The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

There are several possible reasons why your credit score won’t go up, such as the lender hasn’t reported to the credit bureaus yet, you have fallen behind on payments, you have high credit utilization or you have a short credit history.

A good credit score can help you get approved for loans, secure low interest rates, and receive the best terms. However, improving your credit can be tricky, especially if you feel stuck at a certain number.

If you frequently check your credit score and don’t see the number change, you may wonder, “Why won’t my credit score go up?” In this post, we’re going to dive into 10 potential reasons why your credit score is stagnant and what to do about it. Read on to learn more.

Table of contents:

- Your credit score hasn’t been updated yet

- You’ve fallen behind on payments

- You have high credit utilization

- You have a short credit history

- You have negative items on your credit report

- Your credit mix isn’t diverse

- You have multiple new hard inquiries

- Your credit score is already high

- You have errors on your credit report

- You’ve been a victim of identity theft or fraud

1. Your credit score hasn’t been updated yet

Lenders typically report to the three credit bureaus every 30 to 45 days. Therefore, it can take up to a month for your credit score to reflect new changes. If you recently paid off an account and haven’t seen a change in your score yet, there’s no need to worry.

What to do about it: If you don’t see the update reflected in your credit report after a month or two, consider contacting your lender.

2. You’ve fallen behind on payments

Payment history is a fundamental factor that affects your credit—accounting for 35 percent of your FICO® score. If a payment is over 30 days past due, your lender will report it to the credit bureaus. Even one late payment can hurt your credit significantly. Late payments also stay on your credit report for up to seven years, although their influence on your credit report declines over time.

What to do about it: Get in the habit of making consistent on-time payments.

3. You have high credit utilization

Your credit utilization, or the amount of money you owe compared to your credit limit, is another factor that influences your credit. For example, if your credit limit is $12,000 and you owe $3,000, your credit utilization rate is 40 percent.

While using your available credit isn’t necessarily bad, a high credit utilization rate can signal to lenders that you’re reliant on credit and, therefore, are a high-risk borrower.

What to do about it: Aim to keep your credit utilization under 30 percent by reducing your spending or increasing your credit limit.

4. You have a short credit history

Your length of credit history, or the amount of time your accounts have been established, accounts for 15 percent of your FICO score. A long credit history is helpful to your credit because it provides lenders with enough data to accurately determine your credit risk. Remember that while a long credit history is beneficial, FICO assures that it’s “not required for a good credit score.”

What to do about it: Be patient and keep old credit accounts open.

5. You have negative items on your credit report

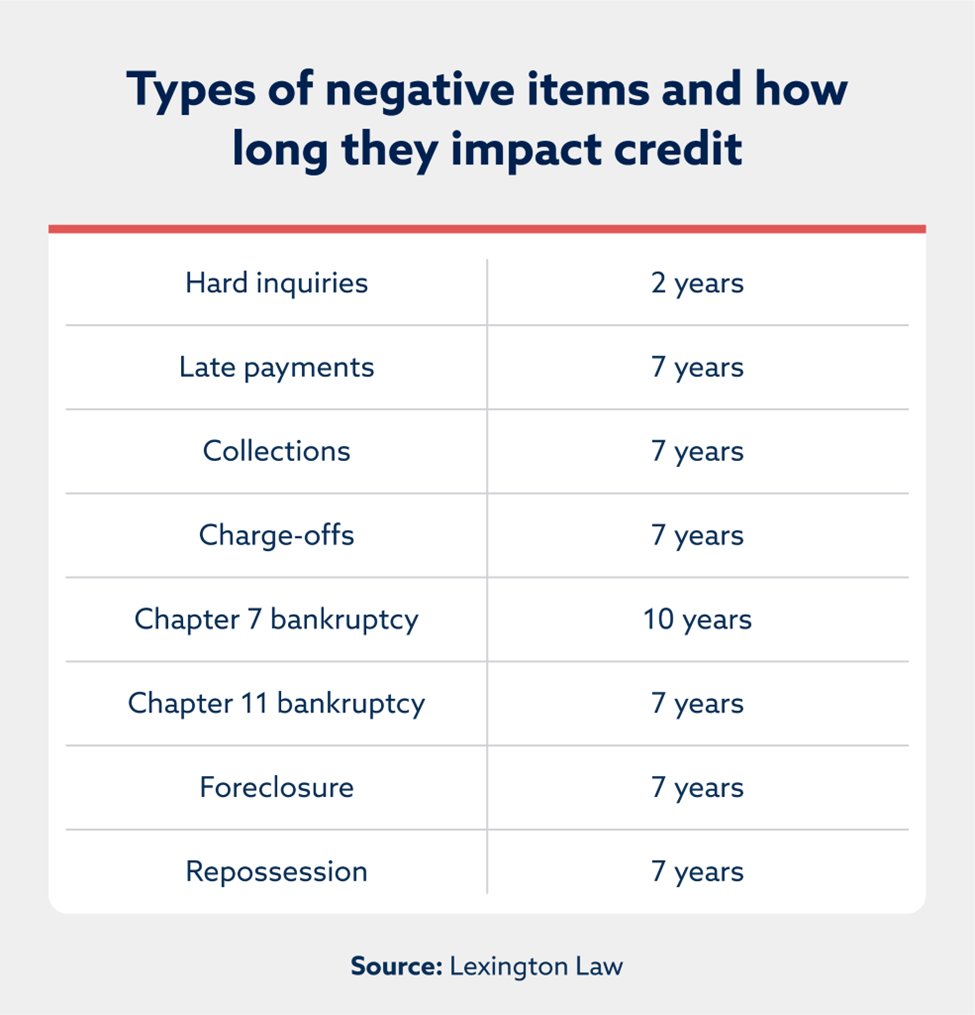

Delinquent accounts, bankruptcies, charge-offs, and collection accounts are all major negative items. If you have any of these on your credit report, they may be preventing you from improving your credit.

Although negative information will eventually fall off your credit report, the amount of time that takes depends on the type of negative item. Most negative information stays on your credit report for about seven years.

What to do about it: While not guaranteed, you can try sending a pay for delete letter or request a goodwill deletion from your creditor to get the negative items removed.

6. Your credit mix isn’t diverse

Credit mix refers to the variety of credit accounts you hold. Examples of credit accounts include credit cards, mortgages, auto loans, credit cards, installment loans, and so on. Credit mix determines 10 percent of your credit score.

What to do about it: While you don’t necessarily need one of each type of credit, consider opening new accounts to diversify your credit mix.

7. You have multiple new hard inquiries

When you submit a new credit application, the creditor will perform a hard inquiry on your credit file, which can temporarily lower your score. While the impact of a hard inquiry is only around 5 points, multiple credit inquiries can add up and cause a significant drop in your credit.

If you frequently apply for new credit, the compounding hard inquiries may be preventing you from improving your score.

What to do about it: Wait at least six months between each new credit application to limit the effect of hard inquiries on your credit.

8. Your credit score is already high

Those with very good or excellent credit scores may struggle to advance their credit standing. The better your credit score, the harder it becomes to raise it because there is less room for improvement. Once your score is in the 700s or 800s, increasing it can be challenging.

What to do about it: Keep up with your good credit habits, but be aware that progress may slow as your score increases.

9. You have errors on your credit report

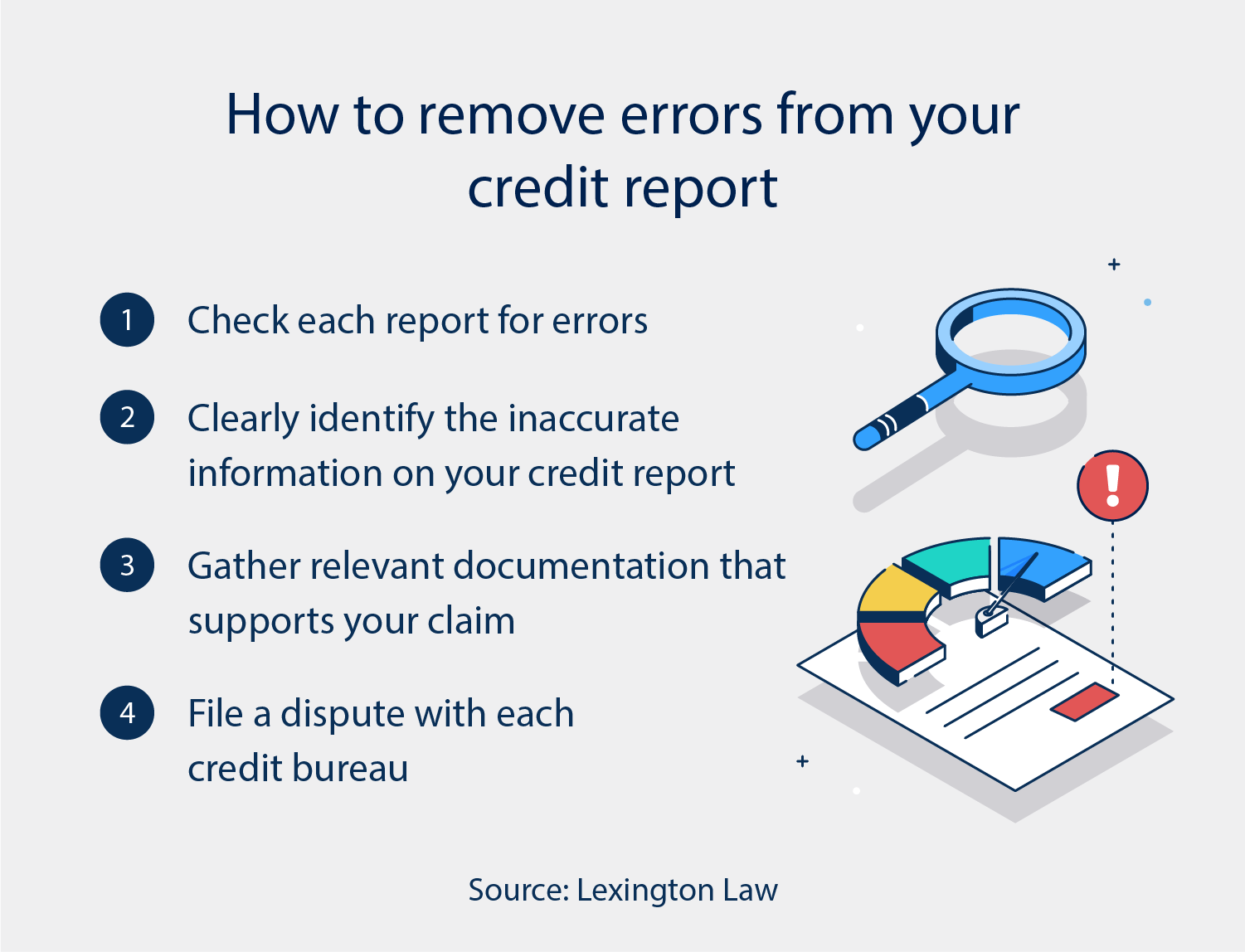

Errors on your credit report can damage your credit. Review your credit report at least once a year to check for inaccurate information. According to the Consumer Financial Protection Bureau, common errors include:

- Identification errors

- Misreported account status

- Data management errors

- Inaccurate balances

What to do about it: If you find an error on your credit report, file a dispute with the credit bureaus to get it corrected.

10. You’ve been a victim of identity theft or fraud

Identity theft can wreak havoc on your credit score. Scammers can open new accounts in your name, purchase items with your credit card and more. That’s why it’s important to keep an eye out for the following warning signs of identity theft:

- Charges for purchases you didn’t make

- Calls from debt collectors regarding accounts you didn’t open

- Accounts on your credit report that you didn’t open

- Loan applications getting rejected

- Mail stops being delivered to, or is missing from, your mailbox

What to do about it: If you suspect you’ve been a victim of identity theft, make sure to set up fraud alerts and freeze your credit. Ready to move the needle on your credit score? At Lexington Law Firm, we’ll determine what inaccurate negative items might be hurting your credit and address them with the credit bureaus. Among our services, we offer an Identity Theft Focus Track, created specifically for individuals financially recovering from identity theft. Get started today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.