The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Key takeaways:

- Insolvency is a state in which a person or entity is unable to pay what they owe to creditors.

- Insolvency typically arises when a person or business is experiencing economic hardship or borrowing excessively.

- Businesses and individuals can potentially avoid bankruptcy by increasing income, working with a financial advisor, and settling debts.

Insolvency, or being unable to pay one’s bills, typically arises when a person or business is experiencing economic hardship or borrowing excessively. When experiencing insolvency, businesses and individuals can potentially avoid bankruptcy by increasing income, working with a financial advisor and settling debts.

When asking, “What is insolvency?” the distinction between individuals and businesses is an important one. This will help you understand the options and determine the right fit for your situation.

Here, you’ll learn about the different types of insolvency as well as how and why it happens. We’ll also cover the difference between insolvency and bankruptcy so you’re aware of different routes you can take to repair your finances.

Table of contents:

- How does insolvency work?

- What causes insolvency?

- What are the signs of insolvency?

- What are two types of insolvency?

- Insolvency vs. bankruptcy: What’s the difference?

- 5 steps to take when you’re insolvent

- What happens when you claim insolvency?

- What is insolvency? FAQ

How does insolvency work?

Insolvency isn’t a process—it is a state in which a person or entity is unable to pay what they owe to creditors.

The IRS defines insolvency as when a person or business’s liabilities have become greater than its assets. The IRS uses this situation to decide if canceled debts should or should not be included in a person’s income taxes.

What is an example of insolvency?

To better understand insolvency, let’s look at some examples. If a restaurant owner owes $200,000 to their various vendors but the restaurant is only worth $150,000, the business is insolvent. Or, if an individual owes $30,000 in credit card debt but their net worth is only $25,000, they would also be insolvent.

What causes insolvency?

Insolvency can happen due to poor financial management as well as factors out of a person’s control, like unexpected bills. There are various ways that financial insolvency can happen.

Some of the most common causes of insolvency for businesses include:

- Budget mismanagement

- Rising costs to vendors

- Losing a lawsuit

- Not keeping up with competitors

- Excessive borrowing

For individuals, common causes include:

- Job loss

- Reduced salary or working hours

- Divorce

- Medical debt

- Excessive use of credit cards

What are the signs of insolvency?

Knowing the signs of insolvency can help you avoid this situation. This will give you more time to get your finances in order and prevent the negative consequences that come from being insolvent.

The following are signs that you or your business may be nearing insolvency:

- You are regularly late making payments

- You are late to pay employees

- You are taking on more debt to pay off other debts

- You have lost vendors due to late or missed payments

- You need to sell assets or property to pay debts

- You are unable to collect debts that are owed to you

- You regularly receive calls or notices from your creditors

What are two types of insolvency?

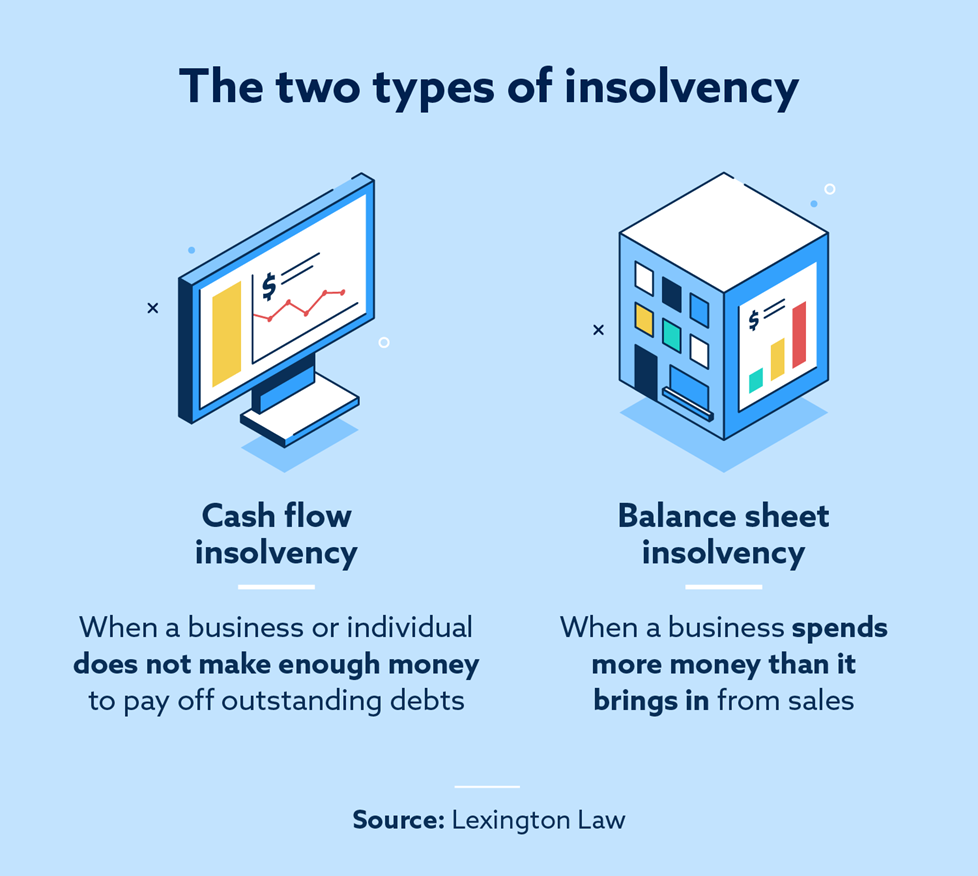

To further understand insolvency, it’s helpful to unpack the two types: cash flow and balance sheet insolvency. Cash flow insolvency is more common for both individuals and businesses and can happen at any time. Balance sheet insolvency is primarily a concern for businesses.

Cash flow insolvency

Cash flow insolvency happens when you don’t have the money to pay off your debts. This is more common because it can happen whenever you have an unexpected financial situation. For example, people often become cash flow insolvent when they’re laid off and no longer have a reliable source of income. Ongoing financial mismanagement can also lead to long-term insolvency.

Some individuals or businesses find that they’re insolvent after they exhaust other options like selling personal assets. This can also happen if you were borrowing money to pay off debts and no longer have access to new loans.

Balance sheet insolvency

In short, balance sheet insolvency is when a business is spending more than it is bringing in. For example, if you’re spending $30,000 a month to keep the business running and it’s only bringing in $10,000 per month, this is balance sheet insolvency. When the business isn’t bringing in enough money and the value of its assets is less than what it owes to creditors, the business has negative net assets.

If an owner believes that their business is insolvent, there are a few common routes they can take to avoid bankruptcy:

- The business may hire a financial advisor or accountant to see if the business can cut spending or budget in other ways.

- The business may hire a business consultant to see if they can improve business operations.

Insolvency vs. bankruptcy: What’s the difference?

Insolvency is a financial situation, while bankruptcy is a legal proceeding. You can go through insolvency without having to file for bankruptcy. The bankruptcy process allows you to find a resolution with creditors through the legal system. With insolvency, there’s a low possibility that you’ll need to deal with the courts at all.

There are downsides to filing for bankruptcy, so individuals or businesses may benefit from finding a solution to insolvency before turning to bankruptcy as an option.

If you do decide to file for bankruptcy, it is important to know that there are different forms of bankruptcy, like Chapter 7 and Chapter 13. Deciding on which form of bankruptcy to file depends on the individual or business. If your bankruptcy filing is approved, it can help to either eliminate debts or provide you with a manageable payment plan. Although it can provide some relief, bankruptcy may be difficult to remove from your credit report.

5 steps to take when you’re insolvent

The following steps may help you prevent bankruptcy if you are insolvent.

Step 1: Contact a debt counselor or debt management company

A debt counselor or debt management company can help you find options for dealing with your insolvency. You may even be able to find nonprofit help in your area. They can assist you with a plan of action to pay or settle your debts, which often includes either debt restructuring or debt consolidation.

Debt restructuring involves renegotiating the terms of an existing debt to make payments more manageable. With debt consolidation, borrowers can pay off multiple debts by taking out a new loan, often at a lower interest rate.

Step 2: Try to negotiate a settlement for your debts

Negotiating your debts can be done with or without outside help. You can contact your creditors to see if they’re willing to settle the debts you owe for a lower price. If you are dealing with collection agencies, it can be helpful to know debt collection laws. In some cases, you can lower your debt by upwards of 50 percent of what you owe.

Step 3: Find out if you owe taxes

If you’re able to settle your debts, you may be liable for taxes. This can happen if the creditor writes off your debt in a settlement. To find out if you owe any taxes, it’s helpful to contact a tax professional or credit counseling agency.

Step 4: Check if you are eligible for an insolvency order

An insolvency order happens through the courts and protects you from filing for bankruptcy. If approved, the insolvency order may also prevent debt collection efforts temporarily.

Step 5: Seek legal counsel

Finally, it may be beneficial to contact legal counsel. You may be dealing with illegal debt collection practices that you’re unaware of. By working with a lawyer, you’ll receive professional advice to ensure you handle your insolvency properly.

What happens when you claim insolvency?

Once a business has filed for insolvency, it will typically work with an insolvency practitioner to determine the best course of action.

This professional will assess the business’s assets and liabilities and determine whether it can be restructured or should be wound up. In the case of restructuring, the professional may work with the business to develop a plan to pay off its debts over time. If the business is wound up, it will sell off its assets and distribute the proceeds to creditors.

When an individual claims insolvency, they typically file for bankruptcy, which involves a legal process to seek relief from debts they can’t pay.

FAQ: What is insolvency?

In case you’re still wondering what insolvency is, we’ve answered common questions about it below.

Can you recover from insolvency?

Whether you’re a business owner or an individual, you can recover from insolvency. As you’ve learned, insolvency can be due to a temporary setback or mismanaged finances. In both cases, you can bounce back by taking the right steps.

For a business, this may mean better business management or accounting. If you have a business that’s spending far more money than it’s bringing in, it may be time to develop a new plan. This may involve cutting spending or finding ways to bring in new customers.

Individuals who become insolvent may need debt relief, which gives you the opportunity to adjust your payments. You may also find that seeking out additional sources of income or spending less allows you to recover and pay off your debts.

What is insolvency in simple words?

Insolvency occurs when a person or a business can’t pay their debts on time. It can happen for many reasons, such as poor money management, loss of income, or unexpected events.

What is insolvency in business?

Insolvency in business occurs when a company can’t pay off its debts as they become due. When a business becomes insolvent, it may have to consider restructuring, selling off assets or developing a debt repayment plan. The goal is to help the business get back on its feet and become financially stable once again.

Does insolvency affect your credit?

If you’re dealing with insolvency, it may be affecting your credit. Things like missing payments, making late payments and maintaining high credit utilization hurt your credit. It’s also possible that you might have errors on your credit reports that negatively affect your credit. Fortunately, help is available.

Lexington Law Firm can help you understand your credit and work to address any errors on your credit reports. The consequences of your insolvency may not be as bad as you think, and that is where we come in. To see which service is right for you, get your free credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.