The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Nearly 60 percent of credit-invisible consumers want to build credit, but many don’t know where to start. This becomes a real issue for those who want to get a loan with no credit history, as many lenders require a good credit score.

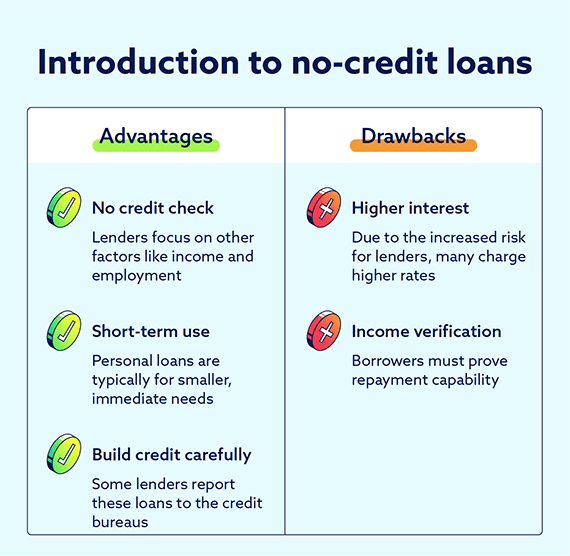

Getting a loan with no credit is challenging, but it’s not impossible. No-credit loans are a viable option for people looking to borrow with no credit history, as they use alternative approval criteria instead of traditional credit scores.

What is a no-credit loan?

Contrary to common belief, you can get a loan with no credit. No-credit loans are for people who lack credit history or have insufficient credit to qualify for traditional loans. Instead of evaluating credit scores, lenders look at alternative factors such as income, employment stability, bank account activity or collateral to determine eligibility.

While no-credit loans can provide access to finances, they may also come with higher interest rates or stricter repayment terms due to the increased risk for lenders.

Let’s debunk some common misconceptions about no-credit loans:

- They always have extremely high interest rates or predatory terms. This isn’t always true, as reputable lenders like credit unions and community banks can offer fair options.

- They build credit automatically. Not all of them; only the ones reported to credit bureaus do.

- They are impossible to get without collateral. Many lenders evaluate based on income or other factors.

Types of loans without credit checks

When navigating the world of no-credit loans, it’s important to understand the different types of personal loans that may be available to you:

Secured loans

| Pros | Cons |

|---|---|

| Lower interest rates | Shared responsibility |

| Easier approval | Credit risk to both borrowers if payments aren’t fulfilled |

| Access to higher loan amounts | Difficult to remove co-borrower |

| On-time payments build credit | Potential relationship strain |

Secured loans require you to provide collateral — an asset such as a car, house or savings account — to back the loan. If you fail to repay the loan, the lender can seize the collateral to recover the owed amount.

Secured loans are often easier to obtain if you have no credit history, as the collateral reduces the lender’s risk. They also typically come with lower interest rates compared to unsecured loans.

Joint loans

| Pros | Cons |

|---|---|

| Higher chances of approval | Risk of losing collateral |

| Better loan terms | Longer approval process |

| Both borrowers can build credit from positive repayment | Limited availability |

| On-time payments build credit |

A joint loan can be a good option for someone with no credit, as it allows you to share responsibility with a co-borrower with a stronger credit history. Since the lender considers both you and the cosigner’s creditworthiness, you can be approved with better terms, such as a lower interest rate.

Joint loans can allow you to access financing while building credit as long as all co-signers make timely payments. However, it’s important to remember that both you and the co-borrower are equally responsible for repaying the debt.

By allowing you to share responsibility with a co-borrower, joint loans can also be an option if you need a loan on bad credit. If you apply with a co-borrower that has better credit, your chances of being approved may improve.

Credit card cash advances

| Pros | Cons |

|---|---|

| Immediate cash access | High fees and interest |

| No additional approval needed | Interest starts accruing immediately |

| Flexible use | Lower withdrawal limits |

| Risk of debt cycle if you have repayment difficulties |

If you have no credit, a credit card cash advance allows you to withdraw cash from a credit card account, which functions similarly to a loan. Since cash advances don’t require a credit check, they are accessible even for individuals with no credit history.

However, they come with significant risks, including high interest rates — often higher than regular credit card purchases — and fees for the advance itself. Additionally, interest starts accruing immediately, with no grace period. If you are unable to repay the amount quickly, the debt can grow rapidly and lead to financial strain.

Payday alternative loans

| Pros | Cons |

|---|---|

| Lower interest rates than payday loans | Membership requirement |

| Longer repayment terms | Lower loan limits |

| Credit building opportunity | Limited availability |

| Regulated by federal credit unions |

Payday alternative loans (PALs) provide a more affordable, short-term borrowing option through credit unions. Unlike the typical high-interest, high-fee payday loans, PALs have lower interest rates and more flexible repayment terms. If you don’t qualify for traditional loans due to limited credit history, PALs might be a safer alternative.

However, they are typically only intended to cover emergency expenses until your next payday and only cover small amounts ranging from $100 to $1,000.

PALs are also only available only through credit unions, so you need to be a member of the credit union for a certain period and meet membership requirements.

Risks may include having insufficient funds or the possibility of fees and late payments. If you are unable to repay the loan, you could face penalty fees and additional financial strain, although the consequences are less severe than regular payday loans.

How to improve chances of approval

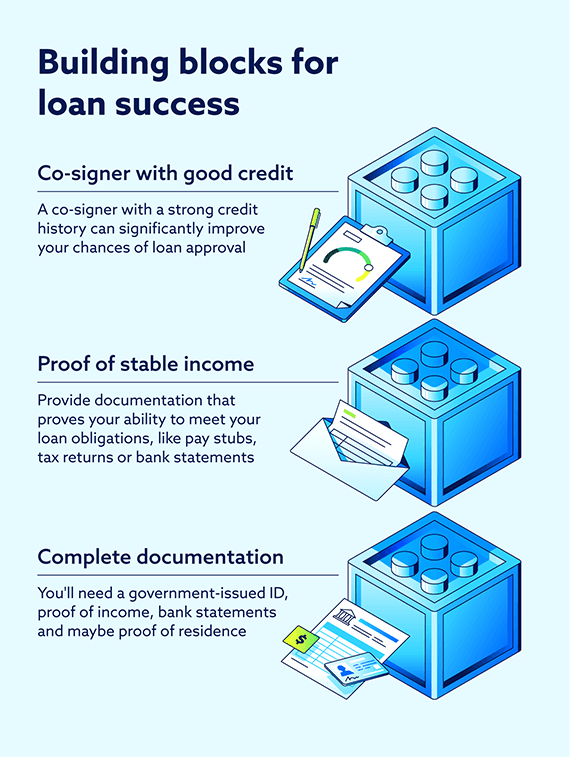

There are several ways to increase your chances of approval for a no-credit loan. Try these strategies to make your loan application more attractive to lenders:

- Apply with a co-signer who has good credit, as they can significantly improve your chances of approval and help secure better interest rates.

- Show proof of stable income and employment, such as pay stubs or tax returns, to demonstrate your ability to repay the loan and make you a more attractive borrower.

- Provide identifying documents like a government-issued ID, proof of income, recent bank statements and sometimes proof of residence to verify your identity and financial stability.

Taking these steps shows lenders that you are reliable, even without a credit history.

Alternatives to no-credit-check loans

Alternatively, there are several other options to bypass no-credit loans if they are not the most suitable choice for your financial situation.

- Credit-builder loans: These allow you to borrow a small amount of money, which is held in a secured account while you make regular payments. This helps to build your credit when the lender reports your payments to the credit bureaus. Credit-builder loans can be a good option if you don’t need immediate cash but want to establish credit over time.

- Secured credit cards: Opening a secured credit line requires a deposit, which also serves as your credit limit. When used responsibly, they can help build your credit by demonstrating your ability to make timely payments. However, the drawback of secured credit cards is the need for an upfront deposit, and some cards may also come with high fees or interest rates.

Both options require discipline and consistency to avoid falling into debt, but they are effective ways to establish a solid credit history.

Get your credit snapshot today

For those of you wondering how you can get a loan with no credit, there are some solid options to consider. However, navigating the world of no-credit loans can be confusing, so seeking legal or financial advice may be a good idea before making any major decisions.

If you don’t know where your credit currently stands, you can sign up for a free credit assessment .

Loan with no credit FAQ

How do I compare interest rates for loans with no credit?

Research various lenders, including credit unions, online lenders and peer-to-peer platforms, and carefully review the loan terms, fees and APR to find the most affordable option.

How to compare different loan offers?

To compare loan offers, focus on the APR, loan term and monthly payments to find what fits your budget. Check for additional fees like origination or late payment charges, and review eligibility requirements such as credit score or income. Also, read reviews to learn about the lender’s reputation.

How to track my loan application status?

You can contact the lender directly through their customer service or online portal, where they usually provide updates or a tracking feature for your application.

Where can you get a loan with no credit?

You can get a loan with no credit from credit unions, online lenders, peer-to-peer lending platforms, payday lenders or by using collateral for a secured loan.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.