The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Credit card companies report payments at the end of their monthly billing cycle, also known as the statement closing date.

Credit cards are great for making large purchases and racking up points or miles and useful for building and improving your credit. If you’re a credit card holder constantly tracking your credit score to see improvement, it can be helpful to know when companies report to credit bureaus.

Unfortunately, issuers don’t report to credit reporting agencies on a specific day of the month. However, we can investigate a few factors to provide a prediction of when they will report as well as when you will see your payments reflected on your credit report.

Table of contents:

- When do credit card companies report to credit bureaus?

- How does credit card utilization affect your credit score?

- How to decrease your credit utilization risk

- How often do credit reports and scores update?

When do credit card companies report to credit bureaus?

Unfortunately, there isn’t a set date for when credit card companies report to the three credit bureaus: TransUnion®, Experian® and Equifax®. However, you can estimate the time frame by considering a few factors. Credit card companies typically report payments at the end of the monthly billing cycle. This is also known as your statement closing date. You can find these dates on your monthly statement.

However, don’t expect your credit report to update on the same day. It usually takes a bit for credit reporting agencies to update the information on your credit report. Updates on your credit report will also depend on:

- The number of lines of credit

- Due dates for every line of credit

- If the credit issuer reports to all three credit bureaus or just one or two

- The frequency and speed with which the credit bureau updates reports

If you’ve just paid your statement balance or previously unpaid balances, you likely want to see that reflected on your credit report as soon as possible. Since we don’t have a set-in-stone date for when you’ll see updates on your credit report, we recommend waiting at least a month or so to see any changes. If several months pass and you don’t see any updates to your report, we recommend contacting your credit card company to confirm your payments were correctly processed.

How does credit card utilization affect your credit score?

Credit utilization is the ratio of your current outstanding credit debt to how much total available credit you have. Available credit is the maximum amount of money you can charge to your credit card. A low credit utilization is a good sign that you, the borrower, are using a small amount of your credit limit.

A large outstanding credit balance—or higher credit utilization—can negatively affect your credit. This is especially true if the credit utilization percentage is higher than 30 percent. The lower your credit utilization, the better your credit may be.

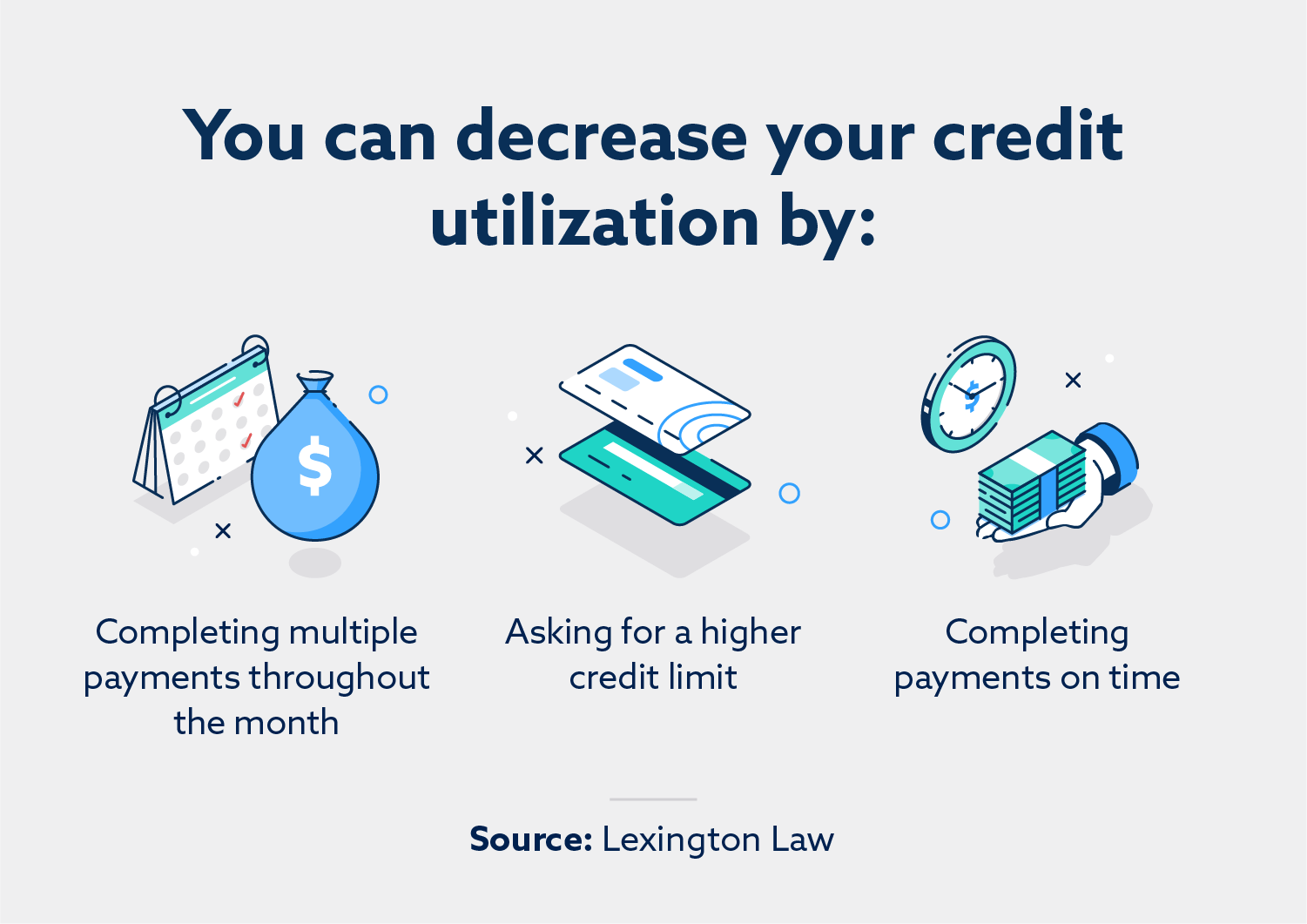

How to decrease your credit utilization

Your credit score is affected by five factors: credit utilization, credit mix, new credit, payment history and length of credit history. However, credit utilization makes up 30 percent of your score. If you’re worried about how your credit utilization impacts your credit score, there are ways to decrease your risk and potentially improve your credit.

1. Complete multiple payments

Completing smaller payments every month can help lower your credit balance. You can also set up automatic payments so your credit balance is as low as possible when your credit card company reports to the credit bureaus.

2. Ask for a higher credit limit

Increasing your credit limit can lower your credit utilization ratio, as you’ll have more credit available. This can improve your credit score as it reduces the percentage of credit used every month. However, a higher credit limit may encourage you to spend more, which could go against your goal to improve your credit. Only ask for a higher credit limit if you think you’ll stay within your current average spending amount.

3. Complete payments on time

Paying your bills by their due date is the easiest way to improve your credit. This can become harder if you have multiple credit accounts, as they won’t always have the same due dates. Keeping track of your due dates (found on the monthly statements) via credit card management apps or similar tools can help you stay on top of your bills.

If you can do so, making multiple payments on your card(s) throughout the month is the smartest move. This is because it can increase the likelihood that your credit utilization ratio is low when your credit card provider reports your data to the credit bureaus.

How often do credit reports and scores update?

While there isn’t an exact date when your credit score and report will update, it usually occurs within a 30- to 45-day timeframe. This also depends on when the credit bureaus refresh the information in your report. Remember that if you have multiple lines of credit, you’ll see your credit score constantly fluctuating based on when your creditors report to the credit reporting agencies.

How long until a new card appears on your credit report?

Just received and activated a new credit card? You’ll need to wait a bit to see your new credit card appear on your credit report. You can expect it to show up 30 to 60 days after your application was approved and your creditor opened the account. The number of days will depend on your credit card’s billing cycle.

Assess your credit with Lexington Law

Now that you have a better understanding of when companies report to credit bureaus, it’s also a good time to assess your credit score. If you receive your credit report and notice your credit score isn’t as good as it should be, don’t worry. With help from professional credit repair consultants at Lexington Law Firm, you may be able to improve your credit through our credit repair process. Get started with a free credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.