The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The bills most commonly reported to the credit bureaus and included on your credit report are for credit cards, student loans, car loans and mortgages. Rent, utility and phone bills typically don’t affect credit unless you opt into a third-party service.

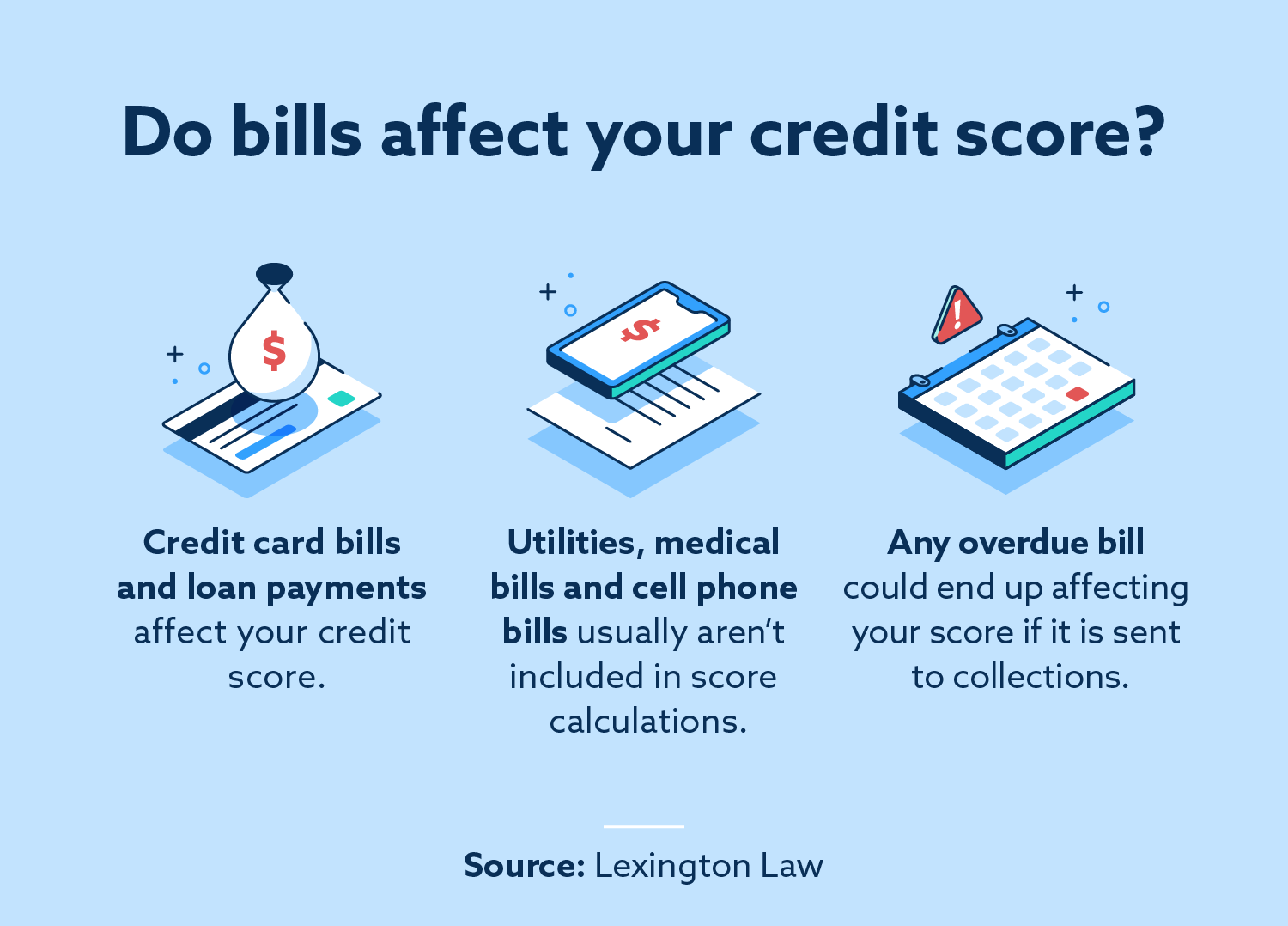

Credit bureaus calculate your credit score using many factors — including balances and payments made for your bills. That said, the bills that affect your credit score are typically for credit cards and installment loans, like auto, student or mortgage loans. Other bills, like utility payments or cell phone plans, usually aren’t listed on your credit report.

However, many bills can end up on your credit report if you fail to pay, and it is possible to get certain bills on your report if you want to improve your credit score by showing additional accounts in good standing.

Read on to learn more about what bills affect your credit score and how to monitor your credit report for accounts related to your bills.

What bills help build credit?

In general, the bills that help build credit are for your credit cards and loan payments. Other bill payments — including rent, cell phone plans, utilities or medical bills — are not typically included in your score.

Remember, your credit score is calculated with a scoring system like FICO® or VantageScore. These models look at all of the accounts listed on your credit reports to assign a score, which signals to lenders how risky it is to offer you new credit, like a credit card or a loan.

These scoring models can only work with information accessible on your credit reports, which are maintained by three bureaus — TransUnion®, Experian® and Equifax®. The three credit bureaus simply report the information that is provided to them by lenders.

Credit card bills

Credit card payments are reported to the credit bureaus and can significantly impact your credit score. To build credit with credit card payments, remember to pay your bill on time each month to create a positive payment history. Even one late or missed payment can negatively impact your score.

In addition to keeping track of payments, try to keep the amount of credit you’re using, referred to as credit utilization, low. The best way to do this is by paying your entire balance each month.

Student loan payments

Paying your student loans on time is a great way to build credit. Not only will this establish a positive payment history, but it can also improve your length of credit history and diversify your credit mix. On the other hand, late payments on your student loans will hurt your score.

Car loan payments

Car payments are another loan type that is reported to the credit bureaus. When buying a car, make sure you can afford to make at least the minimum payment each month to ensure you can make your payment on time each month. To do so, many financial experts recommend that you spend under 10 percent of your take-home income on your car payment.

Mortgages

While your credit score may take an initial hit from taking out a mortgage, it will rise as you make consistent, on-time payments.

Keep in mind that a late or missed payment on a mortgage is more detrimental to your credit score than a late payment for a credit card account. Not to mention, multiple missed payments in a row will lead to foreclosure, which can negatively impact your score by over 100 points.

Rent, utility and phone bills

Since utility companies, apartment complexes, cell phone companies and other businesses don’t generally report information about account balances and payments to the credit bureaus, those bills generally aren’t included in your credit score calculation.

Fortunately, there are a few ways that you can use these bill payments to potentially improve your credit score. If you’re currently making payments on your rent and utility bills and have accounts in good standing, you may want to look at how a couple of programs could raise your credit score.

For example, you can add rent and utilities to your credit report. Rent and utility reporting services add these payments to your credit report to help you build credit.

What bills can hurt your credit?

Any bill that you miss enough payments on can show up as a negative item on your credit report. Delinquent accounts — accounts that are no longer in good standing — could be sent to collections, which will usually show up as a negative item on your credit report.

For example, an unpaid medical bill, an overdue cell phone payment, or late rent could eventually end up on your credit report if you fail to pay what you owe. Since the original lender wants to recoup some of the money you owe them, they’ll work with a collection agency to try to get a payment from you. A collection account on your credit report could lead to a significant drop in your credit score, so it’s important to make payments on time and in full for any bills you owe — not just credit cards and loans but also bills for any utilities or services you use.

If you’re struggling to pay your bills, it’s often helpful to reach out proactively to set up a payment plan, which may prevent your bill from being reported as a negative item on your credit report.

Many utility companies, cell phone providers and medical centers can negotiate costs or offer support to people in difficult financial situations. As a result, it’s generally in your best interest to try to make arrangements before your credit score takes a hit from a bill going to collections.

Monitor your credit with Lexington Law Firm

If you make any bill payments — whether for credit cards, utilities or services — you’ll want to make sure that you’re regularly monitoring your credit report. That way, you’ll know what bills are affecting your credit score and what else is affecting your score, too.

You can get a free credit report from each of the three credit bureaus annually, and this report will include information about your accounts, balances and payment history.

When scanning your credit report, you’ll have the opportunity to look for any accounts that have been misreported — such as reflecting inaccurate information or if there’s an account that doesn’t belong to you. Misleading negative items could unfairly lower your credit score.

If you’re wondering where your credit stands, you can start with a free credit assessment.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.