The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Unfortunately, we can’t live forever, and many people have debt until their final years. Have you ever wondered what happens to your debt when you die? According to Debt.org, roughly 73 percent of Americans die with debt. Although your family and children aren’t responsible for your debt, creditors can seize your assets to pay off the debt, which takes away from what many would leave their families after they pass.

There are ways to take care of your debt should you pass away, and this comes in the form of credit life insurance. In addition to life insurance, there are more types of credit insurance that can help with your debt should you become disabled or unemployed.

Here, you’ll learn all about credit insurance for auto loans and mortgage loans and whether or not it’s the right option for you.

What is credit insurance?

Credit insurance is a form of insurance that helps protect you if you’re not able to pay off your debt due to disability or death. It may also be able to cover your debt if you become unemployed.

This type of insurance can become a large additional expense, so it’s helpful to fully understand it and weigh it against alternatives.

How does credit insurance work?

Similar to other forms of insurance, you make payments to maintain credit insurance. Some credit card companies offer credit insurance as a feature, and the insurance rates are billed through the unpaid balance of the card.

There are some unexpected scenarios where credit insurance for an auto loan or mortgage loan can be helpful, but it’s also expensive. Sometimes, life insurance policies can help for a lower rate.

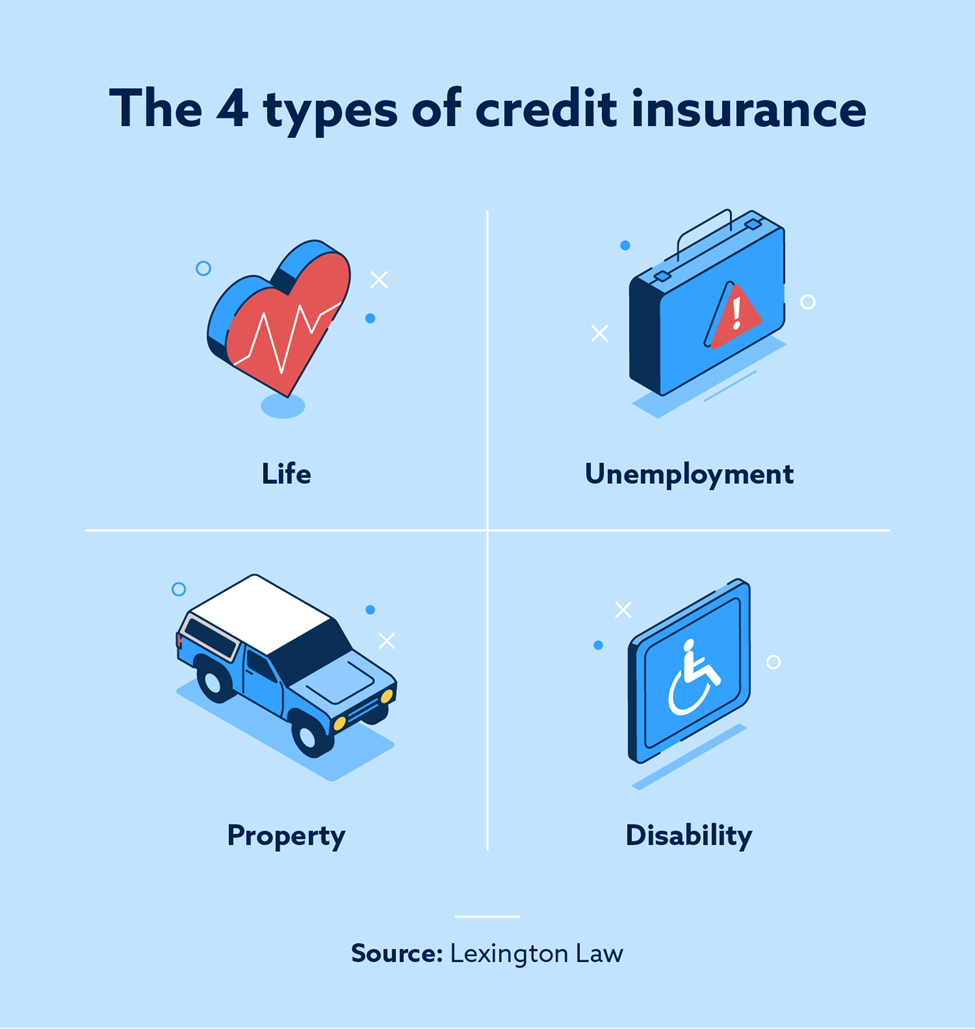

4 types of credit insurance

There are four different types of credit insurance to choose from. Each has different benefits for different situations.

Credit life insurance

Credit life insurance isn’t like typical life insurance policies. Whereas a term or permanent life insurance policy will give a payout in the event of death, credit life insurance is different. When you purchase credit life insurance, it’s for a specific loan like an auto or home loan. Should you pass away, credit life insurance will pay off that specific loan.

Credit unemployment insurance

If you lose your job, this form of credit insurance helps ensure you don’t miss any payments. While unemployed, unemployment insurance will give you a payout to pay the minimum balance of a specific loan. In most cases, you have to be unemployed for a certain amount of time before you begin receiving benefits.

Credit disability insurance

Credit disability insurance is there to help with a loan if you become disabled. This insurance has the same parameters as the others, meaning it makes minimum monthly payments to a specific loan. This insurance is sometimes called accidental and health insurance.

Credit property insurance

Credit property insurance covers property acting as collateral for a secured loan. In states like Wisconsin, lenders can “require any property used as collateral on a credit transaction to be insured.”

What does credit insurance cover?

If you have an outstanding balance on a loan, credit insurance may cover the remaining debt. Typically, the loan payment includes the premium for the credit insurance. Depending on the type of credit insurance, it may only cover the minimum monthly payment. With credit life insurance, the loan is paid off in full.

Some of the loans credit insurance may cover include:

- Credit card loans

- Open lines of credit

- Personal loans

- Student loans

How to decide if credit insurance is right for you

Credit insurance can cost more than it’s worth, so it’s helpful to have some criteria to help decide if it’s right for you. The following are some questions to ask before deciding whether or not to get credit insurance:

- Do you already have insurance? You may already have a life insurance policy or other form of insurance that covers debt obligations should something happen.

- Would life or disability insurance be better? Compare prices and see if one of these other forms of insurance does the same for a lower cost.

- Is the coverage enough? Check to see if the insurance covers the entire term of the loan as well as the balance if needed.

- Is there a waiting period? When getting disability or unemployment credit insurance, see if there’s a waiting period before the payouts.

- Is the rate fixed? If the insurance rate can fluctuate, it may be a red flag.

How much does credit insurance cost?

The cost for credit insurance can vary depending on a variety of factors. Like other insurance policies, the price may be higher depending on your health and circumstances. Some of the factors that may increase the cost of your credit insurance include:

- Age and personal health

- Type of loan

- Amount of debt

- Type of insurance policy

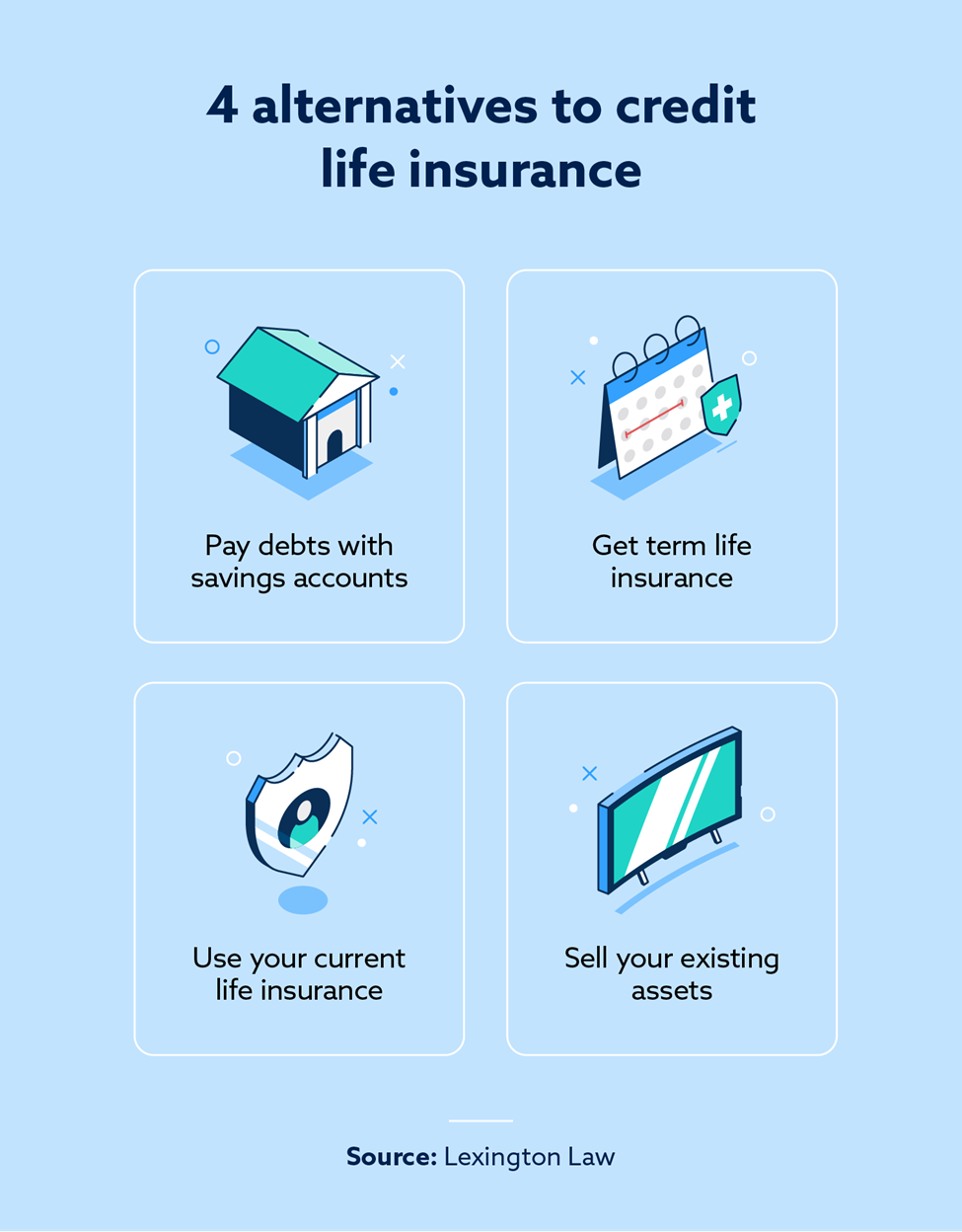

Alternatives to credit life insurance

If it sounds like credit life insurance may not be the right option for you, there are other ways to manage your debt should something happen to you. When making financial decisions, it’s helpful to research and weigh the different options to see which one suits your needs the best. Here are some alternatives to credit life insurance:

- Current life insurance: If you already have a life insurance policy, you can see if it covers your debt. If it doesn’t, you may be able to increase your policy limits, which still may be cheaper than credit insurance.

- Term life insurance: This form of life insurance may be the right option for you if you want coverage for a certain amount of time. Term life insurance can be in increments of 5 to 30 years.

- Savings accounts: If you have a savings account, retirement account, or investment account, you can use these to pay off debts.

- Selling assets: Similar to handling other debts, there’s the option of selling off assets. If you have property that can help pay off the loan, this may be better than getting credit insurance.

Examine your credit before getting credit insurance

If you’re struggling to pay off your debts, it can affect your credit. Poor credit can lead to higher interest rates and difficulty securing new loans and lines of credit. As we explained, credit insurance can be expensive, so it may be better to check your credit before getting insurance.

Lexington Law Firm provides various credit services, and you can get a free credit assessment to see where you stand. We could also help you work to address any errors on your credit reports that may be hurting your credit. To get started, sign up today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.