The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Yes, you can discharge student loans in bankruptcy. However, this process is difficult and involves proving undue hardship in court.

You may have wondered whether you can file bankruptcy on student loans. The short answer is yes, you can file bankruptcy on student loans—but it’s not easy.

Filing either Chapter 7 or Chapter 13 bankruptcy could allow you to discharge your student loan debt. To do this, in addition to the normal bankruptcy process, you must prove that paying the loan amount is causing you undue hardship.

This process is notoriously difficult, involves filing what is called an adversary proceeding and carries potential burdensome consequences with it.

In this article, we’ll explain what undue hardship is for student loans, how to prove undue hardship and what to do if you can’t prove it in court.

Table of contents

- What is student loan bankruptcy?

- What is undue hardship for student loans?

- How to file bankruptcy on student loans

- Potential student loan bankruptcy outcomes

- The downsides of bankruptcy for student loans

- Alternatives to filing bankruptcy on student loans

What is student loan bankruptcy?

Student loan bankruptcy is a method borrowers can use to discharge their student loan debt. While bankruptcy does not discharge student loan debt automatically, there are steps you can take to have your student loan debt discharged with your other debts if you file for Chapter 7 or Chapter 13 bankruptcy.

This involves additional filings and arguments in court, where you will have to prove that the loans are putting you through undue hardship.

What is undue hardship for student loans?

In essence, undue hardship means that student loans are putting a substantial amount of stress on your finances that makes it difficult or impossible to maintain a minimum standard of living.

Different courts use slightly different standards, but the main test is called the Brunner test. With this test, you must prove three things in order to claim your student loans are giving you undue hardship:

- Poverty: You will be unable to maintain a minimum standard of living for yourself and your dependents given your current income if you are forced to repay your debts.

- Persistence: If forced to repay the debts in full, your financial struggles will remain well after the debt has been repaid.

- Good faith: You have made a good faith attempt to repay all debts, including student loans.

There is also the totality of circumstances test used by some courts. As its name implies, it uses the totality of your financial circumstances to determine whether your student loans are causing undue hardship.

These circumstances can include:

- Dependents

- Disability/health

- Age

- Any government assistance you are receiving

- Current income

- Payment history

- Extenuating circumstances

- Attempts to increase your income and reduce your spending

While people generally consider it easier to prove undue hardship with the totality of circumstances test, both tests are lengthy processes that require substantial documentation. Consider seeking legal consultation at all steps of this process.

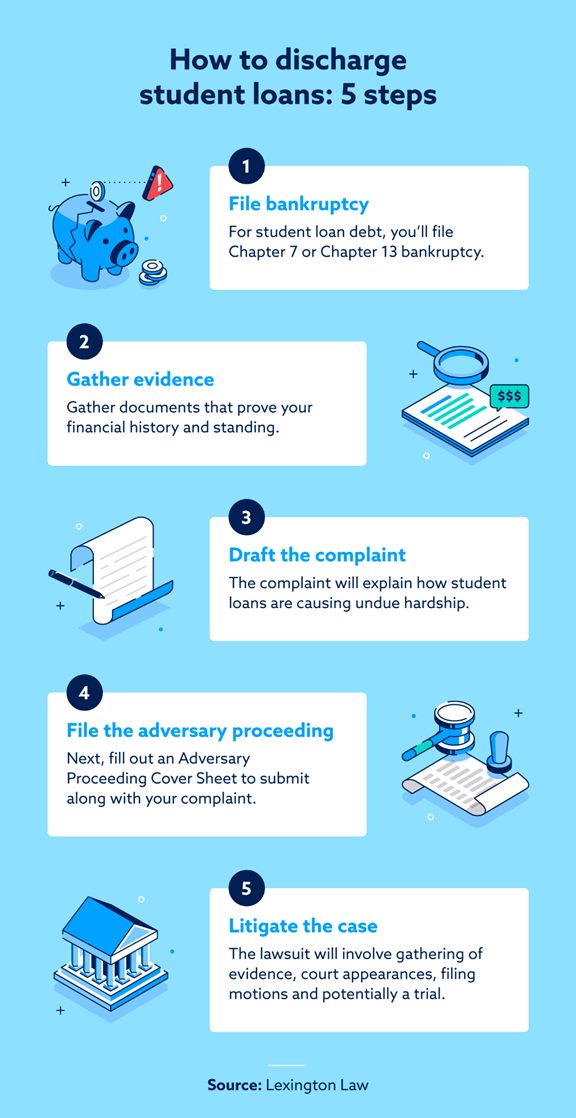

How to file bankruptcy on student loans

The process for discharging student loans in bankruptcy is different depending on if you file Chapter 7 or Chapter 13 bankruptcy. We’ll take you through the steps for both.

1. File bankruptcy

Before anything else, you need to file Chapter 7 or Chapter 13 bankruptcy. To do this, seek out a bankruptcy attorney and compile all student loan records and other personal financial paperwork.

Your personal financial situation will determine which bankruptcy status is right for you. With Chapter 7 bankruptcy, after a rigorous means test, your nonexempt assets are liquidated to pay off creditors. Any remaining debt is then discharged in the bankruptcy.

A Chapter 13 bankruptcy works differently. Instead of an immediate discharge, Chapter 13 works by setting up a payment plan over the course of three to five years, where you will pay some, but not all, of your debts. Assuming you meet all requirements, at the end of this period, whatever remaining debts you have may be discharged.

2. Gather evidence

Gather evidence of financial behavior including income history, job history, relevant medical history, prior attempts to pay your debts and other personal financial details. Ensuring you’re prepared with all documentation is key, as it can make or break a case.

When in doubt, it’s better to over-prepare than under-prepare. We recommend consulting with an attorney to ensure you gather all necessary documentation.

3. Draft the complaint

Before continuing to the adversary proceeding, you’ll need to draft a complaint. This is the legal basis for a lawsuit. An adversary proceeding is essentially a lawsuit within a bankruptcy filing, where you assert that the student loans are causing you undue hardship.

This complaint also includes administrative details and the circumstances of your undue hardship. The complaint is complicated, so it can be worth consulting a checklist or guide. An example complaint can also be a useful tool in determining how you should draft and format your own.

4. File the adversary proceeding

An adversary proceeding is a bankruptcy court’s version of a lawsuit. To file one, you must fill out the Adversary Proceeding Cover Sheet (Form B 104), and submit it with your complaint to the appropriate court. While this process can be completed without a lawyer, if you’re unsure which court is appropriate for you, consider seeking out an attorney in your area.

Once your complaint and adversary proceeding have been received, the clerk’s office will issue a Summons in an Adversary Proceeding Form (Form 2500A). You (or your attorney) will issue this form to your loan provider to let them know they are being sued.

Summons in an Adversary Proceeding Forms have strict rules and steps that must be followed, so review them carefully with your attorney, or let your attorney handle it for you.

5. Litigate the case

If you haven’t hired an attorney by this point, it’s recommended to do so now. A lawyer will help guide you through the complexities of litigation and keep you informed of your duties and obligations.

Once the attorney for the lender or student loan servicer has replied to the Summons in an Adversary Proceeding, the lawsuit will begin. This will play out similarly to most other cases, involving gathering evidence on both sides, making court appearances, filing motions and potentially going to trial.

Many cases will end in a settlement, where both parties agree to a certain resolution outside of court and the case is dismissed. This is often the desired outcome, as court time is time-consuming and expensive.

Potential student loan bankruptcy outcomes

After this lengthy process, there are four potential outcomes to filing bankruptcy on student loans:

- Complete discharge: The court agrees that you’ve met the burden of proof for undue hardship and your loans are discharged completely.

- Partial discharge: The court decides that you can still pay some of your student loans while maintaining a minimum standard of living. Any remaining balance is still your responsibility.

- No discharge: You fail to prove undue hardship. Whatever you owed before is still what you owe afterward. However, sometimes you can negotiate a lower interest rate on your remaining balance.

- Settlement: You and the lender agree, outside of court, on a lump sum and/or monthly amount that they will take off your remaining balance.

While some outcomes are better than others, there are potential benefits even if you don’t receive any discharge.

The downsides of bankruptcy for student loans

Though bankruptcy can be a useful method to help deal with excessive student loan debt, it’s only recommended as a last resort. Other methods are available, and may be far easier than filing bankruptcy.

- Bankruptcy carries significant disadvantages for future financial prospects.

- It can have a large negative impact on your credit.

- People who file for bankruptcy will end up paying between $400 and $4,000 dollars on average.

- This does not count the costs of an adversary proceeding.

- Filing an adversary proceeding will cost about $350, excluding attorney fees.

These costs are also impacted by the state you live in, at what stage you hire a lawyer, the type of bankruptcy you file and other factors unique to your case. Attorney fees with an adversary proceeding can make your costs jump up a few thousand dollars, depending on where you live and what firm you choose.

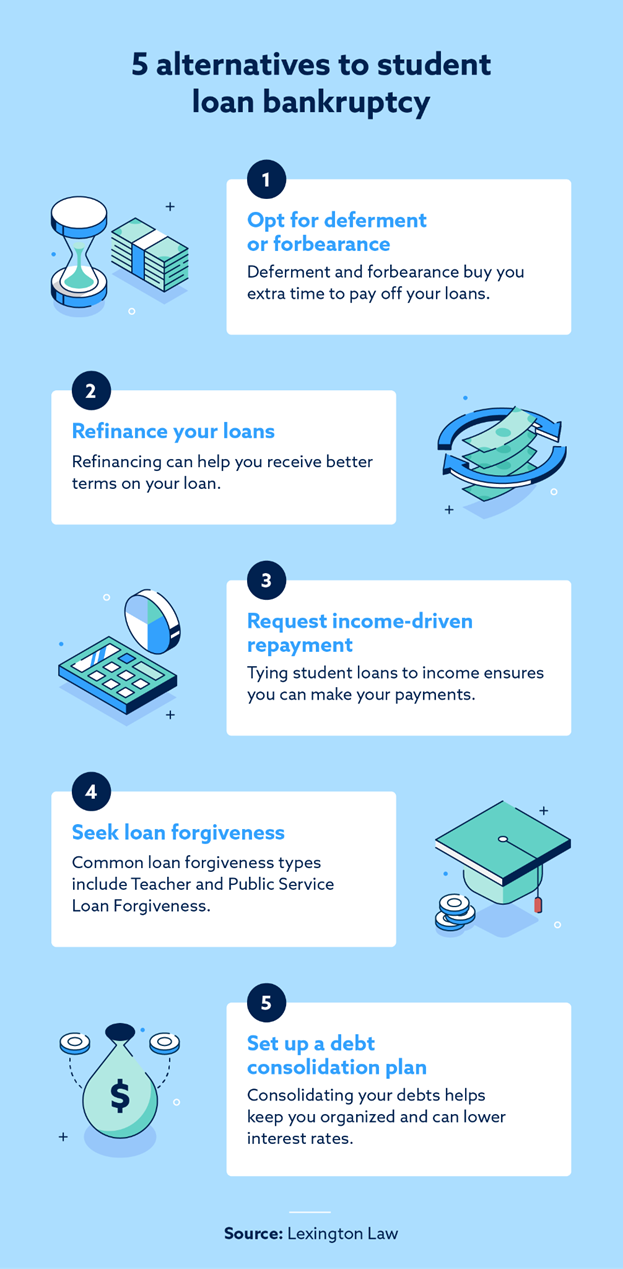

Alternatives to filing bankruptcy on student loans

If you go through this entire process and find you cannot prove undue hardship in court, hope isn’t lost. There are many other methods of alleviating the burden of your student loan debt besides bankruptcy.

Opt for deferment or forbearance

Deferment and forbearance are ways to have the payments on your student loans delayed. Deferment is a period of time—up to three years—where you don’t have to pay your student loans. This can be helpful if you’re experiencing a temporary period of hardship, such as struggling to pay rent or utilities.

However, this can potentially be dangerous, and lead to you owing more. Depending on what type of loan you have, you may end up accruing interest even while the principal payment is deferred.

Forbearance is similar to deferment and easier to qualify for. However, forbearance only pauses your payments for up to a year. Interest will also typically accrue during forbearance, so keep that in mind if you’re considering this option.

Refinance your student loans

Refinancing is done by taking your student loans to a private lender and negotiating a better interest rate or a more manageable monthly repayment.

This carries a few requirements, like a solid credit score, a clean credit report and enough income to cover other debt payments. If you meet these criteria, refinancing can potentially save you thousands of dollars over the lifetime of your loan.

Refinancing does come with drawbacks. For one, the inquiries required can affect your credit, and refinancing is always done through a private lender. This can make you ineligible for federal loan forgiveness programs and federal repayment options, like an income-driven repayment plan.

Request income-driven repayment

If you received your student loans through the federal government, you may be eligible for an income-driven repayment plan. This is a program that attaches your student loans to a percentage of your discretionary income, usually between 10 and 15 percent.

This repayment term lasts between 20 and 25 years. At the end of the term, if you still have an outstanding balance, your loans are eligible for forgiveness. Income-driven repayment is a great option for eligible borrowers, though it may end up costing you more in interest payments over time, and any forgiven student loans may be considered taxable income.

Seek loan forgiveness

The Department of Education has student loan forgiveness options available for people who attended a fraudulent school, suffered a severe and permanent physical or mental disability or work in public service. However, even debt forgiveness has pros and cons, so be sure to examine your options and eligibility under federal law.

Set up a debt consolidation plan

Debt consolidation allows you to combine multiple debts into one. This way, you only have to remember one payment instead of multiple, and it can potentially lower your interest rates. However, there are downsides. Those with poor or fair credit scores may not be eligible, and you may have to pay certain fees.

Student loan bankruptcy is a tricky process to navigate. If you do decide that bankruptcy is right for you, however, it doesn’t have to mean the end of your good credit.

There are steps you can take to repair your credit after bankruptcy. If you think that your credit has been unfairly impacted by inaccurate credit reporting, consider talking to our credit repair consultants to see if we can help.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.