.

You may get denied

A common misconception is that filing for bankruptcy is a sure thing, but it’s possible that the court will deny your filing. Depending on which chapter of bankruptcy you choose to file, there are different requirements. For example, if you make too much money, the court may not approve your request.

Your credit takes a hit

If your bankruptcy is approved, it can show up on your credit reports for up to 10 years. This negative mark on your credit reports can make it difficult to get a loan, rent a house or apartment and utilize other services, since it lowers your credit score.

According to TransUnion®, Chapter 13 bankruptcy should fall off of your credit reports seven years after the filing date. For those who file for Chapter 7 bankruptcy, it may take up to 10 years.

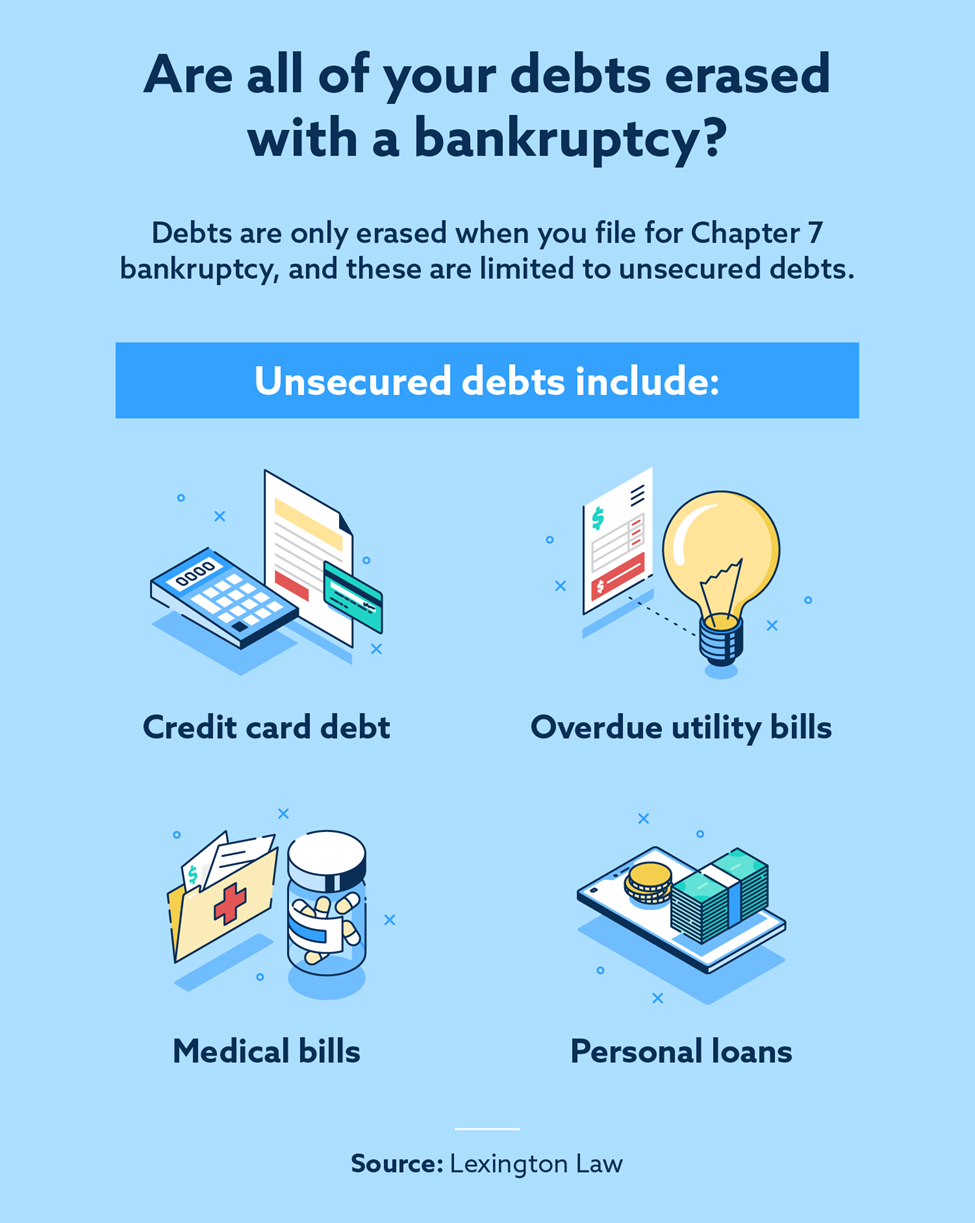

Your debts may not be erased

One of the first questions people have is “Does filing for bankruptcy eliminate debt?” The answer is that it depends on the type of bankruptcy you file and what kinds of debts you have.

Typically, when speaking about erasing debt, people are referring to Chapter 7 bankruptcy. It can erase some of your unsecured debts, but this decision is ultimately decided by the bankruptcy trustee and your creditors.

Some debts that might not qualify for discharge include:

- Recent taxes

- Court-ordered fines

- Child support

- Alimony

- Debts incurred through fraud

- Student loans

You’re at risk of fraud

Bankruptcy fraud is a real risk. According to the Journal of Accountancy, bankruptcy red flags include:

- Hidden or undervalued assets

- Messy or misleading financial records

- Transfers of high-value assets or large sums of money

This is why it’s often a good idea to work with an attorney who is familiar with bankruptcy law. There are a lot of details that go into the bankruptcy filing process, and hiding or even unintentionally not disclosing the right information can put you at risk of fraud. An attorney is an additional cost alongside your bankruptcy fees, but it may be worth it.

It can impact others

If others are connected to you financially, they won’t receive a discharge from your personal bankruptcy. This means that creditors can still try to receive payment from anyone you have a joint account with, as well as cosigners.

You can lose your business

For business owners, your business may not be safe from loss of assets during the bankruptcy. Your appointed bankruptcy trustee may question the value of your assets. If they feel your business can be used to pay back creditors, they may seek court approval to do so.

You can lose job opportunities

Some employers run your credit report when you apply, and negative marks can be a red flag for some jobs. This is primarily an issue with sensitive jobs.

What are the advantages of filing for bankruptcy?

It’s also important to know that bankruptcy has several advantages as well. Bankruptcy is designed to provide people with a fresh start or a payment plan that works with their financial situation. Knowing the advantages can help you weigh the pros and cons a little bit better.

Bankruptcy provides you with a fresh start

People often turn to bankruptcy because they’re drowning in debt, so filing can provide you with a fresh start. Regardless of which chapter you file for, ideally, your financial situation will be better than before you filed. Bankruptcy, after all, can help you get rid of credit card debt as well as medical bills or personal loans.

You get to keep your assets

The liquidation of property is specific to Chapter 7 bankruptcy, but you don’t lose all of your property. Each state has exemptions, too. This means that if some belongings like vehicles, jewelry or household items are valued under a set amount, you won’t need to liquidate them. Your trustee may also decide that some property isn’t worth liquidating.

You are granted an automatic stay

When you initiate the bankruptcy process, the court notifies creditors to stop calling and sending letters. This is a provision known as an “automatic stay.” An automatic stay prevents wage garnishments as well. For some, the regular collection calls and notifications in the mail are quite stressful, so putting a halt to collections can be a relief.

You’ll receive a payment plan that works for you

If you decide to file Chapter 13 bankruptcy, this is a debt restructuring option that allows you to create a payment plan. During the early stages of the filing process, you submit to the court a payment plan that you think works within your budget based on your current income. This can be helpful because your prior payments may have been much higher and more unmanageable.

You’re no longer at risk of legal action

When you’re in debt, there’s a chance that creditors may take legal action to receive the money that is owed. Once your bankruptcy is filed, it prevents creditors from taking you to court due to nonpayment. If a case was in court prior to filing for bankruptcy, the court case will be stayed.

You can still get loans

Yes, a bankruptcy will be on your credit reports, making it difficult to get loans, but you may still be able to acquire a loan. There are lenders who specialize in “high risk” lending, which means that they lend to people who have bad credit or negative marks like a bankruptcy.

How does bankruptcy affect your credit?

Not only does a bankruptcy typically appear on your credit reports for seven to 10 years, but it can also affect your score. According to Debt.org, a bankruptcy lowers your score depending on your score prior to filing. Those with higher scores will see a bigger drop than someone with an already low score.

If you already had a low score of 500 or lower, filing for bankruptcy may actually help boost your score. This is because bankruptcy can improve your utilization ratio, which is a comparison of your outstanding debt to your overall credit limit.

Getting approval for a loan or credit card after a bankruptcy can help as well. This is because you would have little to no outstanding debt compared to your available credit limits, and that would result in a favorable utilization ratio. Make sure to pay off your credit card debt through full and timely payments.

Should I file bankruptcy?

The decision to file for bankruptcy is ultimately up to you, but weighing the advantages and disadvantages will be helpful. If you’re married, it may be a good idea to sit down and do this with your partner. It’s also recommended that you seek the outside help of a financial advisor to get their professional advice.

These are some possible indications that bankruptcy might be right for you:

- You are unable to make payments regularly and on time

- You have numerous debt collectors calling

- You’re having difficulty paying other bills due to current debts

What happens when you file for bankruptcy

Prior to filing for bankruptcy, you’ll need to complete a credit counseling course. Once this is complete, you’ll start the filing process with the courts, which will put a stop to collections and wage garnishments. At some point, you’ll meet with a bankruptcy trustee, who will go through your bankruptcy paperwork and work with creditors, see if property needs to be liquidated and make a decision about whether your bankruptcy should be approved or not.

The bankruptcy process varies slightly depending on which chapter you file. For example, Chapter 7 bankruptcy will involve liquidating assets, and Chapter 13 lets you make a payment plan. The Chapter 13 bankruptcy process takes approximately three to five years to complete, but Chapter 7 bankruptcy can take as little as five or six months.

How much does filing for bankruptcy cost?

When you file for bankruptcy, you may pay between hundreds and thousands of dollars. Bankruptcy fees vary depending on your region, but you’ll typically be responsible for the following:

- Bankruptcy filing fee

- Trustee surcharge

- Administrative fee

These fees can be hundreds of dollars. It’s often recommended that you work with a bankruptcy attorney as well, and this is an additional cost based on the attorney’s rates. Americans who file for bankruptcy typically pay between $400 and $4,000 on average for the entire process if they choose to use an attorney.

What do you lose when you file for bankruptcy?

Liquidation of property is typically limited to Chapter 7 bankruptcy, and it can include various items. When you meet with a trustee, you’ll have provided a list of your property, and they will evaluate your items for potential value.

Property that you may lose includes:

- Jewelry

- Vehicles

- Money in bank accounts

- Investment accounts

Primarily, they’re looking for valuable items, which can also include valuable collections or artwork. A trustee is less likely to sell household items like clothes and furniture because they aren’t worth as much. Each state also has exemptions for different pieces of property like vehicles, tools and electronics. For example, in the state of Washington, vehicles worth less than $2,500, clothing worth less than $1,000 and books worth less than $1,500 are not seized.

Do you get out of all debts if you declare bankruptcy?

It’s very unlikely that all of your debt will be discharged. Many things play into what debt is discharged, including the type of debt, the chapter you file and the laws in your jurisdiction. You may discharge debts in Chapter 7 and Chapter 13, as well as Chapter 11. Each case is individual and may be handled differently. It is fairly common to eliminate all or a portion of unsecured debts, which often include:

- Credit card debts

- Utility bills

- Medical bills

- Personal loans

Is a bankruptcy discharge guaranteed?

When you file for bankruptcy, there is a change it could be denied. The bankruptcy trustee goes through the specifics of your bankruptcy case and will make recommendations to your judge, who will make the decision about your discharge. If your bankruptcy isn’t discharged, there’s also a chance that you may not be able to file for bankruptcy again for a specified period of time.

Here are some of the reasons your bankruptcy might not be discharged:

- You don’t file the paperwork properly

- You make too much money

- You did not complete the required courses

- There are fraud actions against you in the Bankruptcy Court or the U.S. Trustee’s Offices

- You did not make your Chapter 13 bankruptcy payments

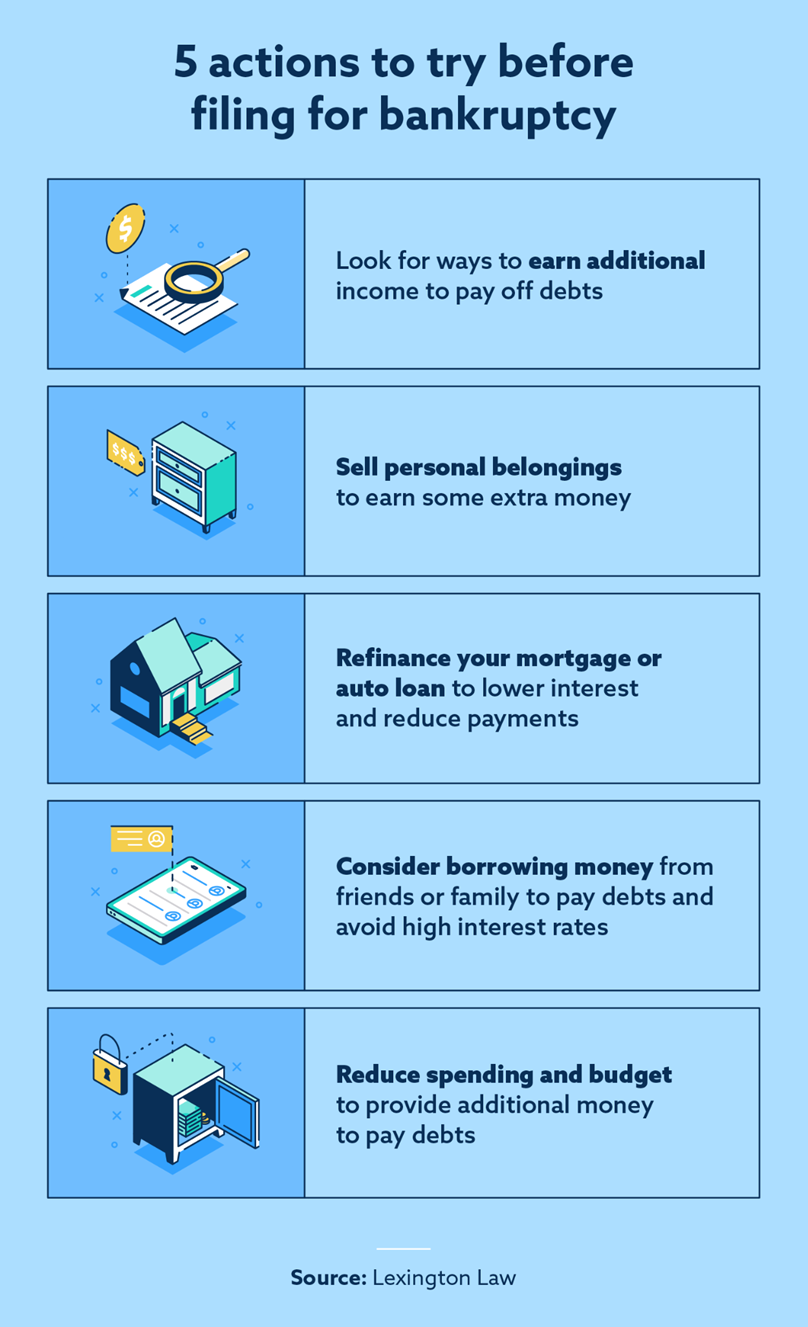

What are the alternatives to filing for bankruptcy?

There are plenty of alternatives to bankruptcy that you can try before making the decision to file. One common method people use is debt settlement, which is when you work with collectors to try and negotiate a lower payoff price. There’s also the option for debt consolidation to combine your debts into one payment and hopefully get a lower interest rate as well.

You can also consider these other options:

- Look for additional sources of income

- Sell personal assets

- Ask friends or family for a loan

- Refinance your mortgage and auto loan

- Find ways to reduce monthly spending

These alternatives can save you from harming your credit score and the other disadvantages of a bankruptcy. Options like borrowing money can help you avoid interest as well. For example, a friend or family member is less likely to charge you interest if you pay them back than a typical lender.

What’s next?

Now you have additional information to help you make your decision about filing for bankruptcy. Should you choose to file for bankruptcy, your credit score will likely drop, but there may be ways to address the bankruptcy item on your credit reports.

Lexington Law Firm has a team of consultants who can assist you with credit repair. We provide a wide range of services for those looking to work on their credit. To learn more, contact us today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.