The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

One of the biggest benefits of a credit union is that they’re member-owned rather than large corporations. One of the downsides is that credit unions have far fewer branches than some of the bigger banks.

For many people, credit unions are a great alternative to banks, and they’re growing in popularity. Allegiance Credit Union reports that there were over 135 million credit union members in 2023 — a more than 37 percent increase in the last decade. While these financial institutions have various benefits, it’s helpful to know the pros and cons of credit unions before getting an account.

Credit unions are financial institutions similar to traditional banks, but the members own them. This means that members get a say in how their credit union runs instead of board members and shareholders.

Credit unions are unique because they’re owned by their members and not large corporations. There are many other benefits to joining a credit union, but they also have their drawbacks. Here, you’ll learn more about the advantages and disadvantages, plus how they compare to banks.

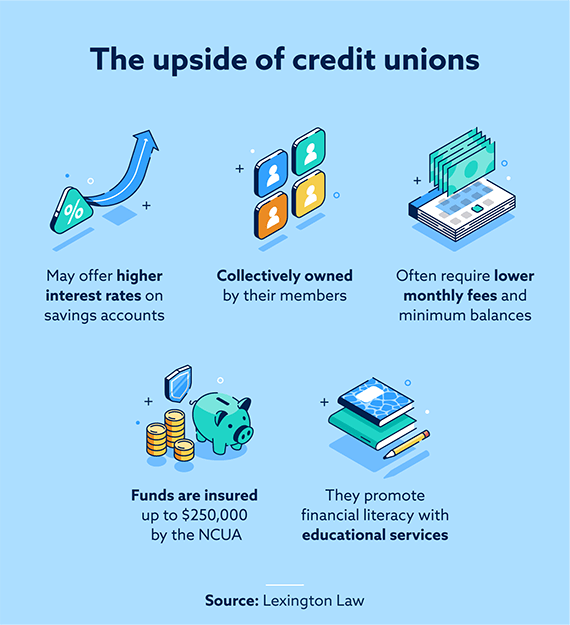

Advantages of credit unions

As localized, community-focused financial institutions, credit unions provide more personal service. Some of the other primary benefits of joining a credit union include:

- Member-owned: As a member, you’re also a stakeholder, giving you a say in how a bank is run. Larger banking institutions have board members who often focus on maximizing profits while not passing earnings or savings onto their customers.

- Educational services: Many credit unions offer financial education resources to members. Financial literacy isn’t often taught in public schools, so this can be quite beneficial to the communities credit unions serve.

- Better interest rates: Interest can work for you or against you, and credit unions often offer better rates in both directions. A part of returning profits to members includes credit unions providing higher interest rates on your savings accounts. They may also have lower interest rates for loans, including personal, home and auto loans.

- Insured funds: Similar to how the FDIC backs banks, the National Credit Union Association (NCUA) insures your funds for up to $250,000.

- The same products with better rates: Credit unions offer most of the same services as banks, and they offer them at lower rates. You can get credit cards and different types of loans from your credit union, and you can often save money on interest fees compared to the big banks. They may also offer bad credit loans.

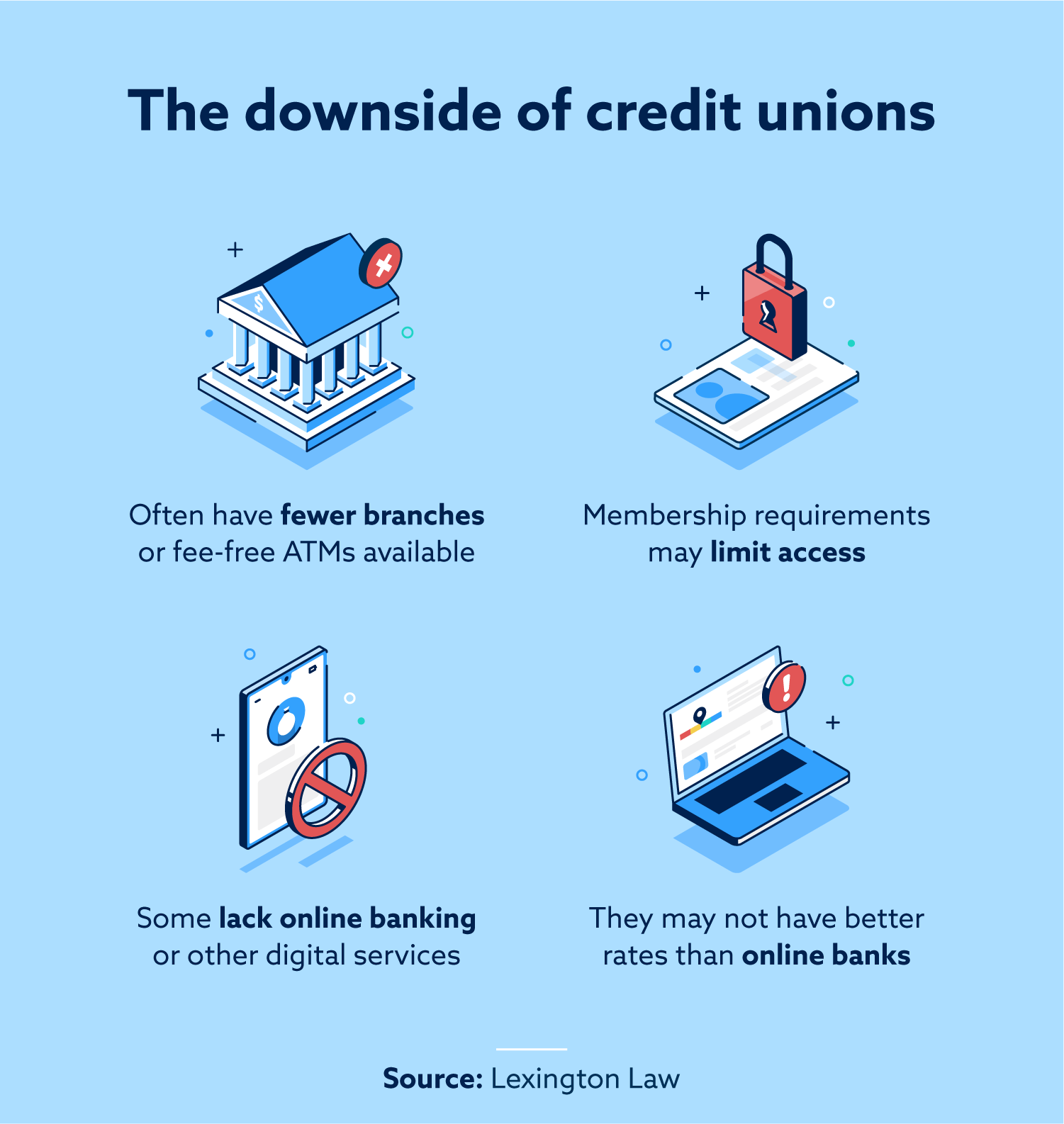

Disadvantages of using credit unions

Although credit unions have many advantages, there are some disadvantages to consider before choosing one over a traditional bank.

- You have to be a member: Becoming a member isn’t as simple as just signing up. You typically need to meet certain requirements, which can be as simple as depositing a small amount of money into a savings account.

- Products and service limitations: Credit unions often offer many of the same services as banks, but some might not. This may mean having fewer loan amounts or not having mobile banking apps. Credit unions may not have peer-to-peer platform connections to apps to send money to people.

- Fewer branches: Many credit unions are local, so they may not have branches outside of your city. Some of them are connected to other credit unions around the country, but you may have banking difficulties while traveling due to the lack of branches.

- The rates aren’t always the best: Credit unions often have better interest rates than the big banks, but they aren’t always the best. You may be able to find better interest rates for savings accounts and loans at some online banks.

When choosing between a bank and a credit union, it may be helpful to see a side-by-side comparison. The following table shows some of the key differences between credit unions and banks.

| Credit unions | Banks | |

|---|---|---|

| Financial institution type | Not-for-profit organizations owned by members | Owned by shareholders and for profit. |

| Membership requirement | Must be a member | No membership required |

| Branch availability | Fewer branches than banks | More branches and may have international availability |

| ATM locations | Fewer ATMs than banks | More ATMs than credit unions |

| Savings interest rates | Often higher than banks | Often lower than credit unions |

| Loan interest rates | Often lower than banks | Often higher than credit unions |

| Balance requirements | Often lower than banks | Often higher than credit unions |

| Fees | Often lower than banks | Often higher than credit unions |

| Federal insurance | Funds insured up to $250,000 by the NCUA | Funds insured up to $250,000 by the FDIC |

Are credit unions safer than banks?

As not-for-profit institutions, credit unions have a heavy focus on protecting the well-being of their members and providing them with useful resources. This also means they take fewer financial risks than many of the big banks. Credit union members’ funds are insured for up to $250,000, which is the same as banks, so they’re just as safe.

How to choose a credit union

If you decide to join a credit union, you may have multiple options in your area. Here are some tips for choosing the right one:

- Compare membership requirements: Different credit unions may have different requirements, like the minimum deposit amount to become a member, so it’s helpful to compare.

- Compare interest rates: Similar to regular banks, credit unions may offer different interest rates on loans, credit cards and savings accounts.

- ATM locations: Some credit unions may only have an ATM at branch locations, but others might have some around town. See which ones have ATMs that are convenient for you.

- Verify coverage by the NCUA: The NCUA is the government entity that insures your funds, so be sure to verify the coverage with the credit union prior to becoming a member.

- Compare product and service offerings: Based on your needs, see what types of products and services the credit union offers. This can include mobile banking, different loan types or financial education resources.

Do credit unions offer credit cards?

Credit unions offer credit cards, and they typically work with the major issuers. These credit cards can have better APRs than the ones bigger banks offer, but you still need to apply. During the application process, they will review your credit score and credit report to make a determination.

Before applying for a credit card, it’s always helpful to know what your score is and important information from your credit report. Here at Lexington Law Firm, you can get a free credit assessment to see where you stand. You can also sign up today to take advantage of some of our additional credit services.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.