The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

While there’s no hard rule about how many credit cards you should have, the average number of credit cards an American adult has is four.

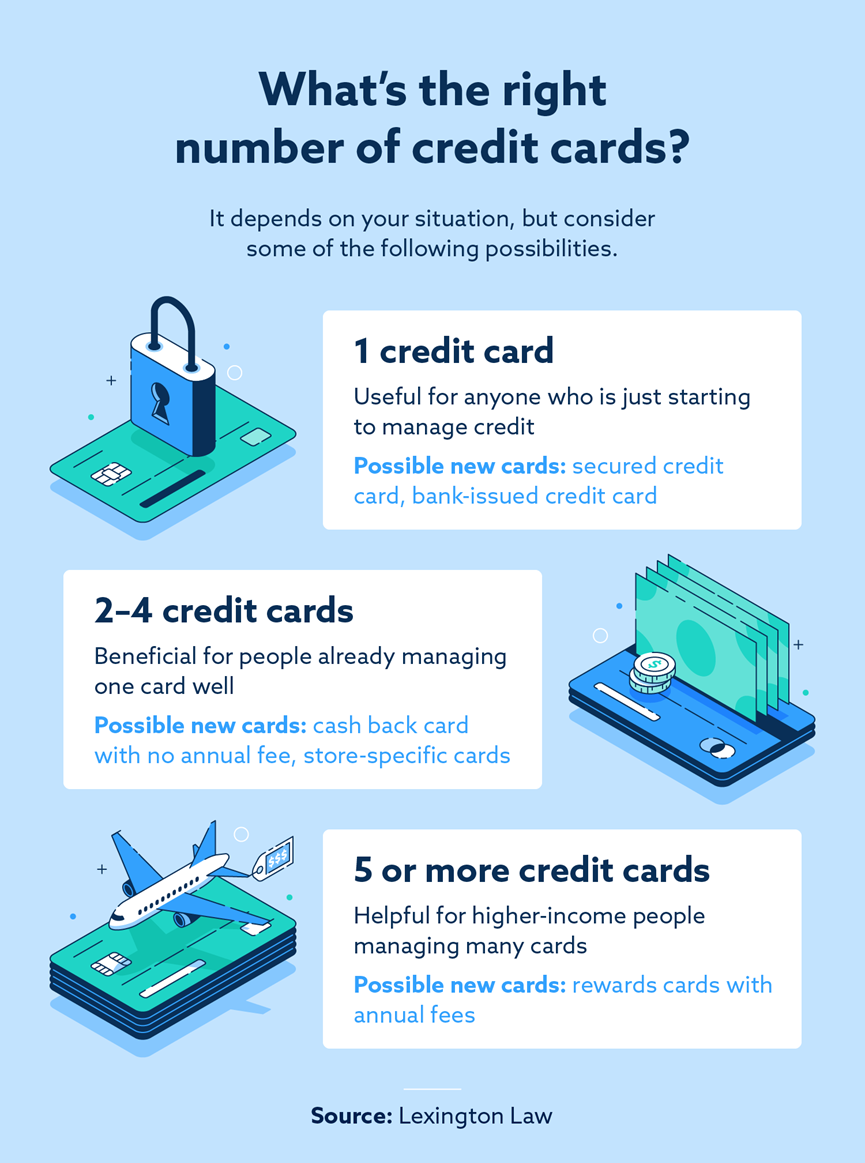

As you build up your financial understanding, you might wonder: how many credit cards should I have? Ultimately, the right number for you will depend on your financial situation and needs. Some individuals benefit from having a single credit card, which offers easy management and fewer decisions. On the other hand, some people can maximize credit card rewards by keeping track of many different cards—often five or more.

The number of credit cards you have can affect your credit score both directly and indirectly. Read on to learn more about how to find the right number of cards for you, how many cards people typically have and how having multiple cards can affect your credit.

Key takeaways:

- There is no set number of credit cards you should have—it depends on your individual financial situation.

- Americans have an average of 3.84 credit card accounts.

- Having multiple credit cards is convenient and can benefit your credit, though it can be challenging to keep track of more than one card.

How many credit cards is too many?

There isn’t a magic number of credit cards that’s the perfect amount for every consumer, and the maximum number is unknown. If you have good credit, you could probably successfully get approved for a dozen cards or more before lenders start to get suspicious. Still, many experts suggest having too many cards can look like a red flag to lenders.

Bruce McClary, senior vice president at the National Foundation for Credit Counseling, warns that even if your credit cards have low balances, having a lot of cards may worry lenders. Each credit card application you fill out shows up on your credit report, and McClary says this may give the perception of a “compulsive borrower.” This is especially true if multiple applications are filled out within a short period of time.

If you need to apply for another credit card, it’s best to apply for only one or two within a six-month period, and no more than five within two years.

How many credit cards should I have?

Only you can decide how many credit cards to have. But here’s a general guide that can be good to follow for the number of credit card recommendations based on your situation:

- You’re just starting with credit cards. (Total credit cards: one.) If you’re looking to get your first credit card, it’s usually wise to stick with a single account. Managing credit can be difficult, and adding multiple accounts from the start can add to the challenge. If you’ve never had a credit card before, you could consider getting a secured credit card, which has restrictions that help you build credit while learning the ropes.

- You’re looking to start generating rewards with your credit cards. (Total credit cards: two to four.) If you’ve built up your credit to the point you can apply for rewards cards, this may be a perk you want to take advantage of. Many people have a cashback card with no annual fee as well as a store credit card with rewards for a retailer they shop at often.

- You’re managing significant amounts of credit and have a higher income. (Total credit cards: five or more.) Some individuals with high incomes and considerable credit card spending can benefit from rewards cards with annual fees. For example, business travelers may get a travel rewards card with benefits like airport lounges or airline miles. Before working toward one of these cards, ensure your spending habits and financial situation will justify the annual fee.

In most cases, you’ll want to consider adding more credit cards to your name only if you have a specific reason for doing so. Having credit cards for their own sake usually isn’t advisable, so consider carefully before opening a new account.

Is it good to have multiple credit cards?

Having multiple credit cards can benefit your credit by lowering your credit utilization rate, which accounts for 30 percent of your FICO® credit score. Opening new accounts increases your total credit limit and decreases your credit utilization—so long as you keep your spending the same.

While this factor is important, payment history accounts for an even larger portion of your FICO credit score (35 percent), which means making on-time payments on the card(s) you have is more important than having multiple cards.

How many credit cards do people usually have?

Although everyone has different credit needs, the average number of credit cards American adults have is around four, according to Experian ®.

Of course, the average number of cards varies based on several factors, including location. For example, in 2020, residents of New Jersey had the highest number of credit cards on average in the United States (4.54), while Alaskans had the fewest credit cards on average (3.06).

Even more interesting is the generational gap among credit card holders. Members of older generations tend to have more credit cards, but we also see older people starting to close accounts as younger people open more lines of credit.

These generational differences make sense because younger adults (Gen Z) likely don’t have enough credit history to get approved for multiple cards. The older generations (Silent Generation and Baby Boomers) are hopefully at a point in their lives where they’re financially secure, have paid off most debts and have less of a need to rely on credit through retirement.

| Average number of credit cards by generation | ||

|---|---|---|

| 2019 | 2020 | |

| Gen Z (18 to 23) | 1.76 | 1.91 |

| Millennials (24 to 39) | 3.18 | 3.18 |

| Gen X (40 to 55) | 4.35 | 4.23 |

| Baby Boomers (56 to 74) | 4.81 | 4.61 |

| Silent Generation | 4.00 | 3.64 |

What are the pros and cons of having more than one credit card?

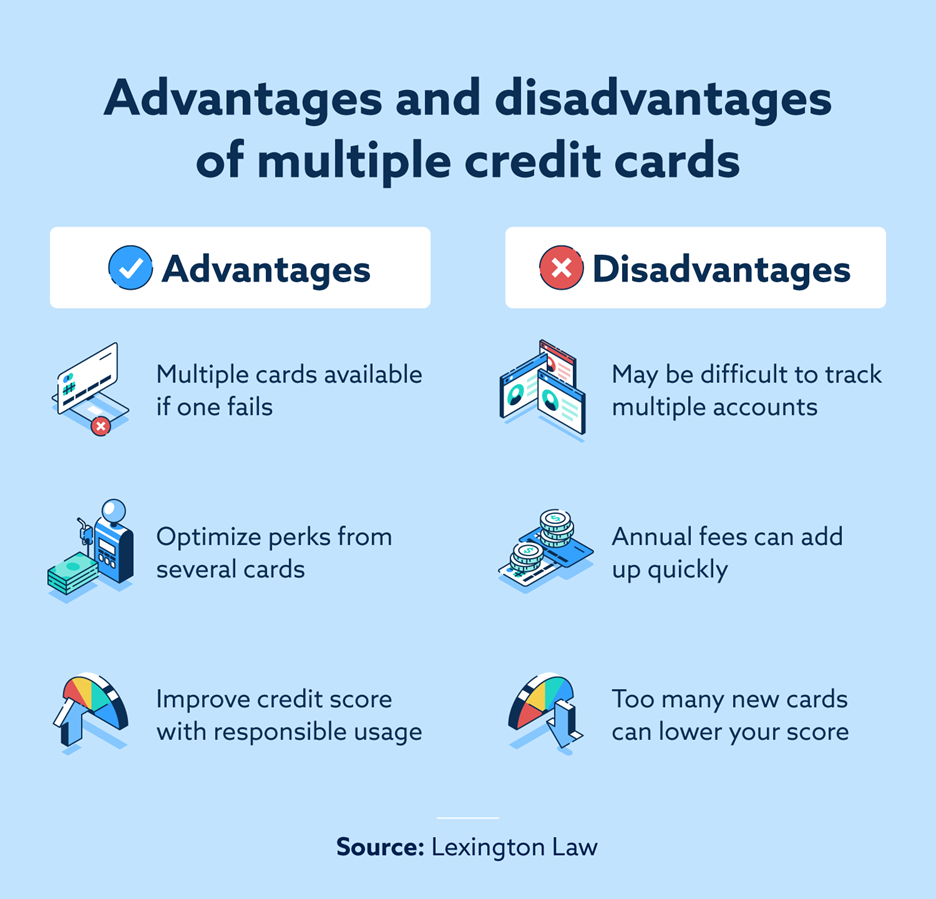

If you’re trying to decide whether to stick with a single card or apply for a new line of credit, it can be useful to think about the advantages and disadvantages of having more than one credit card.

Some of the benefits of having multiple cards include:

- If one card stops working, you have another card available. This is especially important in situations such as traveling, when accessing funds may be extra-challenging.

- You can optimize rewards by using perks from different cards.

- You may be able to improve your credit if you use all cards responsibly.

On the other hand, having multiple cards could have several disadvantages:

- Keeping track of multiple accounts can be difficult, especially for making on-time payments and watching for fraudulent activity.

- Annual fees from multiple cards can quickly add up, so you’re paying for your rewards rather than getting a free perk.

- Getting too many new cards at once could lower your score by dropping your average age of credit and placing hard inquiries on your credit report.

- Having too many credit cards can make lenders suspicious that you’re over-borrowing and desperate for money.

Tips for managing multiple credit cards

If you decide having multiple cards is a good choice for you, follow these tips for managing them effectively:

- Use your cards strategically to maximize rewards. For example, if you have one card offering 5 percent cash back on gas purchases and another offering 1 percent cash back on all purchases, be sure you’re using the one offering 5 percent back when you hit the gas station.

- Keep track of terms and conditions. If you have several credit cards, you’ll need to be familiar with the terms and conditions, credit limits, interest rates, due dates, rewards and more for all your cards. Keep a spreadsheet with all this information so you don’t lose track.

- Only carry the cards you actually use. You likely don’t need to physically carry every single card you have. For instance, if you use one card specifically for paying bills, it doesn’t need to take up space in your wallet—keep it at home for convenience and added security.

- Pay on time and in full. This is the golden rule when it comes to using credit responsibly. It could be helpful to get your payments on the same schedule so it’s easier to remember or set up autopay so you never miss a payment.

Whether you choose to have a single credit card or many, you’ll want to get in the habit of checking your credit score and credit report. Your credit report shows what each of the three credit bureaus knows about your credit history—accounts, balances and payments. If you notice any inaccurate information, like an account that doesn’t actually belong to you, you’ll want to file a dispute with the credit bureaus to potentially get that information removed.

If you’re working to address negative items on your credit report or have had any other difficulties managing credit, learn more about how Lexington Law Firm’s services can help.

Note: The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.