The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

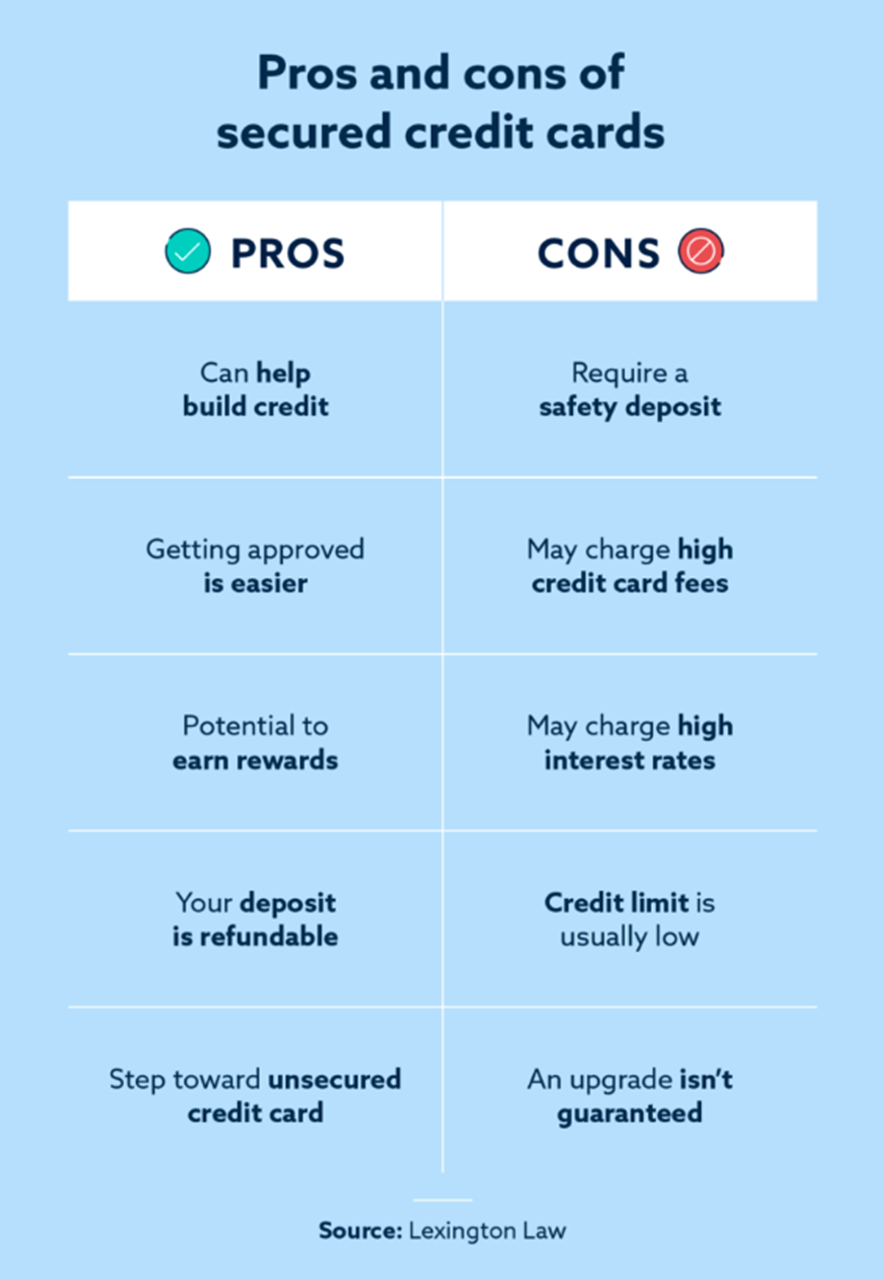

The pros of secured credit cards are that they can help you build credit, get approved easier, earn rewards and have a refundable deposit. Cons of secured credit cards are that they require a safety deposit, may charge high credit card fees and interest rates and have a low credit limit.

While secured credit cards come with both benefits and drawbacks, the positives ultimately far outweigh the negatives. That said, they aren’t for everyone. If you’re looking to build your credit from scratch or rebuild credit that has been dented, secured credit cards could help you reach your goals.

Secured credit cards, unlike regular credit cards, require a deposit. This deposit serves as collateral for the purchases made on the card, mitigating the risk to the card issuer. If the cardholder fails to pay off their card’s balance, the card issuer will keep the deposit. Otherwise, the deposit will be returned to the cardholder after a set number of months or when the account is closed.

Despite these differences, secured credit cards can be used just like any other credit card. You can spend as much money as your credit limit allows as long as you pay off your balance regularly and on time.

Table of contents:

- Pros and cons overview

- Pros of secured credit cards

- Cons of secured credit cards

- How to choose a secured credit card right for you

- Frequently asked questions

- Build credit with a secured credit card

Pros and cons overview

Pros of secured credit cards

Secured credit cards are great tools for establishing and repairing credit. There are several benefits that make secured credit cards attractive.

Secured cards can help build credit

Just like regular credit cards, secured credit card companies send your account data to credit bureaus. This means they are included in your credit report and can help you build credit, if you consistently pay your balance on time.

Getting approved is easier than for unsecured credit cards

Thanks to the deposit that you pay as collateral to your card issuer, the risk of defaulting on payments is less of a concern. Since your creditworthiness is less important when applying for these cards, it’s much easier to get approved without an excellent credit score.

Potential to earn rewards

Although it’s not incredibly common, certain secured credit cards offer perks comparable to unsecured cards, such as travel insurance, credit monitoring services and cash back. If your card offers cash back, consider using this extra cash to help pay off your monthly balance.

Your deposit is refundable

Unless you default on a payment, you will get your deposit back. Even if you do default, all you’ve lost is your deposit—assuming you don’t owe more than your deposit. However, it’s important to remember that late payments on secured cards still negatively impact your credit.

Stepping stone to an unsecured card

For some, the ultimate goal of a secured credit card is to transition to an unsecured card after improving their credit. If you only qualify for a secured card for the time being, it can be a great step toward broadening your credit mix.

Cons of secured credit cards

Thankfully, many of the drawbacks of secured credit cards can be offset by doing your due diligence and choosing the right card. That said, it’s important to be aware of the primary concerns related to secured credit cards.

They require a safety deposit

Many secured cards require a deposit of at least $200, which may not be affordable at the moment. If this makes a card feel unreachable, look into the handful that require a minimal deposit. Just remember that the amount you deposit tends to correlate with the credit limit you’re offered.

High fees may apply

Like any credit card, your secured card may charge high fees. These could include application fees, processing fees or annual fees. Explore your options to find a card that doesn’t tack on too many burdensome charges.

They usually have high interest rates

Since secured credit card issuers anticipate high default rates among people with lower credit scores, these cards usually do not offer generous interest rates, increasing your monthly charges. This may be the least avoidable drawback, with most secured cards charging 15 – 25 percent interest.

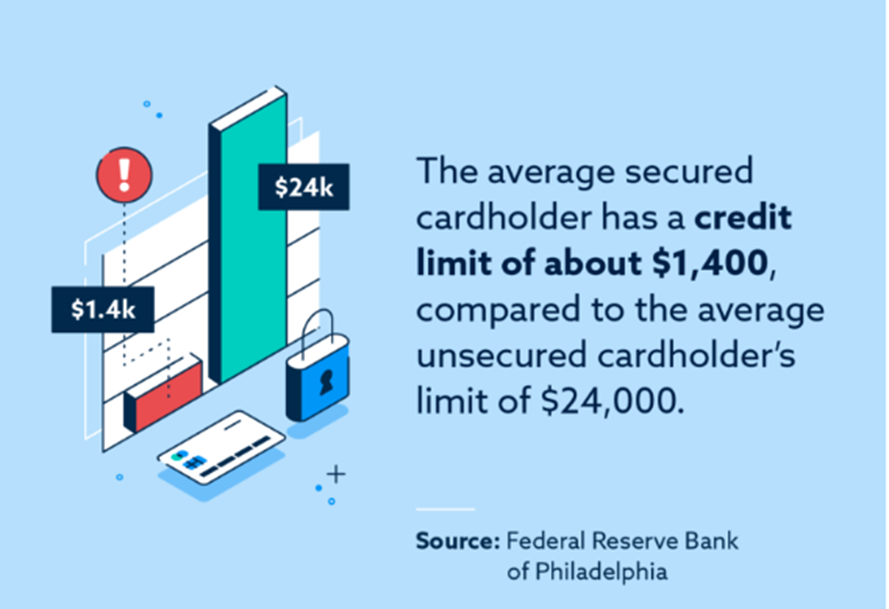

Their credit limit tends to be low

If you want to make a large purchase, your card may get denied due to a low credit limit. Low credit limits can also be harmful to your credit score by making it difficult to keep credit utilization low. If your limit is $300, for example, you’ll want to keep your balance below $100 at all times to keep your credit from taking a hit.

An upgrade isn’t guaranteed

Even if you pursue a secured credit card, there’s no sure path to an unsecured card. If you close your account to pursue another card, this may negatively impact your credit history and keep your score below the approval threshold for an unsecured credit card.

How to choose a secured credit card that’s right for you

Deciding to apply for a new credit card, whether secured or not, is a major decision. Even after weighing the pros and cons of secured credit cards, you’ll probably be juggling some additional considerations. Here are a few factors to consider when choosing the right card for you.

Research different options

While most credit card companies offer secured credit cards, not all have the same offers. When researching different types, compare their cardholder benefits and requirements. This includes security deposit rules, fees, annual percentage rates (APRs) and even the credit reporting practices of each issuer.

Seek upgrade opportunities

Ask the credit card issuers you’re considering if you can upgrade any of their secured cards, such as cashback rewards. Some may even have automatic upgrades for card members after a period of time.

Read the fine print

As with any credit card, it’s important to understand the terms and conditions. Be sure to read the fine print, monitoring for any hidden fees and potential pitfalls. For example, some secured credits charge for cash advance fees and foreign transaction fees when you’re traveling overseas.

Frequently asked questions (FAQ)

Does applying for a secured credit card count as a hard inquiry?

Hard inquiries are notorious for bumping your credit score down by a few points. If you’re struggling to keep your score afloat, you may want to avoid a card whose application warrants a hard inquiry.

Although most secured credit cards do require a hard inquiry, there are a handful that do not. Explore credit card options that don’t conduct a hard credit check, such as the OpenSky® Secured Visa® Card and the Applied Bank® Secured Visa® Gold Preferred® Card. Consider whether avoiding the hard inquiry is worth pursuing one of these options.

Are secured credit cards bad for your credit?

Secured and unsecured credit cards show up identically on your credit report. That said, secured cards are subject to the same credit risks and opportunities as regular credit cards. If you use your secured card in a way that would harm your credit, such as closing your account early or paying late, then your score will suffer. If you use your card responsibly and follow best practices for building credit, however, your score should benefit.

How quickly can you build credit with a secured credit card?

When secured cards are used wisely, you’ll probably begin to see a positive impact on your credit after your first six months of use. Of course, sole reliance on a secured credit card isn’t likely to get you past a certain credit score threshold.

As we mentioned, secured credit cards usually come with a lower credit limit, which may make it difficult to keep your credit utilization low. Likewise, since secured cards tend to be the only credit cards owned while a person is establishing or rebuilding credit, your credit mix will probably not be very diversified until you open new accounts.

Build credit with a secured credit card

All in all, secured credit cards are great options to consider when working to build or repair your credit. There are several options available, each of which offers different benefits and potential drawbacks, so it’s not a bad idea to take a day to shop around and compare your options. When in doubt, remember to consult your financial advisor to figure out what’s right for you.

The credit-building journey doesn’t have a one-size-fits-all solution. Just remember to consistently follow best practices for building credit, and consider using a credit monitoring service to stay on track.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.