The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A credit privacy number (CPN) is formatted similarly to a Social Security number and is commonly used by fraudulent companies to scam people with bad credit. Using a CPN to apply for credit constitutes fraud, and they’re often tied to criminal activity.

A credit privacy number (CPN) is sold to consumers as a product to repair bad credit. In reality, these numbers can be associated with identity theft. The Federal Trade Commission (FTC) considers identity theft to be any instance where a criminal uses someone else’s personal information to “open accounts, file taxes or make purchases.” CPNs can pave the way for such fraudulent activity.

Here, we’ll explain what credit privacy numbers are, what they’re used for and how to avoid scams. Most importantly, you’ll also learn how to fix your credit without a CPN.

A credit privacy number, or CPN, is sold to consumers as a way to repair bad credit. But did you know these numbers can be associated with identity theft? Experian® reports that approximately one in every 20 Americans becomes a victim of identity theft each year, so it’s important to learn the dangers of CPNs if a company advertises one to you.

When you have bad credit, you may be more susceptible to methods that hurt your situation more than help it. Here, you’ll learn about what credit privacy numbers are, what they’re used for and how to avoid scams. Most importantly, you’ll also learn about how to repair your credit without a CPN.

Key takeaways:

- Credit privacy numbers (CPNs) are often stolen Social Security numbers (SSNs).

- Creating and even using a CPN can count as fraud.

- No entities have the legal authority to issue CPNs despite their claims.

Table of contents:

- What is a CPN?

- What is a CPN used for?

- How are CPNs different from SSNs, EINs and ITINs?

- Is a CPN legal?

- How to avoid a CPN scam

- How to repair your credit without a CPN

- Repair your credit with Lexington Law

What is a CPN?

A credit privacy number (CPN) is a nine-digit number set up in the same format as a Social Security number: XXX-XX-XXXX. CPNs aren’t issued by the federal government and have no official legal standing. They operate in a legal gray area, but using a CPN to apply for credit constitutes fraud, and they’re often tied to criminal activity.

You may also come across some other terms for CPNs, like:

- Credit profile number

- Secondary credit number

- Credit protection number

What is a CPN used for?

Companies market and sell CPNs to supposedly fix bad credit, but using these products can have steep legal ramifications. CPNs are stolen Social Security numbers or products of synthetic identity fraud. It’s illegal to use a CPN to apply for credit, so even if you are “issued” one by a company, you can’t use it in any way that helps your credit.

A common scenario is criminals stealing Social Security numbers that belong to minors or those who are already deceased, since credit monitoring services usually don’t track their use. These stolen SSNs are then sold as CPNs, so all parties involved are participants in identity theft.

Synthetic identity fraud is another way criminals create CPNs to sell. This method involves using a computer algorithm to randomly create nine-digit numbers that match the formatting of Social Security numbers. Criminals then use an illegal online validator to ensure the fake number will pass as a legitimate SSN before selling it. One way they do this is by using potential SSNs that haven’t been issued to anyone yet.

How are CPNs different from SSNs, EINs and ITINs?

There are several types of numbers that can be used as identifiers for legal and financial purposes. Here’s a breakdown of the most common:

- Social Security number (SSN): Issued by the federal government and is a unique identifier. Most U.S. citizens are issued one at birth, which they use to apply for a driver’s license, hold jobs, file taxes and apply for credit, among other things.

- Employer identification number (EIN): A unique identifier for businesses and issued by the IRS. This allows business owners to open business bank accounts, get business licenses and file taxes under the business’s name.

- Individual taxpayer identification number (ITIN): Similar to Social Security numbers, but the main difference is that ITINs are used by those classified as “authorized noncitizens.” For example, an immigrant working in the United States would need an ITIN to file and pay taxes.

The big difference between these numbers and a credit privacy number is that they’re legitimate numbers issued by actual entities within the federal government, and a CPN is not.

Is a CPN legal?

No, using a CPN is not legal. CPNs started as a byproduct of the Privacy Act of 1974. This act made it so that you couldn’t be forced to provide your Social Security number to a third party unless it was required by federal law, such as applying for a passport. This was meant to give Americans more privacy and protect them from identity theft.

Credit repair scams often market CPNs to those trying to rebuild their credit. But in fact, any business that sells a CPN is engaging in fraudulent activity.

What happens to those breaking the law with a CPN?

By purchasing a credit privacy number, you may unknowingly be breaking the law. According to the Federal Reserve Bank of St. Louis, CPN schemes often involve stolen CPNs from children, the elderly and incarcerated individuals. If an individual purchases a CPN, they may be convicted of various identity theft crimes, as well as the crime of making false statements on a loan or credit application.

The Department of Justice has been cracking down on identity theft, and they carry sentences of 15 to 30 years along with various fines for those who break these laws.

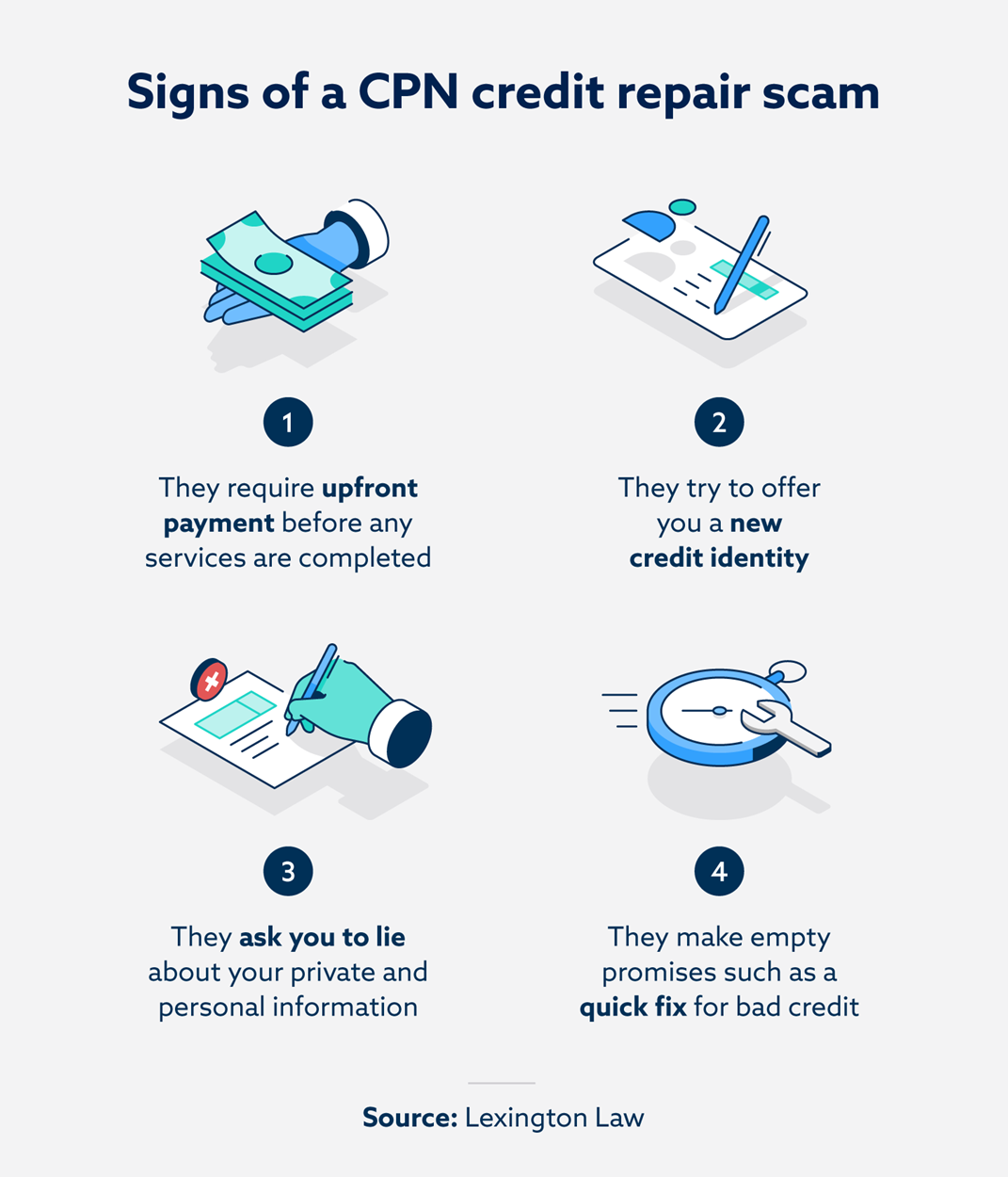

How to avoid a CPN scam

The best way to avoid a credit privacy number scam is to avoid anything involving a CPN. Be wary of a business that offers you a new credit identity—such as a CPN—it’s likely an identity fraud scam.

Other red flags include a company asking or suggesting that you lie about any identifying information, including your name, address or phone number, and a business asking for payment before completing any services.

Check out the Credit Repair Organizations Act to learn more about your credit repair rights.

How to report a CPN scam

The best way to eliminate criminals using fraudulent CPN scams is to report them whenever you see them, and you can do this through the Department of Justice. On their Fraud Section page, they have a variety of links and resources to report different scams.

Scams involving credit privacy numbers can also be reported to your local police department, your state’s attorney general and the Federal Trade Commission. While the investigation will be taking place at the state and federal level, reporting to your local police department can let them know what scams may be operating in the area so they can issue warnings to the community.

How to repair your credit without a CPN

Purchasing a CPN is tempting because it seems like a fast and easy way to repair your credit. In reality, building a good credit score takes time, but there are steps you can start taking today.

- Dispute errors on your credit report: Derogatory marks include collections, late or missed payments, bankruptcies and other negative marks. These heavily weigh down your credit, so clean your credit report often.

- Use a pay-for-delete letter: You may have heard that paying off collections usually won’t improve your credit. If you negotiate a pay-for-delete agreement with the collection agency, they may remove the collection account from your report, which would likely help your credit.

- Become an authorized user: If you have bad credit, try to become an authorized user on a friend or family member’s credit card account to “piggyback” off their credit.

- Find a cosigner: Making payments on loans—like auto or personal loans—can improve your credit. If you can’t get approved for a loan, finding a cosigner may help.

- Don’t miss a payment: One of the best things you can do is ensure you don’t miss any payments that get reported to credit bureaus. Maintaining a good credit history will help you repair and improve your credit.

Repair your credit with Lexington Law Firm

Although there are credit repair scams, legitimate credit repair companies can help you rebuild your credit. Lexington Law Firm has a team of legal professionals who have experience with credit recovery.

They can review your credit report, find errors that may be hurting your credit and challenge them on your behalf. Our services also include tools such as a credit snapshot, which can help you maintain good credit and improve your financial future.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.