The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

You incur a balance transfer fee when you move an outstanding debt from one card to another. There’s usually a 3 to 5 percent charge for this procedure.

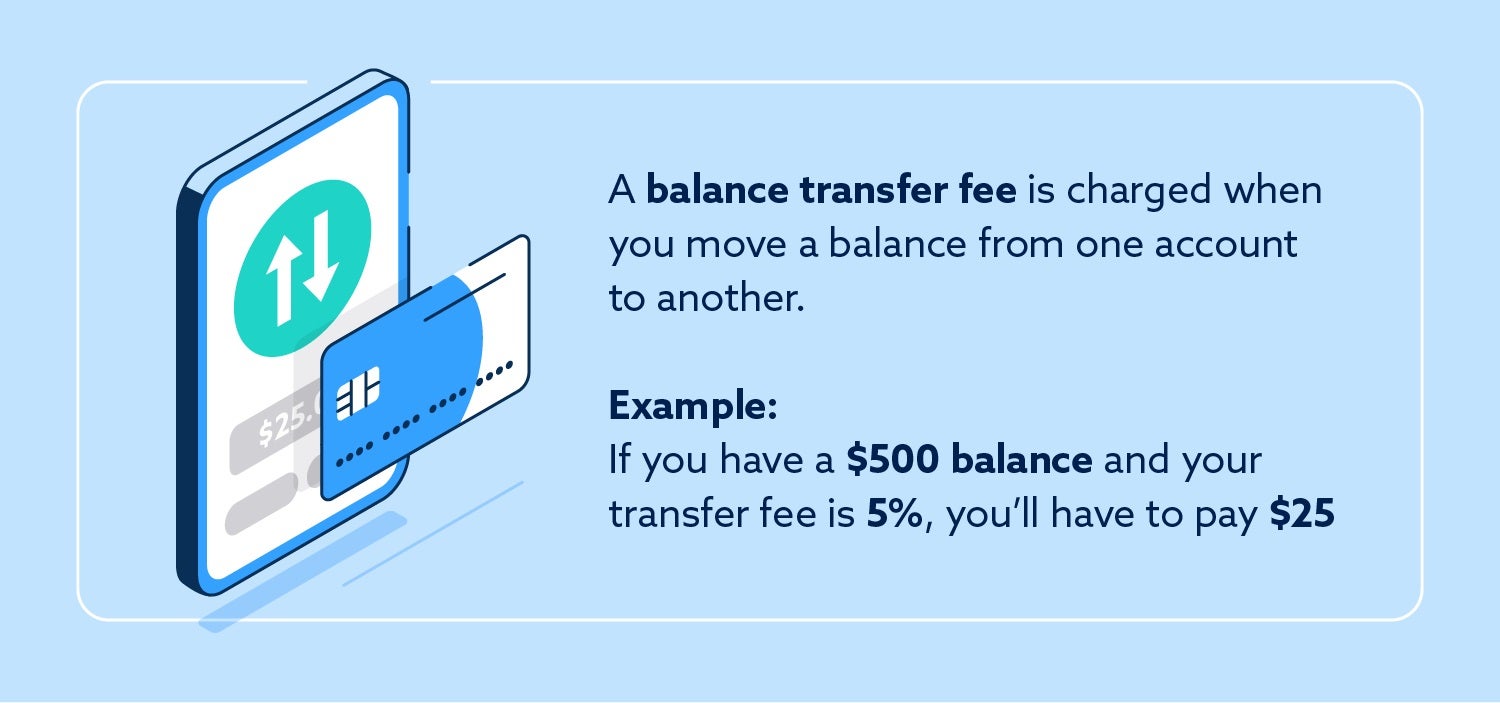

A balance transfer fee is a charge that occurs when you transfer an outstanding balance from one account to another. Balance transfer fees are based on the amount of money you’re attempting to migrate. Normally, fees are around 3 to 5 percent of your outstanding balance.

Boosting your comprehension of credit card terms and conditions, balance transfers and interest rates can help you avoid overpaying with balance transfer fees. This guide will explore these fees in detail and offer strategies to make the most of your credit cards without breaking the bank.

Key takeaways:

- Balance transfer fees only apply if you have an outstanding card balance.

- There’s usually a $5 or $10 minimum fee for balance transfers.

- Fees can apply even if you transfer your balance to a card with zero percent interest.

Table of contents:

- What is a balance transfer fee?

- How do you avoid balance transfer fees?

- Does a balance transfer hurt your credit score?

- Is a balance transfer fee worth paying?

- How to find the right balance transfer credit card

- Increase your financial knowledge with Lexington Law Firm

What is a balance transfer fee?

To help you better understand what a balance transfer fee is, we’ll break this term down:

- Your balance refers to the amount of money that you’re currently borrowing from a lender.

- A transfer results from asking a lender to move your balance from one account to another.

- The fee kicks in as a charge for initiating that transfer—the cost of which is based on a percentage of the balance you’re transferring.

Balance transfer fees range from 3 to five percent of the amount you wish to transfer. The exact price will vary from one instance to the next, but you can find more specific information in your lender’s terms and conditions for balance transfers.

How do you avoid balance transfer fees?

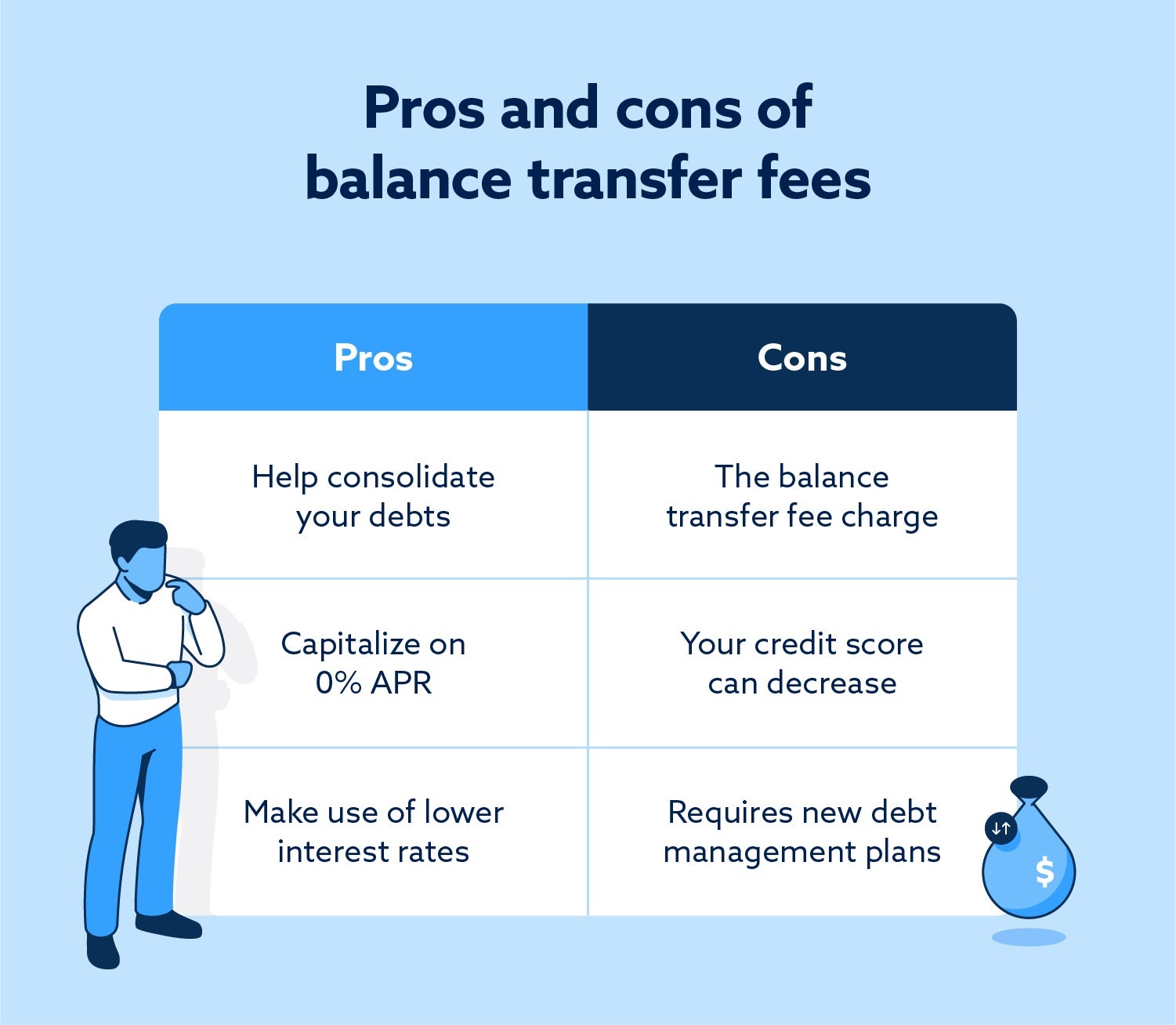

Finding and using a card that doesn’t charge a fee is the most straightforward way to avoid balance transfer fees altogether. These cards may also have a 0 percent APR offer for a set amount of time, which can save you lots of money in the long run.

Another alternative to initiating a balance transfer is utilizing a debt consolidation loan. Rather than keep track of multiple accounts with varying interest rates, this option can help you consolidate credit card debt in one place. However, keep in mind that consolidation loans can have high requirements for applicants, and your accounts might be frozen while the process takes place.

Does a balance transfer hurt your credit score?

Initiating a balance transfer won’t affect your credit alone, though the result may cause your scores to fluctuate. One factor it may affect is your credit utilization, which compares your current balance against your total credit limit and makes up 30 percent of your FICO® credit score. Transferring funds to even out the balances on your credit cards can improve your credit utilization and positively affect your credit health. It’s best to aim for a credit utilization rate of less than 30 percent, if you can.

Conversely, applying for a new credit card typically triggers a hard inquiry on your credit profile, which can temporarily hurt your credit. Inquiries can stay on your credit report for up to two years, but they shouldn’t hurt your credit very much or for very long.

Lastly, the fee generated from initiating a balance transfer can take away from funds that you would’ve used to pay down a balance. Missing or being late on a payment can negatively impact your credit, as payment history makes up 35 percent of your FICO score.

Is a balance transfer fee worth paying?

Balance transfer fees are often worth it if you’re transferring money onto a card with low or no interest at all. Let’s say you currently have a card with a 30 percent APR and a balance of $1,000. If you have a 30-day billing cycle, that balance would generate $24.95 each cycle.

If you transferred that balance to a card with 0 percent APR, that balance would generate $0 each cycle for a one-time balance transfer fee of $30 to $50. In essence, balance transfer fees might be worth it if you have a balance that you’ll need to pay off over a long period.

How to find the right balance transfer credit card

The best balance transfer cards offer much more than a promotional 0 percent APR incentive. How these cards function long-term can also help you determine if they’re right for you. Below, we outline several important factors to keep in mind when shopping around for a balance transfer card.

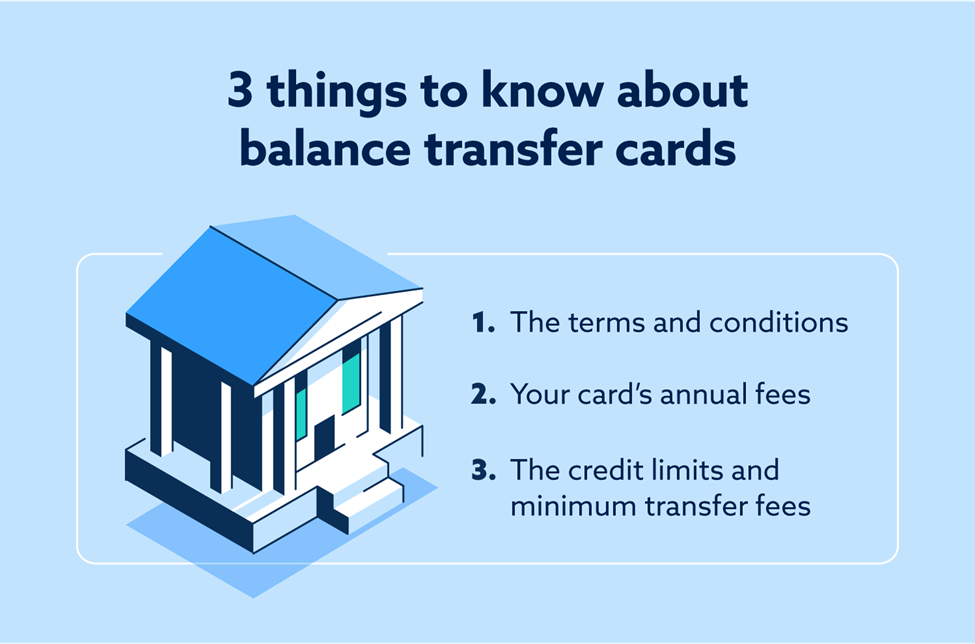

Double-check your terms and conditions

The terms and conditions of a new credit card will outline a wealth of helpful information for you to keep in mind. You can typically find these documents digitally, or have them mailed to you. Here, you can see your card’s specific parameters for balance transfers along with your credit limit and APR.

Check if there are minimum balance transfer fees

As previously mentioned, balance transfers normally float between 3 and 5 percent of the transfer amount. However, minimum fees can kick in if you transfer a small amount of money. Normally, these minimum fees range from $10 to $15.

Look out for annual fees

Annual fees can vary for different types of credit cards. Some don’t charge anything, while others can cost hundreds of dollars. When transferring funds onto a new card, be sure that you can manage the annual fee that might come with it.

Increase your financial knowledge with Lexington Law Firm

Balance transfer fees are often inconvenient and occasionally confusing. Speaking with a financial expert can take much of the guesswork out of handling account balances, so you may want to look into this.

Additionally, Lexington Law’s services can help you review your credit report and keep an eye out for any inaccurate negative items that may be affecting your credit. You can also refer to our library of articles about credit and other financial topics for more information.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.