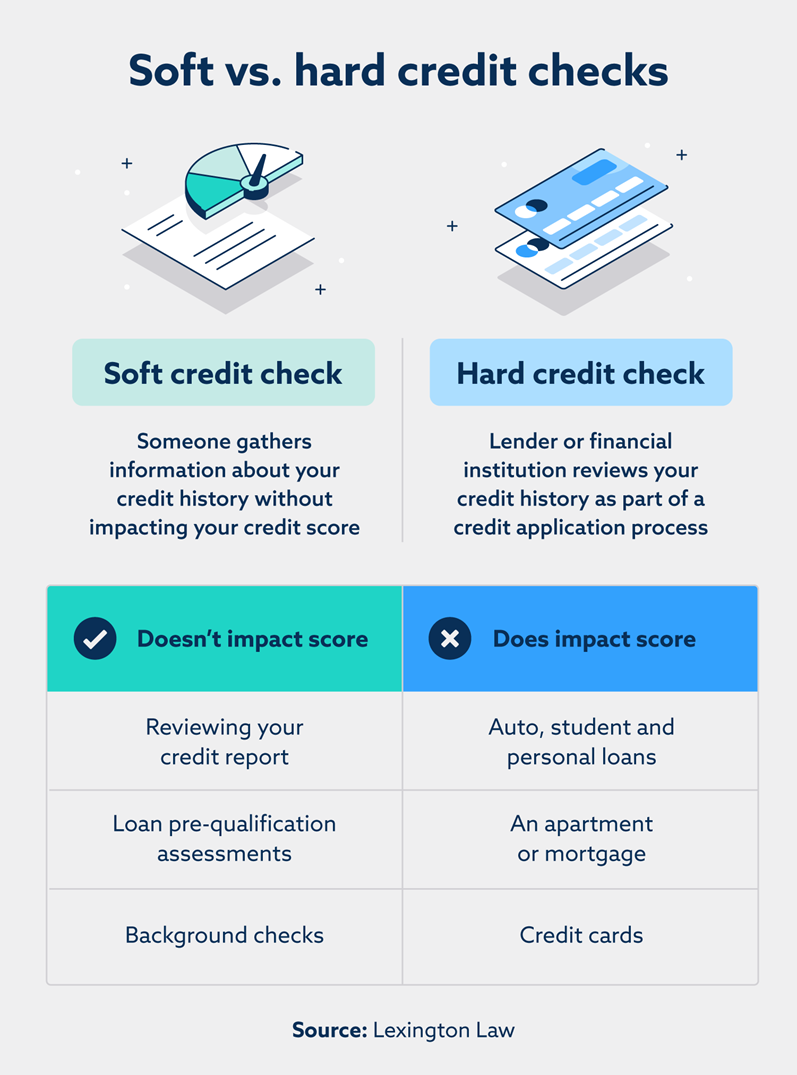

A soft credit check occurs when someone accesses your credit report for information purposes and does not affect your credit score or require your permission. Hard credit checks occur when someone accesses your credit report due to a credit application, temporarily impacting your credit score.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you’re looking to apply for credit, you’ve likely wondered about the differences between soft vs. hard credit checks. Despite both involving credit report access, their purpose and impact differ significantly.

In this article, you’ll learn the differences between soft vs. hard credit checks, their purposes, how they affect your credit report and when and why creditors use them. Read the full guide for a comprehensive understanding of these types of credit checks, or you can jump ahead to the topic you need the most clarity on:

Table of contents:

- What are credit checks?

- What is a soft credit check?

- What is a hard credit check?

- Do multiple inquiries count as one?

- How long do credit checks stay on your report?

- Can you reduce the impact of hard credit checks?

- How to dispute a hard credit card inquiry

What are credit checks?

A credit check is a process that financial institutions, such as banks or lenders, undertake to evaluate a potential borrower’s creditworthiness. Its main purpose is determining whether an individual is reliable and capable of paying their debts on time.

The credit check typically involves reviewing an individual’s credit health based on payment history, outstanding debts, length of credit history and types of credit used. This information helps lenders decide whether to grant loans, extend credit or enter financial agreements with individuals.

What is a soft credit check?

A soft credit check, also known as a soft pull or a soft inquiry, is a type of credit check conducted to gather information about an individual’s credit history without impacting their credit score. Soft credit checks include:

- You reviewing your credit report

- Loan pre-qualification assessments

- Background checks

Individuals can initiate their own soft inquiries, as can potential employers or financial institutions aiming to preapprove individuals for credit opportunities.

Does a soft credit inquiry hurt your score?

No, a soft credit inquiry does not hurt your credit score. They’re essentially harmless and typically occur for informational purposes, such as when you check your credit report.

Only you can see soft inquiries on your credit report, which do not impact your overall credit standing. These inquiries don’t suggest that you are taking on new debt, so credit scoring models do not penalize you for them. And since they don’t negatively affect credit scores, you can request them freely without risking your creditworthiness.

What is a hard credit check?

A hard credit check, also known as a hard inquiry or hard pull, occurs when a lender or financial institution reviews your credit history as part of a credit application process. The purpose of a hard credit check is for lenders to determine the terms of the credit offer based on your creditworthiness.

These inquiries can slightly lower your credit score, usually by a few points, but their impact diminishes over time. Lenders typically perform hard credit checks if you apply for:

- Auto, student and personal loans

- An apartment

- Credit cards

- A mortgage

Be mindful of the number of hard credit checks you accumulate within a short period, as multiple inquiries may signal to lenders that you are taking on too much debt and may not be an ideal borrower.

Does a hard credit inquiry hurt your score?

Unlike soft credit checks, hard credit checks can negatively affect your credit. During a credit application, the lender will typically request a hard credit check to assess your creditworthiness. They may review your credit history, resulting in a small credit score decrease. That said, hard credit checks usually have minimal impact—usually just a few points—and their impact diminishes over time.

Fortunately, the credit scoring models consider that borrowers may shop around for credit options, which is apparent in how they handle multiple inquiries.

Do multiple inquiries count as one?

Generally, credit score models will count multiple inquiries of the same type, such as multiple auto loan inquiries, within a specific time frame as a single inquiry on your credit report. This is called deduplication—removing duplicate inquiries to minimize the negative impact on your credit. These deduplication periods recognize that individuals may shop for the best loan or credit card terms and differ across credit models. For example, VantageScore® has a 14-day window, and FICO® gives you 45 days.

Consolidating credit applications within this time frame allows you to compare offers without worrying about each inquiry affecting your creditworthiness. However, this may not apply to inquiries for different credit types.

How long do credit checks stay on your report?

Soft checks usually do not directly impact your credit, but they can remain on your report for around two years. While these inquiries are visible to you, lenders and creditors accessing your report can’t see them.

Hard credit inquiries can affect your credit score, but the impact is minimal and decreases over time. Most scoring models see recent inquiries as more relevant and important. These inquiries also stay on your credit report for about two years and are visible to anyone who accesses it.

Can you reduce the impact of hard credit checks?

While you can’t completely avoid the impact of hard credit checks on your credit, you can take a few steps to minimize it:

- Consolidate your credit applications: As we mentioned, credit scoring models typically treat multiple inquiries as a single inquiry if they occur within a short period—usually around 14 – 45 days.

- Avoid unnecessary credit inquiries: Being selective about the credit applications you submit can help prevent excessive inquiries, reducing the potential negative impact on your credit.

- Monitor your credit report regularly: If you notice any errors or unauthorized hard inquiries, you can challenge them with the credit bureaus and seek credit inquiry removal.

How to dispute a hard credit card inquiry

When you are faced with a hard credit card inquiry that you believe is inaccurate or unauthorized, knowing how to dispute it is essential. By understanding the necessary steps to challenge a hard inquiry, you can protect your credit by ensuring the information on your credit report is correct.

Step 1: Compile supporting evidence by collecting essential documentation, including credit reports, any correspondence exchanged with the creditor and any evidence that disproves or indicates unauthorized hard inquiries.

Step 2. Thoroughly examine your credit report to identify the specific hard inquiry you intend to challenge. Take the time to review the report carefully and understand the details of the inquiry in question.

Step 3. Contact the creditor who made the hard inquiry and provide them with comprehensive details about the inquiry. To strengthen your case, ensure you have the necessary documents readily available. This can include an identification card, a utility bill, etc.

Step 4. If the creditor fails to respond or cooperate, proceed with filing a dispute directly with the credit bureaus. You can do this online, via mail or over the phone. Include all relevant information and clearly explain why you believe the hard inquiry is either incorrect or unauthorized.

After you’ve filed the dispute, the credit bureau will investigate the inquiry. As part of this process, they will reach out to the creditor and request verification of the inquiry. If the creditor does not respond within the designated time frame, typically 30 days, the credit bureau will eliminate the inquiry from your credit report.

Step 5. Stay vigilant by regularly monitoring your credit report to confirm the removal of the disputed inquiry. If the inquiry persists after the investigation, contact the credit bureau to seek an explanation. To resolve the matter, you may be required to submit additional evidence or escalate the dispute further.

Prevent what you can, credit repair what you can’t

Knowing the difference between soft vs. hard credit checks, how they occur and how to minimize their impact can help you maintain a positive credit history. This will increase your approval odds for agreeable loan terms and interest rates so you don’t end up with overwhelming levels of debt.

While prevention is the best approach, credit repair is useful if your report has negative items. Find out which service might work for you by getting your free credit assessment with Lexington Law Firm.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.