The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A joint credit card is an account shared by two people equally responsible for making payments—and the consequences of success or failure will affect the credit scores of both individuals.

“For richer or for poorer” is the vow millions of couples make yearly. Partners navigate money issues daily, from saving and budgeting to managing debt. Joint credit cards offer couples a great opportunity to build credit and manage their finances together, but it requires substantial teamwork and communication.

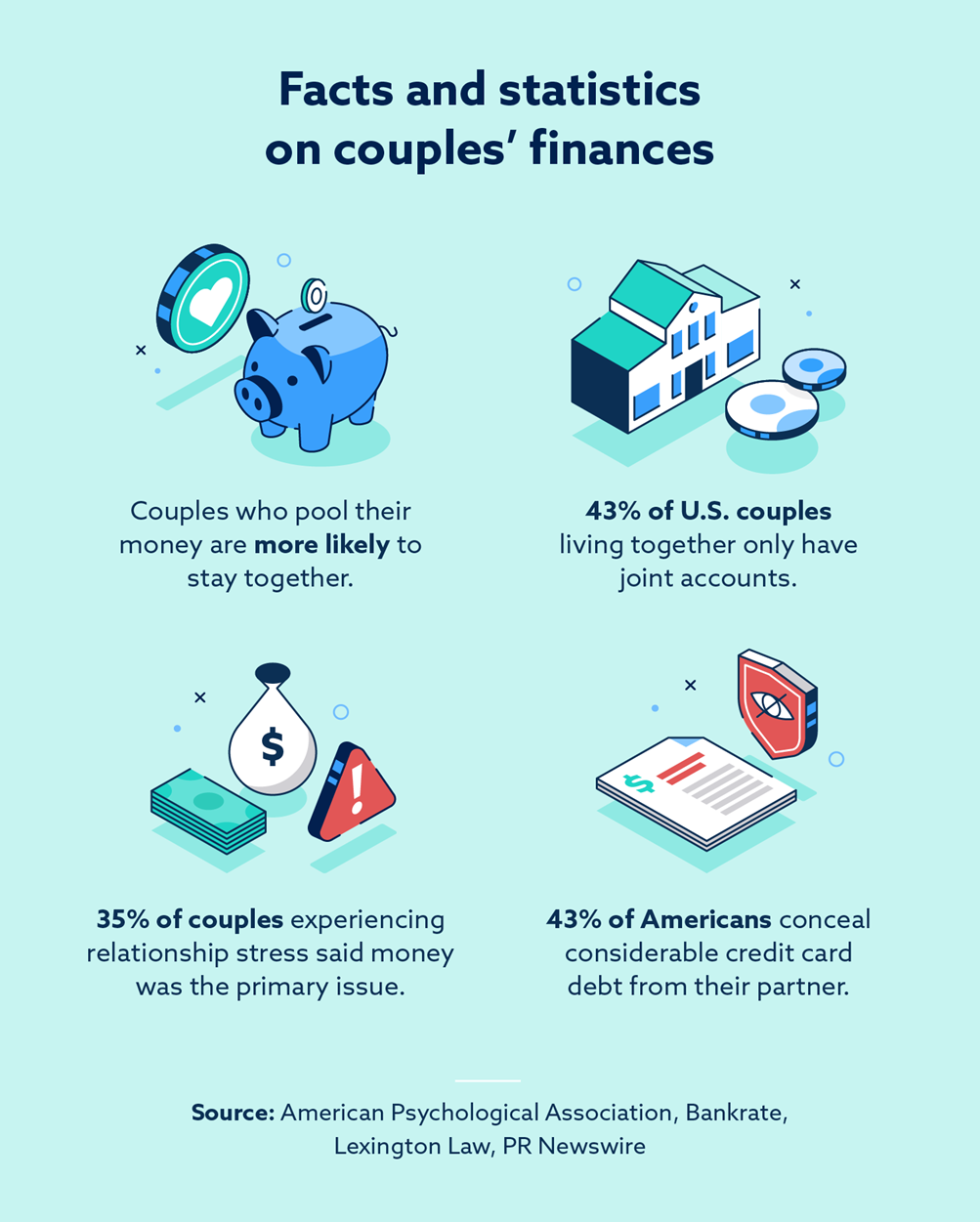

To better understand how couples navigate their financial journeys together, check out these interesting facts and statistics:

- Couples who pool their money are more likely to stay together.

- 35 percent of couples experiencing relationship stress said money was the primary cause of the issue.

- A 2023 report found 39 percent of married couples reported that they didn’t know everything about their partner’s spending.

- A 2021 study found 61 percent of couples talk about their finances at least once a month.

Credit health is something to take very seriously, and joint credit cards can cause problems if they aren’t appropriately managed. Before signing up for a joint credit card, ensure you understand what you’re getting into, including all the potential risks. This guide gives a comprehensive overview of everything you need to know about joint credit cards.

Credit health is something to take very seriously, and joint credit cards can cause problems if they aren’t managed properly. Here, we will discuss what a joint credit card is and its benefits, risks and alternatives—as well as actionable tips for success.

Key takeaways include:

- A joint credit card functions the same way as a regular credit card, except two people share the account.

- Any activity on a joint credit card account will impact both cardholders, and both are equally responsible for paying the card’s balance.

- Potential benefits of joint credit cards include pooled rewards, streamlined finances and improved credit.

Table of contents:

- What is a joint credit card?

- Pros and cons of a joint credit card

- How to apply for a joint credit card

- FAQ about joint credit cards

What is a joint credit card?

A joint credit card functions like a regular credit card, but two people share the account. Each cardholder has a separate card that connects to the account.

The main difference between joint and regular credit cards is that both cardholders share the responsibilities and benefits equally. Any activity on either card will impact both cardholders, who are equally liable for the card’s balance.

Joint credit card vs. authorized users

One alternative to having a joint credit card is to add an authorized user to an existing account. Adding your partner as an authorized user means they can make purchases with your credit card and the positive payment history will appear on their credit report. It can be a fairly safe way to improve their credit by letting them benefit from your positive credit history.

Be careful when adding anyone as an authorized user on your card. No matter how much someone else uses the card, you’ll ultimately be the one legally responsible for paying the balance—not them. If you’re considering adding your partner, have an open and honest discussion about your credit limit and how much you’re comfortable with them charging each month.

Joint credit card vs. cosigners

Another alternative to having a joint credit card is to add your partner as a cosigner. Rather than taking possession and having access to that account as a cardholder, a cosigner vouches for someone applying for a credit card. The cosigner is guaranteeing to the credit card company that they’ll pay the balance if the cardholder can’t.

Cosigning for a credit card is a way to help someone increase their chances of being approved, especially if they’re working to repair or build their credit.

However, having a cosigner could also have its drawbacks. If the cosigner is responsible for the account and can’t make payments, their credit will be affected. Additionally, someone taking on debt as a cosigner can make it more difficult for them to get credit or loans in the future.

| Joint credit card | Authorized user | Cosigner | |

|---|---|---|---|

| Responsibility for repayment | Cardholders are equally responsible | Primary cardholder is responsible | Responsible for repaying the primary cardholder’s debt if the they fail to pay |

| Spending limits | Both users have access to the entire line of credit | Spending limits can be set on authorized user accounts | Doesn’t have the ability to make purchases |

| Credit score impact | Both users credit scores will be impacted | Credit score may be affected by the primary cardholder’s missed payments | Credit score will likely be affected by missed payments |

Pros and cons of a joint credit card

Just like regular credit cards, joint credit cards can offer excellent benefits if properly managed. However, there can also be some serious consequences that can harm both cardholders. Before applying, ensure you know all the pros and cons.

Streamline your finances

When it comes to budgeting, joint accounts—both checking and credit—help simplify your finances. That’s because both people’s transactions are now under one account instead of separate ones. A joint account can help you both get a view of your financial health as a couple and manage your money as a team.

Potential con: If either person abuses their card privileges, it can add stress and feelings of resentment to the relationship. Additionally, if a couple needs to separate or divorce, dealing with joint credit cards can be complicated.

Tip: Maintain open and honest communication about card use, especially large purchases. This will help you stay on track with your budget and financial goals as a couple.

Pool your rewards

A joint credit card lets you amplify your cashback rewards by pooling them in the same account rather than scattering them among multiple credit cards. Additionally, since two people are using the account, the card may see higher use than a singularly owned one, which will rack up the rewards faster.

Potential con: Options for joint credit cards are very limited, so finding a rewards program that fits your lifestyle and needs may be tricky.

Tip: Thoroughly research the annual fees, incentives and cashback percentages before applying for a joint credit card.

Improve your credit

Joint credit cards can help both cardholders’ credit scores, as long as you make on-time payments each month. Additionally, if one person doesn’t have good enough credit to apply for a card on their own, they can leverage the other person’s better credit to score a joint credit card with better interest rates and terms.

Potential con: Just as joint credit cards have the potential to boost your credit, they also have the potential to harm it—even if it’s not directly your fault. If your partner fails to uphold their payment agreement or charges enough on the card to push you past a 30 percent credit utilization rate, your score will likely take a dip.

Tip: Make an agreement on how payments will be made each month to ensure no payments are late or missed. Consider setting up automatic monthly payments to ensure each person contributes to paying off the balance.

How to apply for a joint credit card

If you and your partner decide to apply for a joint credit card, the application process can be similar to that of a standard credit account. Whether you go to the bank or apply directly online, both applicants must provide their financial histories. The card issuer will then conduct a credit check on each applicant’s report.

If both credit scores are good enough to qualify, both of you will:

- Be given full access to the account

- Be able to make adjustments and changes whenever you want

- Have complete discretion over how much money you spend

- Share equal responsibility for making payments

When it comes to charges, an issuer usually doesn’t distinguish between cardholders, and monthly statements aren’t typically broken up based on how much each account holder spends. The entire amount due on the account must be paid when the card’s due date arrives, just as with an individual account. Therefore, remember that even if you each acquire a card, the credit balance will still total one sum.

Frequently asked questions about joint credit cards

Once you decide to apply for a joint credit card, you may wonder what’s next. After reading your card’s terms and conditions, you may have additional questions, such as the ones below:

How do I get my name off of a joint credit card?

Unlike an authorized user credit card—which is easy to remove yourself from—it’s difficult to remove yourself from a joint credit card without completely closing the account. To do this, both parties must agree to pay off the entire balance before closing the account or satisfy whatever requirement the credit card company has for removing one user from a joint credit card account. Keep in mind that this may temporarily hurt your credit, as it may cause your credit utilization rate to increase and your credit diversity to decrease.

What happens to a joint credit card when someone dies?

Notify your credit card issuer immediately if someone on your joint credit card passes away. Ask if they had set up any recurring charges on the card and see that they’re canceled. You should then be able to continue using the card normally as the sole cardholder. Remember that you’ll still be responsible for paying off the balance, regardless of who charged it.

Build your credit together the right way

Whether you and your partner are married, in a civil partnership or living together, a joint credit card can be a great way to streamline your finances, pool rewards and improve your credit if appropriately managed. If you decide to move forward with a joint account, provide clear, respectful and thorough communication about your finances with your partner. Don’t forget to maintain responsibility for your finances as a whole. You can check your credit report regularly to stay on top of potential errors. If you find any mistakes on your credit report, consider working with Lexington Law to address them and learn more about how you can improve your credit.

Note: The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.