The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A billing cycle is the amount of time between the closing dates of consecutive billing statements. Typically, billing cycles are one month long, although they can range from 20 to 45 days.

If you have a credit card, understanding your billing cycle and how it works is necessary to maintain good credit. Not knowing your billing cycle can lead to missed payments, late fees and hefty interest charges. In fact, Americans paid $164 billion in credit card fees and interest in a single year.

Read on to learn more about billing cycles, including the typical length and how it affects your credit score.

What is a billing cycle?

A billing cycle is the time frame between the end of one statement billing date and the start of the next one. Most billing cycles operate on a monthly basis, although this can vary by lender. During one billing cycle, all transactions, interest charges and fees you incur are reflected in your monthly statement.

How does a credit card billing cycle work

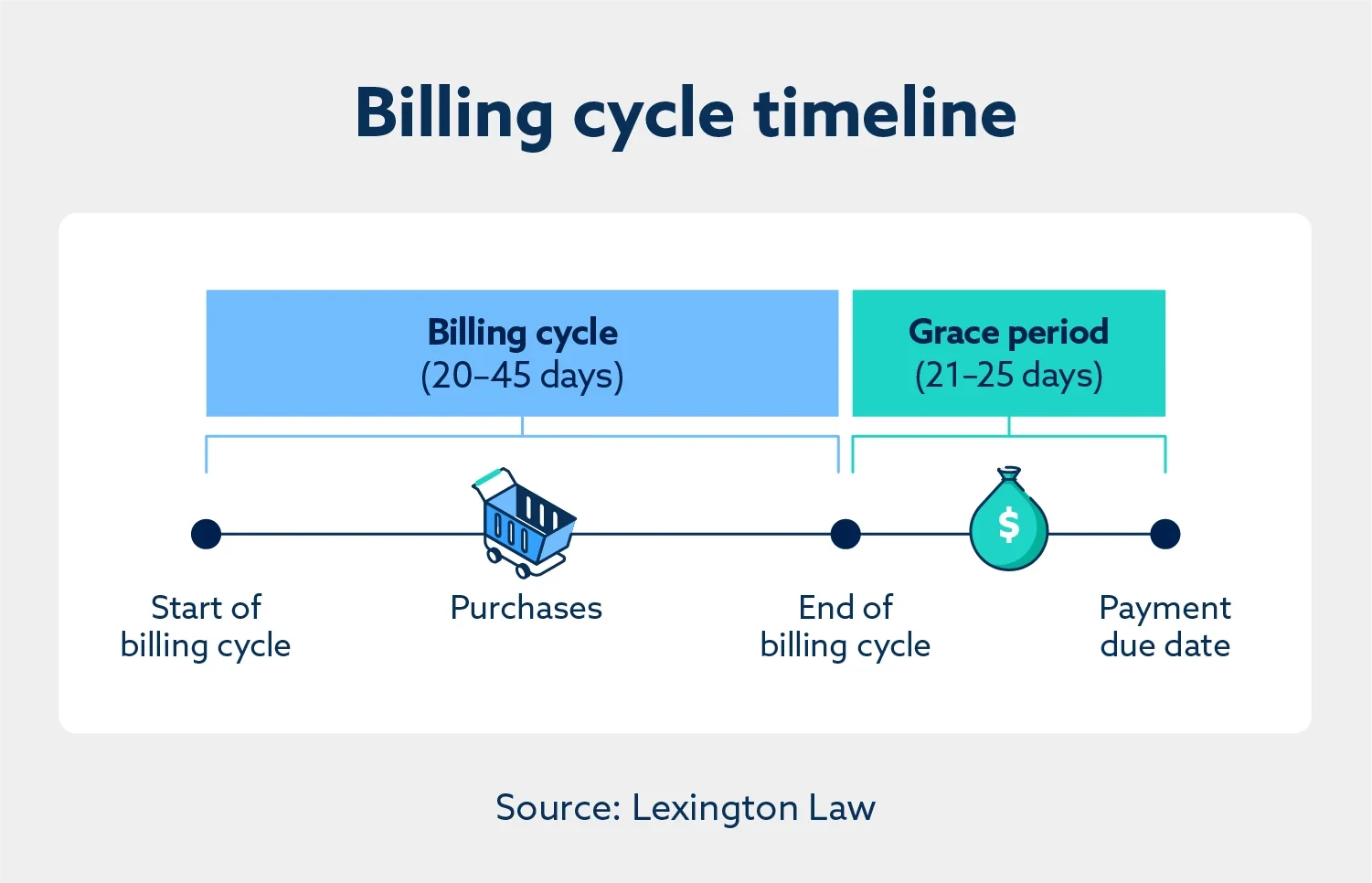

A credit card billing cycle works by tracking all purchases and payments, fees and interest charges over a certain amount of time. At the end of each billing cycle, you will receive a monthly statement from your credit card company that totals the amount you owe.

Typically, your credit card payment is due around three weeks after the end of the billing cycle. This time between the end of the billing cycle and the due date is referred to as the grace period. By the due date, you need to pay your credit card bill, making at least the minimum amount to avoid additional interest charges and late fees.

Billing cycle example

For example, let’s say that your credit card billing cycle starts on May 1st and ends on May 31st. All of your transactions within those dates are included in your May statement, which is generated on May 31st. The payment due date for this billing cycle is June 25th, so you must pay at least the minimum amount due to avoid late fees.

How long is a billing cycle?

Typically, a billing cycle is one month long, although it can range from 20 to 45 days. To determine how long your credit card’s billing cycle is, refer to your credit card agreement or check your credit card statement. It’s usually located on the first page near where you’ll find your balance.

Keep in mind that billing cycles can differ in length by up to four days to accommodate holidays and months that have more or less number of days than others. However, your due date will be the same each billing cycle, such as the 15th of each month.

Can I change my credit card billing cycle?

You may be able to change your account’s billing cycle, although this depends on your credit card issuer’s policies. Often, credit card issuers will allow credit holders to choose from a variety of dates.

To request a different billing cycle end date, contact your credit card’s customer service representative. Keep in mind that most credit card issuers have parameters surrounding how often you can change your billing cycle, and changes may take a couple of billing cycles to take effect.

How your billing cycle impacts your credit score

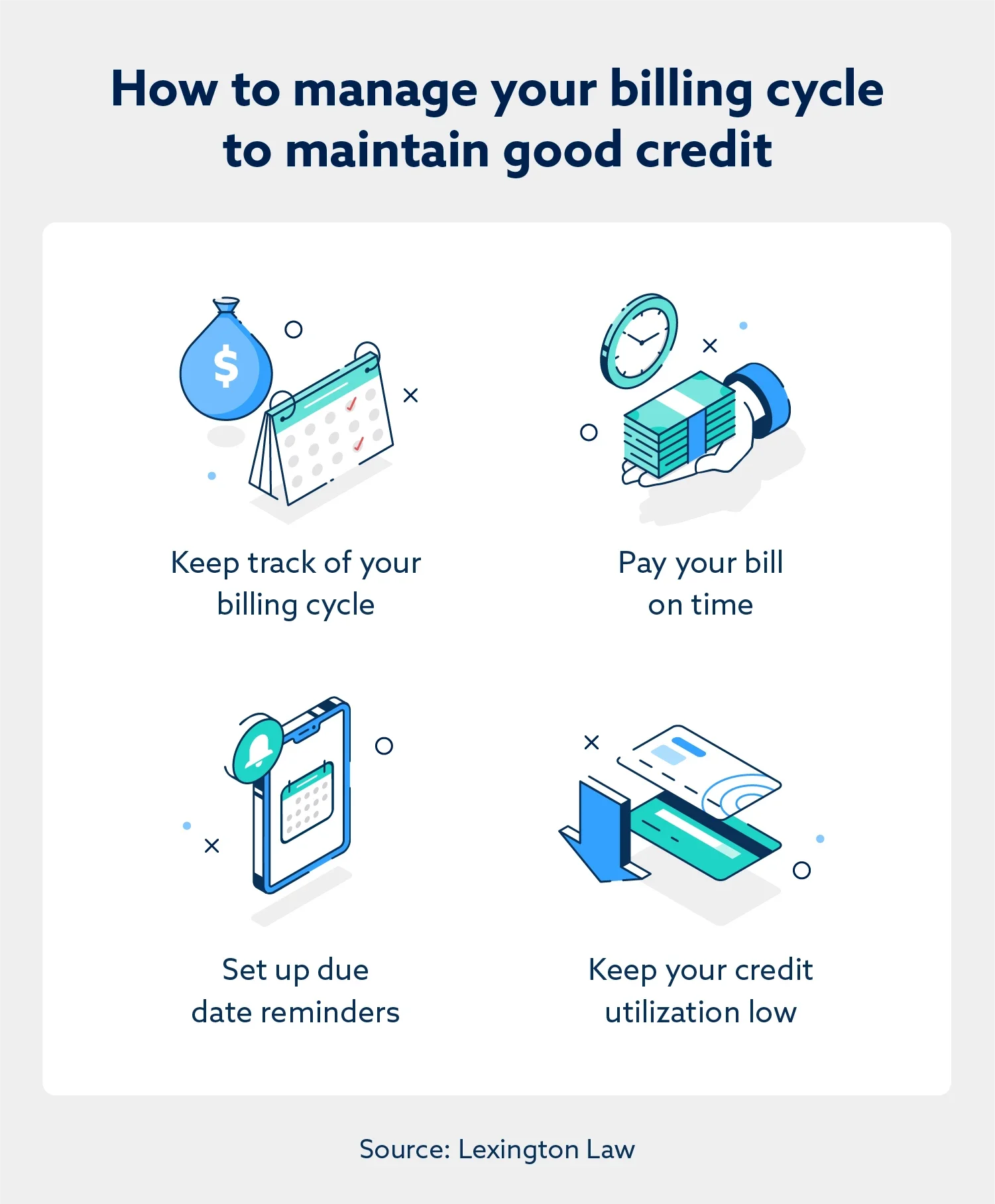

Your billing cycle impacts your credit score because how you use your credit card during that period is reported to the three credit bureaus at the end of each billing cycle. If you make late payments or miss them altogether, your payment history, which typically makes up 35 percent of your credit score, will be greatly affected.

To set yourself up for success, make payments on time each month. You might also consider paying your credit card bill in full each month to help you avoid interest charges.

Another thing to keep in mind is your credit utilization. Your credit utilization ratio, or the amount of credit you’re using compared to your credit limit, is reported to the credit bureaus at the end of each billing cycle. To maintain good credit, it’s recommended that you keep your credit utilization under 30 percent. One way to do this is to pay off the full balance instead of just making the minimum payment.

Lastly, you can also use your understanding of billing cycles to plan for large purchases and ensure you can make timely payments. For example, let’s say you’re planning to go on a vacation. If you book your trip at the start of the billing cycle, you’ll have more time to pay it off than if you were to make that purchase toward the end of your billing cycle.

Monitor your credit with Lexington Law Firm

Understanding your billing cycle is important to ensure you pay your bills on time. In addition to tracking your billing cycle, regularly monitoring your credit score can help you further understand how your financial choices impact your credit in addition to alerting you of any potential errors or discrepancies. Lexington Law Firm can help – get started today with your free credit assessment.