The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Veterans can get financial help from any of these financial resources: Transition Assistance Program, military Savings Deposit Program, financial counseling, Veterans Affairs, Post-9/11 GI Bill, CareerOneStop and much more.

Transitioning back into civilian life after a period of time in military service can be difficult, especially with pressing needs like employment, housing and healthcare. Fortunately, there are many programs and resources available to provide financial help to veterans—especially from government organizations.

We’ve put together a collection of resources to help you sort out your finances: getting training for a new job or working to repair your credit score. We also talk about key financial concepts that can help you feel more in control of your financial situation.

Click the links below or read on to learn more about the financial resources that are available for veterans.

- Preparing for civilian life

- Organizing your finances

- Debt relief and financial counseling

- Grants for housing, education and business

- Maximizing disability benefits

- Job training

- Credit score improvement and repair

Preparing for civilian life

Just as the decision to join the military is a major life event, so is separating from it To ensure the transition into civilian life is streamlined, there are things to think about and prepare for.

Consider some of the following ideas that help ease the adjustment.

Transition Assistance Program

The Transition Assistance Program (TAP) provides informational support to military members and their families on all matters related to the transition into civilian life, including the pursuit of further education, finding a job or starting a business.

TAP gives service members and their families access to educational resources. Counselors are available to assist with the transition and guide veterans through benefit options. Through these services, counselors can help veterans get in touch with companies who actively hire veterans and have dedicated programs to promote career opportunities in the military community.

Identify transferable skills

Service members perform many duties throughout their time in the military. As a result, veterans’ skills and experiences are unique, making them highly qualified for a number of careers.

When preparing for a civilian job interview, be sure to highlight skills gained during time in service such as:

- Leadership. Service members are given opportunities to demonstrate and practice leadership skills. The ability to manage a group is a skill that is in high demand by companies.

- Planning. Military life revolves around a structured schedule. The experience most veterans have with planning is highly desirable to employers wishing to achieve long-term goals.

- Integrity. In military service, trustworthiness is necessary for survival in many cases. Employers look for candidates who demonstrate their own trustworthiness with punctuality, promise fulfillment and discipline.

- Teamwork. Military service requires constant collaboration with others. Working in a team is a valuable skill to employers in any civilian industry.

- Conflict resolution. In the military, officers and senior non-commissioned officers are often tasked with negotiations, persuasion and management of interpersonal conflict. Demonstrate an ability to handle these situations effectively to an employer.

- Flexibility. The military has prepared veterans to calmly handle unexpected changes in plan. This is an essential skill in the fast-paced corporate world.

- Communication. The military relies on communication for streamlined operations. Employers also view communication as a necessary skill in civilian positions.

- Problem solving. The ability to analyze and manage a conflict is key for survival in the military. Civilian work also relies on individuals with exceptional problem-solving skills.

When seeking a career after the military, emphasize a mastery of these skills and how to apply them to a prospective career. For assistance transitioning to a civilian job, there are employment resources and programs for veterans that can help launch a new career.

Organizing your finances

When navigating civilian life, it’s important to have organized finances. Veterans have access to many resources for financial management, so be sure to make the most of veteran status by utilizing these services.

Boost your savings with the Savings Deposit Program

The military’s Savings Deposit Program allows service members deployed to combat zones to invest as much as $10,000 and receive 10 percent annual interest for up to three months after their return from service. Though this program is only available to active service members, it provides exceptional savings at minimal cost and can be used long after retirement to supplement income.

Plan for retirement using a Roth IRA

Even if a veteran served in the military long enough to earn a military retirement and pension, it may not fully cover retirement. Because of this, it is essential for veterans to take senior retirement planning into their own hands.

A Roth IRA is a specialized retirement account funded with post-tax income contributions. Because income has already been taxed, the accounts are eligible for tax-free withdrawals in retirement after age 59.5. These accounts are particularly helpful for newly transitioned veterans who may need an extra cushion of savings to hit the ground running in civilian work and retirement.

Additionally, these accounts take the guesswork out of retirement planning because the money in the account will not be subject to tax. Roth IRA accounts do not require distributions, so veterans can leave the money in their account and let it grow.

Create an emergency savings fund

Life can be unpredictable. An emergency fund is useful to anyone planning their retirement, particularly veterans who may be struggling with disabilities, financial instability or dependent family members who need support.

To ensure veterans are fully prepared for life’s can’t-plan-for moments, consider saving three months’ worth of pay or put aside a percentage of monthly income.

There are many ways to build an emergency budget. To conceptualize what an emergency fund will need, take these steps:

- Track monthly spending. Spending money without careful thought can be dangerous to anyone’s wallet. To avoid unnecessary expenses, consider keeping receipts and writing down all expenses in a journal. It may be easier to cut down on unneeded expenditures once all transactions are written in one place.

- Pick a place to house the emergency fund. Ideally, the emergency fund should be kept in a savings account where it will not be tempting to spend. Many banks and credit unions offer free savings accounts that accumulate interest, offering an easy way to store and grow money.

- Set up automatic contributions. Using an automatic withdrawal from a checking account is an easy way to contribute to an emergency savings fund. Ask a financial service to set up automatic deposits to a savings account on a daily, weekly or monthly basis. The more often veterans contribute to their emergency funds, the faster they’ll build it. For example, to save $1,000 in 90 days, contribute $11.11 to a savings account daily.

All of these financial decisions can have a positive influence going forward in your life.

Debt relief and financial counseling

Getting back on your feet is harder when you’re carrying the burden of debt, but there are options for veterans looking to find relief from debt.

If you have debt—whether it’s from a credit card, a loan or a bill—you might consider options like debt consolidation, balance transfers or financial counseling.

- Debt consolidation provides the opportunity to combine several debts into a single loan, which will simplify and possibly lower your monthly payments. Organizations like Debt.org are committed to helping veterans find options to make debt more manageable.

- Balance transfers enable you to move high-interest credit card debt to a low (or zero) interest credit card. Depending on the fees and promotions, a balance transfer can save you a significant amount in interest payments.

- Financial counseling can be useful to help you assess your options and plan a route forward to get your debt under control. The National Foundation for Credit Counseling provides low-cost and sometimes free support to help veterans manage credit and navigate benefits.

Debt is a detriment that can be overcome with time, dedication and support. Consider your options that could help you lower your payments, making it more manageable to pay off your debt over time.

As you work to eliminate your debts, also explore your options for opportunities tailored to veterans looking to purchase a home, further their education or start a business.

Grants for housing, education and business

A number of grants available to veterans help make housing more accessible, education more affordable and small business ownership more feasible.

Having a bad credit score does not need to get in the way of finding a place to live or improving yourself through education. Programs that support veterans—even with a lower credit score—make it possible to make strides in housing, education and business.

- Housing: Veterans Affairs (VA) loans can help you buy or build a home for yourself and your family. Since there is no specific credit score required for a VA loan, you may be able to secure a mortgage with your current score—and you could refinance the loan later to get more favorable terms. Additionally, special grants are available from the VA for disabled veterans.

- Education: The Post-9/11 GI Bill provides tuition support for veterans, including free tuition for in-state public schools and up to $26,042 each academic year at private schools. The VA also provides other education and training benefits for veterans.

- Business: The U.S. Small Business Administration (SBA) helps connect veterans with business-related benefits, including funding to start a business, entrepreneurship training programs and contract bidding opportunities.

All of these programs offer you the chance to increase your opportunities and work toward your personal and financial goals. As you work to find secure housing and further your education, also look at opportunities to train for a new job that could offer more solid financial footing.

Maximizing disability benefits

The VA provides compensation to those affected by disability, disease or injury sustained during military service. A disability recognized by the VA can apply to physical limitations or injury, as well as mental health conditions like post-traumatic stress disorder (PTSD). This compensation is tax-free, is graduated according to the severity of the disability and is meant to help make up for economic loss and physical and emotional stress.

In order to be approved for disability compensation, the following documents are required:

- Medical evidence of a current physical or mental disability

- Documentation proving the relationship between a disability and an event in military service

To apply for disability benefits, visit a regional VA office or follow these steps on the eBenefits online portal:

Veterans have provided an enormous service to their country, and they deserve support in managing any disabilities resulting from their dedication.

Job training

Special job training resources for veterans can provide an opportunity for more lucrative and satisfying employment.

Job training resources that exist specifically for veterans provide support with finding a job, getting career counseling and securing federal employment.

- CareerOneStop: Sponsored by the U.S. Department of Labor, CareerOneStop exists to help veterans transition back to civilian life with support in finding a job or getting job training.

- Veterans Affairs: The VA has a career and employment page that provides detailed information about career readiness, employment assistance and special benefits for disabled veterans.

- Veterans.gov: Sponsored by the U.S. Department of Labor, Veterans.gov helps connect veterans with jobs in the federal government, including jobs with USDA, Homeland Security and the Department of Energy.

Veterans have a number of transferable skills that make them desirable in a variety of jobs and workplaces. Consult the resources at USA.gov for even more information about finding a suitable career to match your experience and interests.

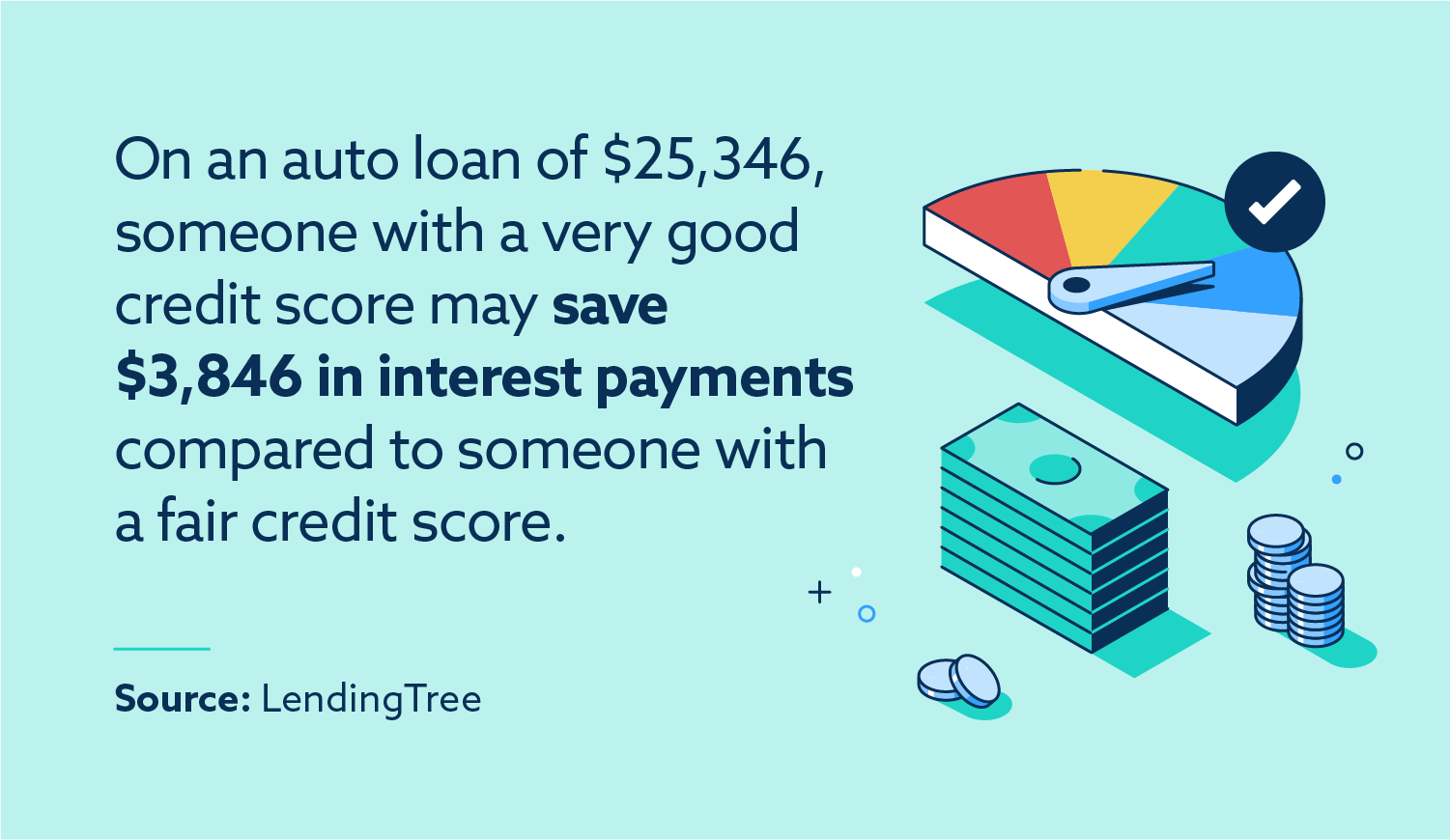

As you continue to advance in your career, you may want to work on building or rebuilding your credit, which can open up the possibility of securing more favorable credit in the future—helping you procure a house, car or small business loan when you need it.

Credit score improvement and repair

A low credit score or a lack of credit history is not a permanent situation—with time and understanding, you can build or rebuild your credit and take advantage of the opportunities that will afford.

For veterans looking to improve their credit, take the following into account:

- Take advantage of secured credit cards exclusive to veterans. USAA, Navy Federal, Armed Forces Bank and other institutions provide secured credit cards, which require a deposit but are available to veterans with low credit scores. Over time, secured credit cards help you build your credit with on-time payments of your full balance.

- Use veteran benefits to lower expenses. Debt from many sources—like medical bills or a mortgage—can start to make your financial life unsustainable. Take advantage of programs like the Post-9/11 GI Bill for help with housing or education to reduce overall debt load.

- Expand your understanding of credit. When building your credit score, it’s important to have knowledge about unfamiliar terms like credit bureaus or utilization rate. By learning the factors that make up your credit score, you can build the habits that make your credit score go up naturally over time.

Finally, make sure that you take some time to get your credit report and check it for accuracy. While you were away serving, it’s possible that inaccurate information landed on your report. For example, your report might list an account you’ve already paid off or never opened at all—perhaps due to identity theft. Any misleading information could be negatively affecting your score.

Fortunately, the process of getting these accounts removed is straightforward. If you’re looking for support with repairing your credit, reach out to the credit repair consultants at Lexington Law Firm, who are honored to support veterans looking to reach their financial goals. Make sure to ask about our military discount.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.