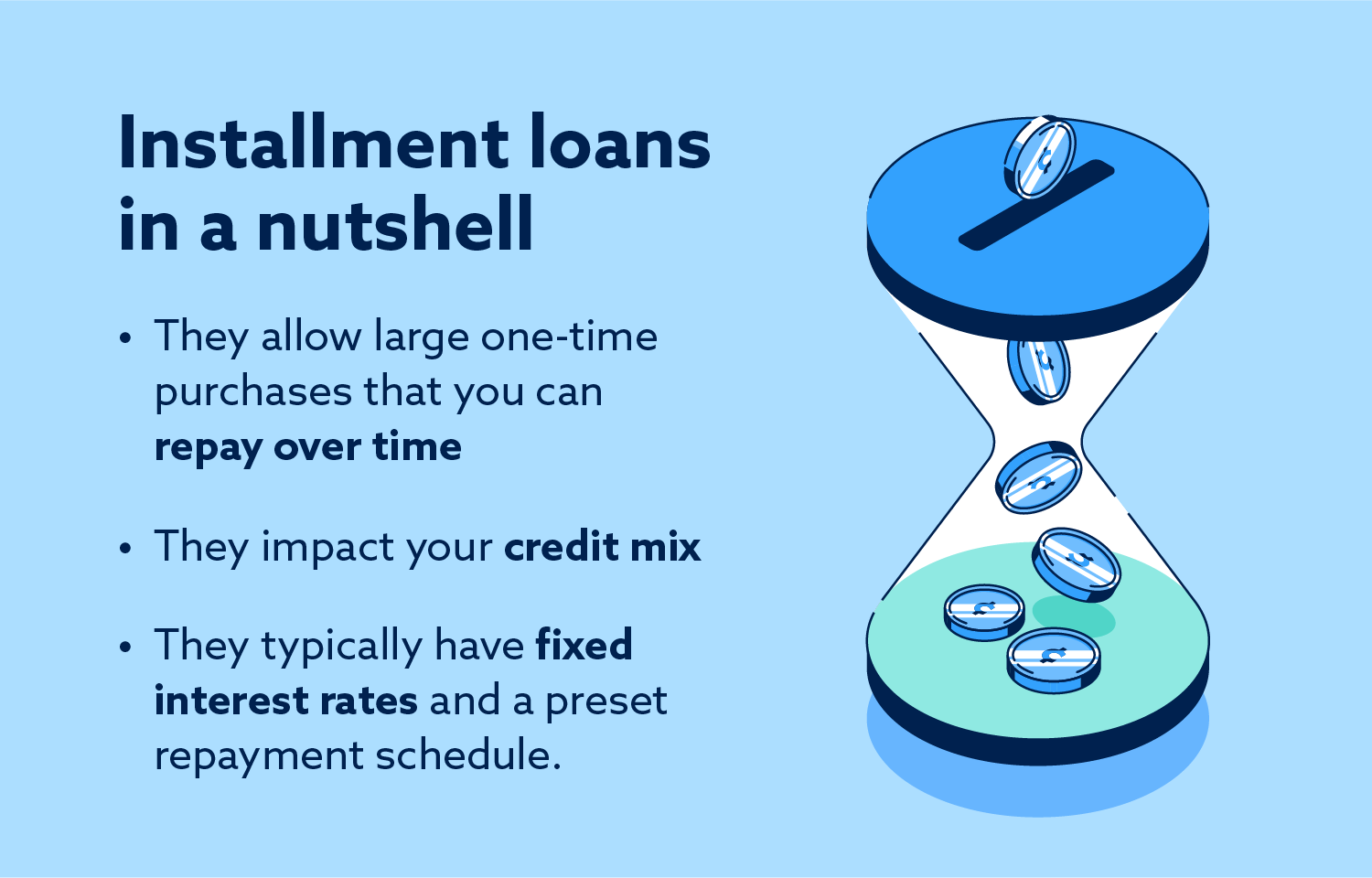

An installment loan consists of a lump sum of money you repay over time. Auto loans, personal loans and mortgages are common examples of installment loans.

The term installment loan, sometimes called “installment credit,” refers to a financial agreement wherein a lender offers you a lump sum of money you’ll have to repay over time. People tend to seek installment loans for big purchases like a new car or financing for a home. Effectively repaying your loan in full and on time can elevate your credit score.

We’ll thoroughly discuss installment loans in this guide, weigh their pros and cons and help you decide if this funding is right for you.

How do installment loans work?

A person can acquire an installment loan by applying with a financial institution such as a bank or credit union. Each lender has distinct criteria they’d like applicants to meet and specific loan terms.

On average, installment loans can offer borrowers anywhere from $1,000 to $100,000 and typically have repayment periods that range from one to 30 years.

If you’re approved for an installment loan, the lender will provide you with the funds to use for whichever purpose is outlined in your loan agreement. Then, you’ll be expected to repay the money you borrowed in weekly or monthly installments — plus any interest generated by your loan’s annual percentage rate (APR).

Interest rates play a substantial role in your loan repayment plan. When you carry a balance on a loan, your APR will be factored in to determine how much interest you’ll be responsible for. If you have a six percent interest rate and you have a balance of $100 due, you’ll end up paying 50 cents in interest. The lower your remaining balance is, the less interest you’ll pay for the remainder of your loan.

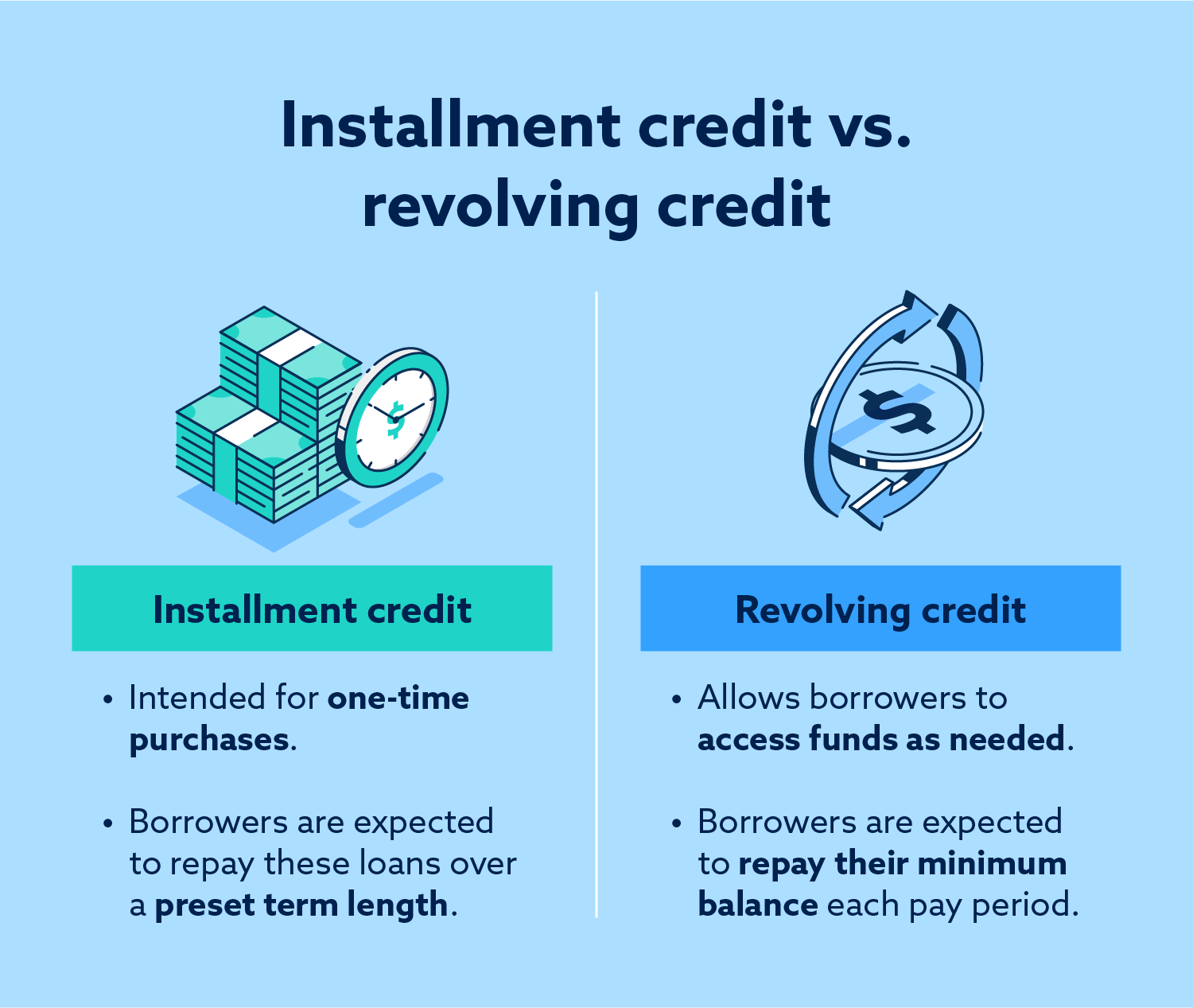

Installment loans differ from revolving credit (like a credit card) in terms of use. With an installment loan, you borrow money for a specific purchase and then pay it off for good. With revolving credit, you repeatedly borrow and repay funds for various purchases in perpetuity.

Do installment loans affect your credit score?

Installment loans influence your score in several ways. When you first apply for funds, lenders will review your credit report. This counts as a hard inquiry to the major credit bureaus and may briefly lower your score.

How you manage your loan repayments can also affect your score for better or worse; consistently paying your minimum balance for each billing cycle can significantly increase your credit score by demonstrating financial responsibility and vice versa.

Managing an installment loan also contributes to your credit mix — a factor that can potentially raise your credit score based on your current number of open accounts.

5 types of installment loans

A variety of installment loans are available for eligible borrowers. Below are five examples of some of the most common loans you’ll encounter.

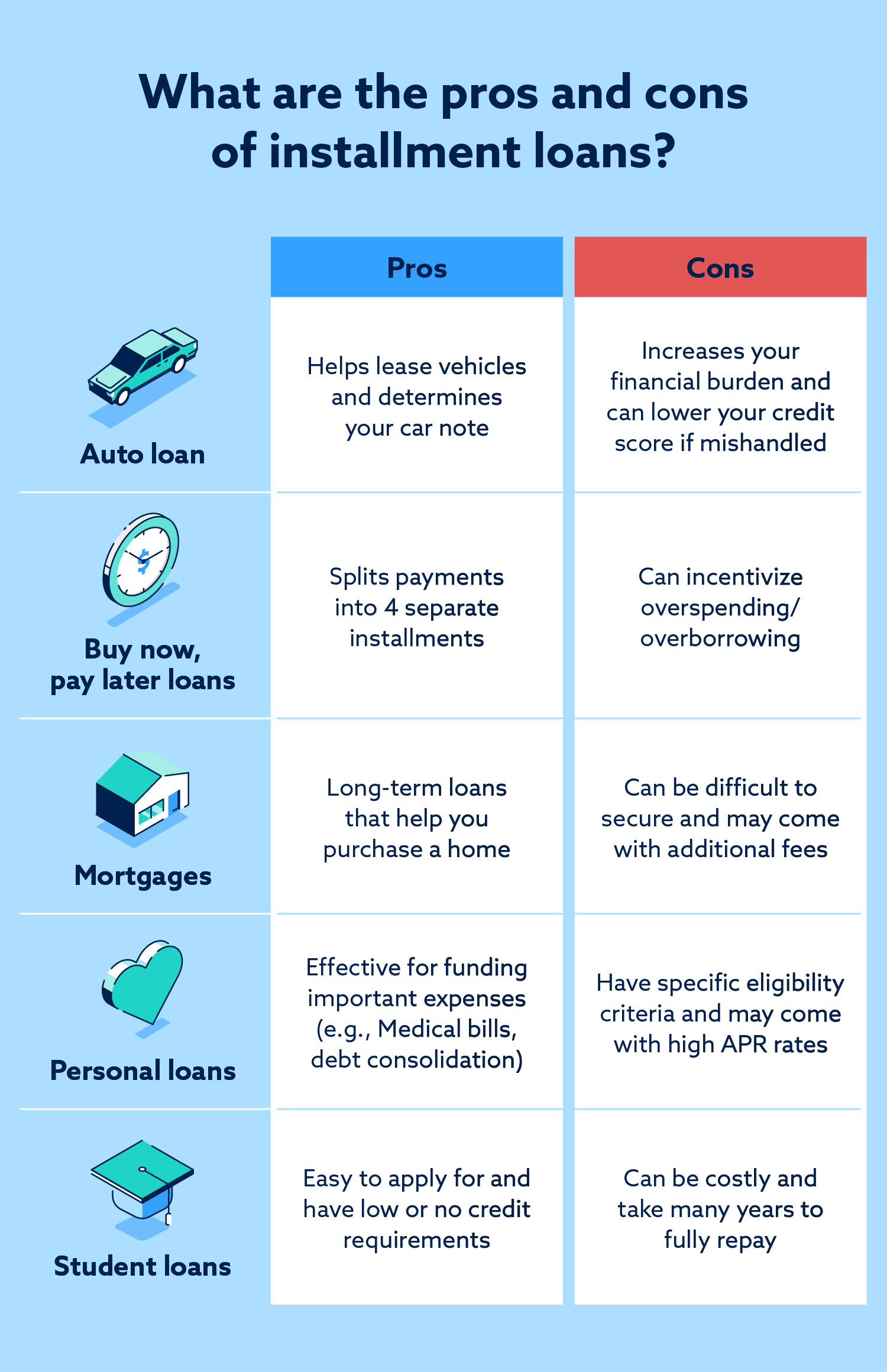

Auto Loans

Auto loans help borrowers obtain vehicles with relative ease and gradually repay what they owe over several years. A person’s monthly car note is largely determined by auto loan rates, APR and their down payment amount. Auto loans for bad credit borrowers might offer smaller amounts or have stricter repayment terms.

- Main advantage: Help borrowers lease or finance vehicles.

- Main disadvantage: Good credit or more is needed for the best auto rates.

Buy Now, Pay Later Loans

When shopping online, you may be able to apply for a buy now, pay later loan. These funding options let you split a purchase into installments and spread across several weeks or months. These loans normally cover purchases between $50 to $1,500.

- Main advantage: Splits eligible purchases into installment payments.

- Main disadvantage: It’s easy for people to borrow more than they can afford.

Mortgages

Mortgages are some of the largest and longest-lasting installment loans a person can apply for. Banks typically offer mortgages with 30-year terms, though this can vary depending on things like the economy and a borrower’s credit profile.

- Main advantage: This can help you purchase a home that you can eventually own.

- Main disadvantage: Mortgages are hard to obtain and can be expensive in the long term.

Personal Loans

Personal installment loans can come in multiple forms, including debt consolidation, medical loans and joint loans.

- Main advantage: Lump sum funding that can have versatile uses.

- Main disadvantage: Normally comes with high interest rates and additional fees.

Student Loans

These are some of the first installment loans that people might be eligible for because they have more open-ended eligibility requirements. Government institutions and banks are usually willing to offer these loans to students with little or no credit history. They might even defer repayment until after graduation.

- Main advantage: Low or no credit score requirements for students, eligible for debt forgiveness and deferment plans.

- Main disadvantage: Come with loan caps and can take 10 to 30 years or more to repay.

Should I use an Installment Loan?

Installment loans are helpful for making important purchases, though one can potentially overborrow if they take out too many loans without a solid repayment plan set. You should use installment loans if you believe you can reliably make your minimum payment amounts each period.

If your financial situation changes, it’s important to notify your lender as soon as possible. Writing a goodwill letter that accurately explains your circumstances can pave the way for leniency and give you more time to marshal your finances.

How knowing your credit score can help you get a loan

People can use installment loans to help make major purchases and boost their credit, so long as they have a plan to repay what they owe. Knowing your credit profile can give you a better sense of the loans you’re currently eligible for. Get a free credit assessment from Lexington Law Firm today.