The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you’re blocked by ChexSystems, you can clear your report by disputing report errors directly, paying off outstanding debts or missing fees, requesting data updates from creditors and waiting for information to fall off a ChexSystems report.

You must send in an application when you want to open a checking or savings account. Similarly to when you are applying for credit, financial institutions can use reports—specifically from ChexSystems—to grant or deny new bank accounts to individuals.

If your ChexSystems report is negative and you can’t open a bank account, what can you do? It’s possible to clear your report or open a second-chance bank account while waiting for your report to improve, but to know all your options, you need to understand what ChexSystems is and what it does.

Key ChexSystems takeaways:

- ChexSystems is a consumer-reporting agency that tracks risky behavior across individual checking accounts.

- A ChexSystems report includes a risk score and consumer disclosure that banks and credit unions can use to evaluate an individual’s account-worthiness.

- It’s possible for the data on a ChexSystems report to drop off after five to seven years.

- Individuals can still apply for and open other financial accounts while a ChexSystems report is negative.

What is ChexSystems?

ChexSystems is a national agency specializing in consumer reports, similar to a credit reporting agency like Experian®, Equifax® or TransUnion®. However, instead of tracking credit accounts, ChexSystems tracks the checking accounts of individuals who have fallen into trouble.

Based on its tracked data, ChexSystems creates reports that flag risky accounts—for example, accounts with bounced checks or unpaid fees may be marked as high-risk accounts on a ChexSystems report.

What’s included in a ChexSystems report?

A ChexSystems report shows banks and credit unions’ specific behaviors in a user’s history, including high-risk behaviors like unpaid fees, bounced checks and suspected fraud. When a bank or credit union views a user’s ChexSystems report, they will see two specific pieces of data:

- Risk score: Scores range between 100 and 899, where higher scores indicate less risky users.

- Consumer Disclosure: The ChexSystems report shows specific risky and involuntary behaviors on users’ accounts. The user can freeze these reports in cases of identity theft or other suspicious activity.

In the body of the report—also known as the Consumer Disclosure—ChexSystems will note risky behaviors like:

- Unpaid balances and overdrafts

- Account termination

- Fraud or identity theft

- Other bank account applications or queries

- Public records such as liens or bankruptcies

These data points directly relate to a user’s previous bank and credit activities, and bank and credit unions can use a ChexSystems report to accept or deny a user’s financial inquiries.

How does ChexSystems work?

ChexSystems works similarly to other financial institutions when a user requests or applies for a new card or account. When an individual requests an account, the bank or credit union can use a ChexSystems report to accept or deny financial requests, including bank account applications.

ChexSystems reports contain data about a user’s risky account behaviors that have been shared directly by a financial institution. When a bank or credit union requests a user’s report, they see firsthand data from other reputable financial institutions. Data included in a ChexSystems report will generally stay on record for five years unless the reporting bank or credit union requests its removal.

It is also possible for individuals to request and view their own ChexSystems reports. Under the Fair Credit Reporting Act, you can receive one free copy of your ChexSystems report annually and when a bank refuses to open an account based on information found in your report.

How to clean up your ChexSystems report

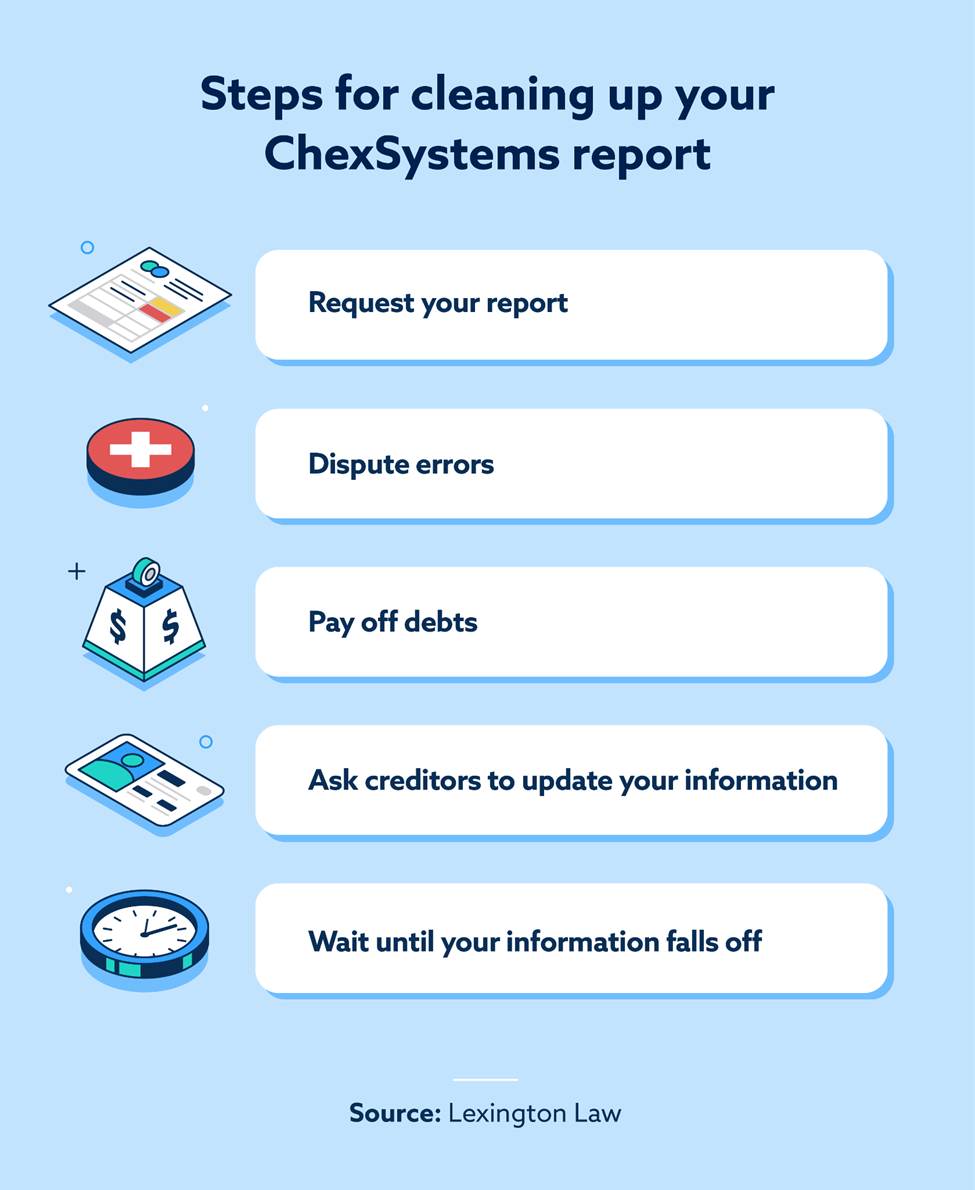

If your ChexSystems report contains data about risky, negative or inaccurate behavior, it’s possible to clean it up. This can help you open a standard bank account and avoid resorting to an account with higher fees. It’s possible to clean up your report in five simple steps.

Step 1: Request your report

If your financial request gets denied, the bank or credit union must provide you information about report requests in an adverse action notice. Otherwise, you can request consumer disclosures on the ChexSystems website or by:

- Phone: Users can call (800) 428-9623 to reach an automated messaging system.

- Mail: Consumer report request forms can be sent to ChexSystems, Inc., by addressing mail to Attn: Consumer Relations, PO Box 583399, Minneapolis, MN 55458.

Step 2: Dispute errors

The contact information provided in your adverse action notice can help you file a dispute with ChexSystems. Alternatively, you can submit your dispute directly through the website or by mail and fax using a request for an investigation form. Upload any documentation to support your dispute with—or attached to—your dispute forms.

Step 3: Pay off debts

An individual can clear accurate report data concerning late fees and user debt once they settle their debts by paying the missing or overdraft fees. If you cannot make a lump-sum payment, it might be possible to set up a payment plan or negotiate a settlement with the bank or debt collection agency.

Step 4: Ask creditors to update your information

If you have paid off your debts and have payoff information in writing or documentation to prove inaccurate claims on your report, you should ask the bank or collection agency to report the changes to ChexSystems. It is also possible for individuals to report these changes directly to ChexSystems themselves.

Step 5: Wait until your information falls off

If you’re able to remove negative information through the dispute process or by paying off a debt, you may have limited options when it comes to cleaning up your ChexSystems report. Since consumer disclosure data usually falls off your ChexSystems file after five years or might be removed due to other credit laws, you may need to wait until this period has passed to update your information or see changes on your report.

How long do you stay on ChexSystems?

Your negative account behaviors usually only stay on ChexSystems for five years. However, federal regulations allow consumer reporting agencies to report certain negative information for up to seven years. Banks and credit unions have their own policies for how long behaviors stay connected to your ChexSystems report, and it’s also possible to change your reports by paying off debts or working with the reporting agency.

Can you get a bank account if you’re in ChexSystems?

You may still be able to get a bank account if you have negative items in ChexSystems. Even with negative marks on your ChexSystems report, some banks and credit unions offer individuals second-chance accounts. Plus, some financial institutions don’t use ChexSystems and may be willing to grant a person with higher risk an account of some type.

While second-chance accounts are available, they can be costly. Many of these accounts require users to pay monthly fees while using them, even if they are only in use for a short time. To avoid this, individuals can dispute their ChexSystems reports and attempt to clear their consumer disclosures from negative marks.

Are there banks that don’t use ChexSystems?

Some financial institutions don’t use ChexSystems. Still, they are few and far between because most banks and credit unions use ChexSystems reports during the review process for a new account.

A few companies that either don’t check your ChexSystems report at all or are more flexible (such as offering a second-chance account) when it comes to negative marks include:

ChexSystems FAQ

Below we offer answers to a few common ChexSystems-related questions.

What happens if you’re in ChexSystems?

If you’re in ChexSystems, it can be difficult to open a bank account. ChexSystems is a consumer-reporting agency that creates reports based on user behavior, which banks and credit unions then use to allow or deny individuals from opening financial accounts. If your ChexSystems report details risky financial behavior, you may need to dispute or clear your report before opening an account.

Can you clear yourself from ChexSystems?

To clear yourself from ChexSystems, you must dispute the data reported on your consumer disclosure, work with your financial institution to remove the reported behaviors or settle any outstanding debts you may have incurred. Inaccurate information can also get disputed, which can clear you from ChexSystems.

How long are people in ChexSystems?

People are usually in ChexSystems for five years. While it is legal for consumer reporting agencies to report negative data for up to seven years, ChexSystems data usually falls off after five years or less.

Does every bank use ChexSystems?

Not every bank uses ChexSystems. While most financial institutions will analyze your ChexSystems report during an account review, companies like Wells Fargo, U.S. Bank and Southwest Financial FCU have ChexSystems-free account options.

Does ChexSystems affect your credit score?

ChexSystems does not directly impact your credit, but negative marks on your ChexSystems report can indicate risky behavior that may have affected your credit report as well. Any negative behavior associated with late or unpaid fees can also be directly reported to the credit bureaus by a financial institution.

At Lexington Law, we don’t work with ChexSystems, but our credit repair services can help you identify errors on your credit report. Lexington Law Firm could also help you address errors on your report, allowing you to get back on track toward meeting your financial goals.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.