The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A debt consolidation loan isn’t a negative mark on your credit. This means that, unlike a negative mark like a missed payment or an account in collections, taking out a debt consolidation loan doesn’t directly hurt your credit.

Juggling multiple types of debt can make it difficult to save for long-term financial goals, such as purchasing a vehicle or house. Debt consolidation doesn’t get rid of this debt, but it can alleviate the burden of tracking multiple payments and dealing with high interest rates.

What is debt consolidation?

Debt consolidation is a method of combining all outstanding debt into a single line of credit. You can consolidate multiple credit cards or a mix of credit, such as a mortgage, a vehicle loan and medical bills. Debt consolidation not only organizes your debt into a single payment but can also offer a smaller interest rate.

Types of debt consolidation

There are several debt consolidation methods to choose from. Each one carries its own benefits and risks, making it important to educate yourself on potential impacts. Ultimately, the best choice depends on your credit score and the amount of debt owed.

Applying for a balance transfer card

A balance transfer card allows you to integrate your debt into a single card with a lower interest rate. Many of these cards offer a promotional period with 0% interest ranging from 6 to 21 months. This helps you access lower payments and eliminate your debt interest-free during that time.

Qualifying for a balance transfer card typically requires having good to excellent credit. Additionally, some cards charge a fee ranging from 3% to 5% of the amount being transferred, which can be significant if you have a large amount of debt.

Applying for a balance transfer card can also add a hard inquiry to your credit report and lower your score. Credit utilization partially impacts your score as well. Transferring significant amounts of money can raise your credit utilization ratio for that specific card, negatively affecting your score.

Taking out a personal loan

Personal loans provide a lump sum you can use to pay off multiple lines of credit. You then make payments to the loan according to your lender agreement. Most personal loans come with fixed interest rates and terms, meaning you don’t have to worry about your payment unexpectedly changing.

If used correctly, personal loans can improve your credit score by diversifying your credit mix. However, you need a good credit score to qualify for low interest rates and other favorable loan terms.

Borrowing from your 401(k)

A 401(k) retirement account allows you to borrow up to half the amount under $50,000 to pay off debt. Borrowing from a 401(k) doesn’t adversely affect your credit score, although you must pay the amount back within 5 years and make at least quarterly payments. Borrowing this money also doesn’t accrue interest since it isn’t from a lender.

Despite its perks, borrowing money from a 401(k) to alleviate short-term debt can significantly impact your retirement savings. You may lose out on money you would’ve made if the funds had remained in the account. Additionally, you risk owing additional taxes and incurring other penalties, especially if you can’t pay the money back.

Utilizing your home equity

If you’re a homeowner, you can use a home equity loan or line of credit to pay off your debt.

A home equity loan offers a lump sum that operates like a personal loan, with interest rates and regular payments.

A home equity line of credit works like a credit card, meaning you only borrow what you need and repay it. Then you can use it again if needed.

Tapping into home equity carries the highest risk. Although it may not significantly impact your credit score, it requires using your home as collateral. This means failing to repay the debt can result in losing your home.

Pros and cons of debt consolidation

To summarize: debt consolidation loans hurt your credit if they aren’t managed correctly. However, they can also reduce the overall amount you owe and offer other perks that can improve your credit.

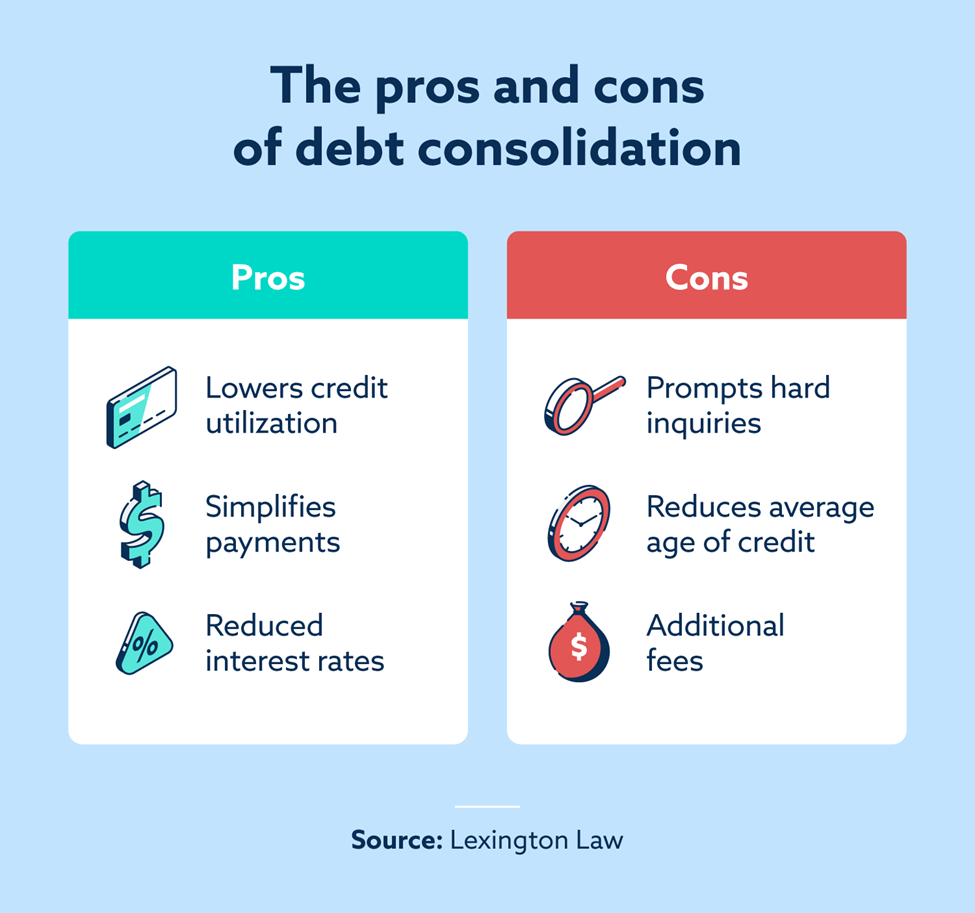

Exploring the pros and cons of debt consolidation can help determine if it’s the appropriate financial strategy for your situation.

Pros of debt consolidation

Debt consolidation can help you:

- Build a history of on-time payments. Making on-time payments carries the biggest weight in calculating your credit score. If you consistently meet payment due dates, your score can increase.

- Lower credit utilization. Credit utilization, or the amount of credit owed, accounts for 30% of your FICO® score. Debt consolidation may help increase the amount of available credit, which can improve your score if you don’t acquire any new debt.

- Access lower interest rates. Depending on your credit score, you may qualify for a lower interest rate when consolidating debt. This can help you pay off debt faster, reducing the amount you owe and boosting your score.

- Diversify credit mix. The types of credit used also impacts your score. For example, if credit cards are your only lines of credit, taking out a personal loan to consolidate debt diversifies your credit mix, improving your score.

Cons of debt consolidation

- Higher Interest Rates: If you have poor credit, you may not qualify for a lower interest rate than your existing debts.

- Extended Loan Terms: While monthly payments might be lower, a longer repayment term could result in paying more in total interest over time.

- New Fees: Debt consolidation loans may involve origination fees, balance transfer fees, or closing costs. These upfront charges can reduce the financial benefits of the loan.

- Credit Inquiries: Applying for a consolidation loan results in a hard inquiry on your credit report, which can temporarily lower your credit score.

- Closed Accounts: If you close credit card accounts after consolidating, your credit utilization ratio might increase, which can negatively affect your credit score.

Alternatives to debt consolidation

If debt consolidation doesn’t work for your situation, that’s okay. Other debt management methods may provide needed relief.

Debt management program

Debt management programs connect you with a counselor who negotiates with creditors on your behalf to score more favorable terms, such as lower interest rates. You then make payments to the agency instead of your creditors. Consulting a debt management counselor doesn’t affect your score, but entering into a debt management plan can.

Debt settlement

A debt settlement procedure involves negotiating directly with creditors to reduce your monthly payments or interest rates. Debt settlements can remain on your credit report for 7 to 10 years, impacting your ability to open new lines of credit. However, if you have massive debt and a settlement helps you pay it off faster, this may benefit you long-term.

Should I consolidate my debt?

Ultimately, whether you decide to consolidate your debt or pursue an alternative debt relief method, it’s important to choose an option that benefits your credit the most. Consider consulting a financial advisor for further guidance. If you’re curious about where your credit currently stands, you can take our free credit assessment to see your FICO score and a short summary of your credit report.