Pandemic Unemployment Assistance (PUA) gives each state the ability to provide unemployment insurance benefits to individuals who are not normally covered by unemployment insurance.

Pandemic Unemployment Assistance (PUA) gives each state the ability to provide unemployment insurance benefits to individuals who are not normally covered by unemployment insurance, like freelancers and gig workers.

PUA is part of the federal Coronavirus Aid, Relief and Economic Security (CARES) Act that provides financial and other aid to Americans affected by the COVID-19 pandemic. However, since unemployment insurance is a state-run program, state governments still determine the application process, the amount paid out and other factors. Stay up to date on your state’s PUA program by visiting your state’s unemployment insurance benefits office website.

Below, we’ll explain how unemployment affects your credit, important information on PUA provided by the CARES Act and how PUA may differ between states.

How Unemployment Affects Your Credit

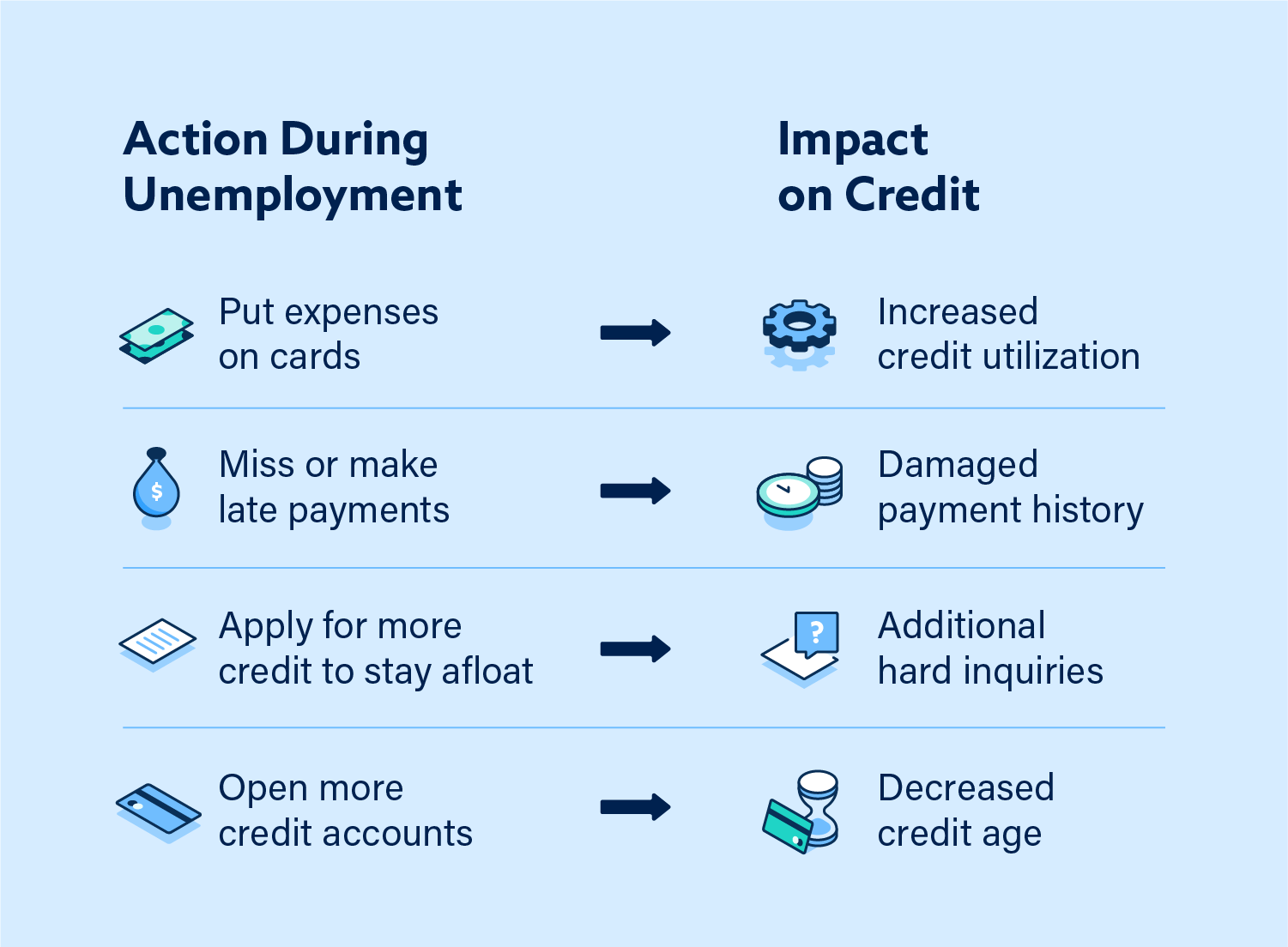

Losing your job and filing for unemployment have no direct impact on your credit score and do not appear on your credit report. However, the effect that unemployment has on your finances may indirectly impact your credit.

For example, you might need to put expenses on a credit card while you are unemployed. The resulting increased credit utilization can knock down your credit score. Your credit score can drop more if you miss a payment as a result of your lost income. However, unemployment insurance can help unemployed workers avoid these issues.

How Pandemic Unemployment Assistance (PUA) Works

The CARES Act was signed into law on March 27, 2020. The benefits of the PUA program are available retroactively if the time of unemployment occurred on or after January 27, 2020. PUA will end on December 31, 2020.

These are the main benefits provided by Pandemic Unemployment Assistance (PUA):

- Extends eligibility for unemployment insurance benefits to those who would not normally qualify like independent contractors, self-employed workers, gig workers and freelancers

- Provides up to 39 weeks of benefits to those who qualify for PUA

The amount of benefits paid also varies by state and is determined based on the weekly benefit amounts (WBA) of that state’s unemployment insurance laws.

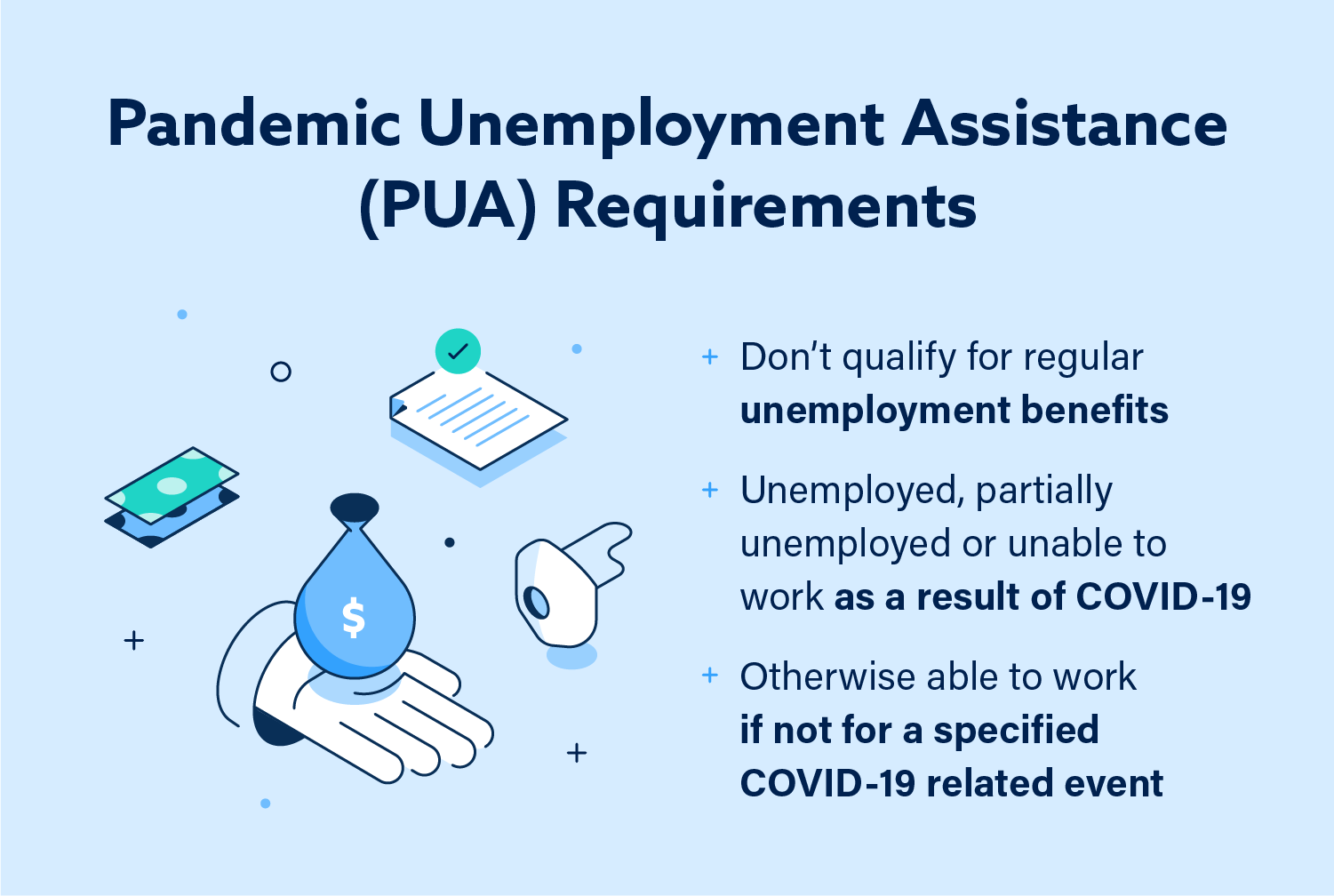

Pandemic Unemployment Assistance (PUA) Requirements

The CARES Act gives states the flexibility to amend their current laws to give unemployment benefits to those affected by COVID-19. Below are the requirements outlined in the CARES Act for a person to qualify for PUA:

- Must not qualify for regular unemployment benefits in your state

- Must be unemployed, partially unemployed or unable to work because of health or economic reasons relating to COVID-19

- Must be otherwise able to work if not for one of the following conditions:

- You are diagnosed with COVID-19 or experiencing symptoms and awaiting diagnosis

- A member of your household is diagnosed with COVID-19

- You are caring for a family member or someone in your household who is diagnosed with COVID-19

- You are the primary caregiver of a child or other person in the household who is unable to attend schools that are closed as a result of COVID-19 and the school or facility is required for you to work

- You cannot reach your place of employment as a result of the COVID-19 pandemic

- You are unable to go to work because a health care advisor advised you to self-quarantine due to COVID-19 related concerns

- You were scheduled to begin a job that’s now unavailable as a result of the COVID-19 pandemic

- You became the breadwinner or major support of your household because the head of household has died as a direct result of COVID-19

- You had to quit your job as a direct result of COVID-19

- Your place of employment has closed as a direct result of COVID-19

The Department of Labor says you may also be eligible for PUA if you’ve exhausted regular unemployment benefits and benefits under the Pandemic Emergency Unemployment Compensation (PEUC) program. We’ll explain PEUC later in the article.

Workers falling under these criteria are not eligible for PUA according to the CARES Act:

- Workers who can telework

- Workers who are not authorized to work in the United States

How to Apply for PUA

You need to apply for PUA with the unemployment insurance office in the state you worked. If you worked in a state different from where you live or worked in multiple states, the state you currently live can give you information about filing a claim in other states.

Each state has their own PUA process. Here are a few examples of what information your state may require:

- Personal information like your Social Security number and address

- Information about your last employer

- Last date worked

- Reason for unemployment

Nontraditional workers with reportable income may need to report extra information depending on your state’s requirements. This could include your most recent tax return or bank statements.

Other Unemployment Programs Under the CARES Act

In addition to PUA, the CARES Act has two other unemployent programs to assist affected workers. Below are brief explanations of both.

- Pandemic Emergency Unemployment Compensation (PEUC): Allows states to provide up to 13 weeks of benefits to qualified individuals after regular unemployment benefits are fully exhausted

- Federal Pandemic Unemployment Compensation (FPUC): Provides an additional $600 weekly payment to qualified individuals who are receiving normal unemployment insurance benefits

How to Manage Your Credit During Unemployment

Here we’ve listed a few ways to stretch your budget and keep your credit afloat during this difficult time. However, it’s important to make the decision that’s best for your situation.

- Take advantage of government assistant programs like PUA and the Supplemental Nutrition Assistance Program (SNAP).

- See if local businesses are offering deals for unemployed workers like free coffee or meals.

- Get supplies from local food banks and other charitable organizations offering help.

- Call companies who regularly bill you, like credit card and utility companies, to ask about forbearance and relief options.

- Make strategic decisions about when you use cash and when you use credit cards.

- Consider the pros and cons of balance transfers if you have a high-interest card with a balance.

Unemployment at any time is tough on its own. These uncertain times add pressure to an already stressful situation. We recommend that you stay as informed and up-to-date on the current situation and available relief options, in addition to carefully budgeting your finances.