Yes, installment loans can help you build credit by improving your payment history, adding variety to your credit mix and lowering your credit utilization. This shows lenders that you can responsibly manage different types of debt.

If you’re looking for ways to build your credit, installment loans are likely on your radar. However, before you take out a loan, it’s important to understand what installment loans are and how they can help (or hurt) your credit score.

Key takeaways:

- An installment loan lets you borrow a lump sum of money and repay it in fixed installments.

- An installment loan can help you build credit by improving your payment history, adding variety to your credit mix and lowering your credit utilization.

- An installment loan can negatively impact your credit if managed improperly.

What is an installment loan?

An installment loan is a debt that provides you with a fixed lump sum of money that you repay in regular installments over a set time period. Installment loans differ from revolving credit, such as credit cards, in that you can’t continuously use the credit. Instead, you’ll need to apply for a new loan if you need to borrow additional money.

Here are some examples of installment credit:

- Mortgages

- Personal loans

- Student loans

- Auto loans

How do installment loans build credit?

Taking out an installment loan will impact your credit. However, whether that impact is beneficial to your score depends on how you manage the loan. Here are a few ways that installment loans can help you build credit.

1. Improve your payment history

Taking out an installment loan is one way to develop your payment history, which accounts for 35 percent of your FICO® credit score. For this to positively impact your credit score, you’ll need to ensure that you’re making regular, on-time payments. Even just one late payment on an installment loan can have a significant negative impact on your score.

To ensure you make your payments on-time, consider signing up for autopay so you don’t miss due dates.

2. Add variety to your credit mix

Credit mix refers to the different types of credit accounts you have, and it makes up 10 percent of your credit score. Having various credit accounts showcases to lenders that you can handle managing different types of credit. A history of successfully managing a mix of both revolving and installment loans signals to lenders that you’re a low-risk borrower.

If you have previously only taken out revolving loans, an installment loan can add variety to your credit mix. However, credit mix only accounts for 10 percent of your credit score, while payment history accounts for 35 percent. Therefore, you should only take out new loans if you feel confident that you can make on-time payments.

Additionally, you should avoid taking out too many loans in a short period, since multiple hard inquiries on your credit report can lower your credit score.

3. Lowers your credit utilization

Another factor that makes up a large percentage of your credit score is your credit utilization, or amounts owed. Accounting for 30 percent of your credit score, credit utilization is the percentage of revolving credit you’re using compared to your overall credit limit.

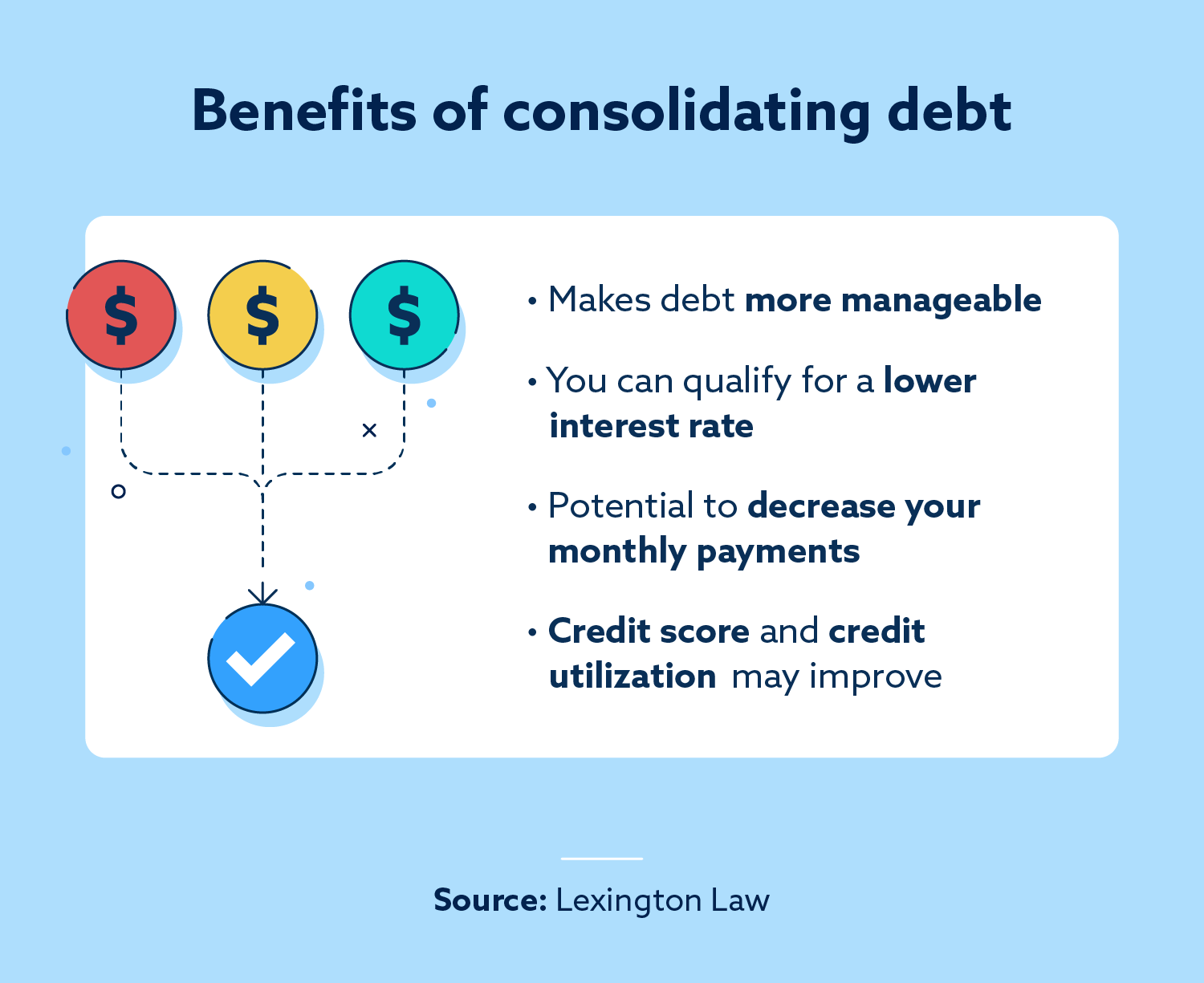

Taking out an installment loan to pay off revolving credit, such as your credit card bill, can help lower your credit utilization by reducing the balance on your credit cards. Referred to as debt consolidation, this involves combining your balances of revolving credit lines into an installment loan. As a result, you’ll only be making one payment monthly instead of multiple payments.

Should you take out an installment loan to improve your credit?

While installment loans can help your credit, taking out an installment loan solely for credit-building purposes is not recommended. In fact, an installment loan can have the opposite effect if not managed properly.

Here are some scenarios in which taking out an installment loan can hurt your credit:

- You miss payments: While making on-time payments can help you build credit, your credit score will drop if you are late or miss payments, and you may be seen as a risky borrower when you apply for future credit products.

- You receive multiple hard inquiries: Applying for a loan results in a hard inquiry, which can lower your credit score by a few points. Too many hard inquiries on your credit report can significantly lower your credit score.

- You increase your debt: Additional debt will add to the “amounts owed” aspect of your credit score.

You should only take out an installment loan if you need the money to make a specific purchase and can afford to make payments on time.

Alternative ways to build credit

If you’ve decided that an installment loan isn’t the right option for you, consider these other ways to build credit:

- Take out a credit-builder loan: An alternative to installment loans, credit-builder loans, are specifically designed to help borrowers build credit.

- Apply for a secured credit card: If you need to establish a credit history, a secured credit card is a great way to easily get approved for credit since you have to put down collateral.

- Make payments on time: Pay your existing bills on time to build a positive payment history.

- Opt into a rent reporting service: While rent payments aren’t typically reported to the credit bureaus, you can use a rent reporting service to build credit through rent payments.

Learn more about building credit with Lexington Law Firm

While taking out an installment loan can help you build credit, if you don’t need the loan, consider exploring other options. There are less-risky ways to establish a credit history and improve your score.

However, before you start taking steps to help your credit, knowing where you’re at is important. Lexington Law Firm offers a free credit assessment, which includes your credit score, credit report summary and a credit repair recommendation. Try it for free today.

Note: The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.