The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

In 2023, there were more reports about identity theft (1 million) than any other complaints filed with the Federal Trade Commission (FTC). Identity theft can make an otherwise stable financial situation tricky and damage your credit score.

Monitoring your credit and protecting your identity is essential to your long-term financial well-being. These steps help you safeguard your financial information and can help you keep your finances in a stronger position. In this post, we’ll look at the difference between credit monitoring vs. identity theft protection.

Key takeaways:

- Credit monitoring focuses specifically on monitoring your credit report for changes, such as new accounts opened, credit inquiries or changes in your credit score.

- Identity theft protection provides a more comprehensive approach to safeguarding your personal information by monitoring the dark web for your personal data, alerting you to potential breaches and offering assistance with recovery in case of identity theft.

- Protective measures like credit monitoring significantly reduce the risk of identity theft and credit fraud, safeguarding your personal information and financial well-being.

What is credit monitoring?

Credit monitoring is the process of watching your credit report and credit history for any fraudulent activity or changes to your credit report that you didn’t approve or initiate.

Monitoring your credit report can help you:

- Check and track your credit score

- Monitor the number of accounts on your credit report

- Track new account openings

- Watch for potentially fraudulent activity that could impact your credit score

You can use a dedicated credit monitoring service to stay on top of any activity or monitor your credit manually by requesting a copy of your credit report from the three major credit bureaus and reading through each report in detail. You’ll want to be mindful of how you pull your credit report if you choose to do it manually so you can avoid common credit score scams.

You can pull your credit report for free once each year at AnnualCreditReport.com or pay for a dedicated monitoring service that can send you alerts for any activity on your report.

Take action: If you notice any suspicious activity, you can dispute the activity with the credit bureaus. They’ll investigate, and if they determine that the activity is fraudulent, they may remove it from your credit report. This can help you keep your credit score higher.

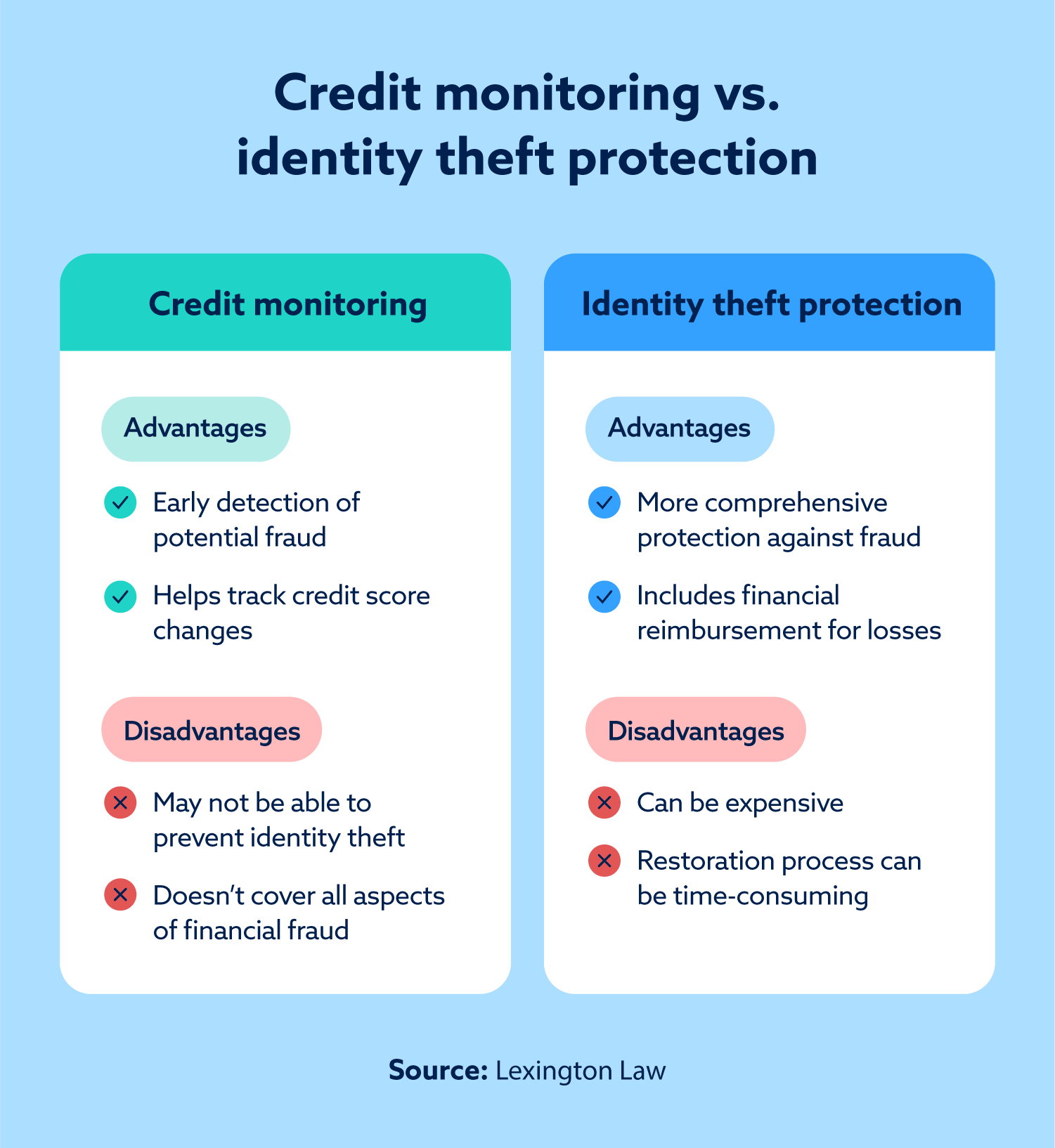

Pros and cons of credit monitoring

Here are some of the advantages of monitoring your credit, whether you do it manually or work with a monitoring service:

- Track credit score changes. Knowing your credit score lets you make better decisions about applying for loans or new credit cards.

- Detect potential fraud. Fraudulent activity like new loan applications you didn’t authorize or new accounts you didn’t open can hurt your credit score. Monitoring helps you detect that fraud so you can report the issue quickly.

- Establish peace of mind. Knowing where you stand financially can help you optimize your financial strategy, allowing for a stronger sense of security.

Though credit monitoring is beneficial, it’s not perfect. Here are some of the disadvantages you may experience:

- Doesn’t prevent identity theft. Credit monitoring only alerts you after changes occur. It won’t be able to prevent fraudulent activity or identity theft.

- May not cover all credit bureaus. Some credit monitoring services only work with one or two credit bureaus. You’ll need to access all three credit reports to fully understand your financial situation.

Credit monitoring can still be a great idea. It takes the stress out of checking your credit score and makes it easier to see where you stand so you can make any necessary changes.

What is identity theft protection?

Identity theft protection offers many benefits of credit monitoring but takes it a step further. It includes services like:

- Monitoring your credit report

- Checking the dark web for your personal information

- Watching for signs of identity theft, like new account openings

- Helping you restore your identity if it’s stolen

- Offering insurance to help you cover money lost due to identity theft

You’ll still be able to see where your score lies and check for activity on your credit report. But you’ll also receive fraud alerts for suspicious activity and get support if someone steals your identity. You may be eligible for compensation to help you recover from any financial losses caused by the theft.

Take action: Work with identity theft protection services. They often have experts who can help you navigate the recovery process so you won’t feel like you’re on your own.

Pros and cons of identity theft protection

Identity theft protection can help in the following ways:

- Monitoring your personal information. Identity theft protection helps you monitor your personal information. If your data is part of a data breach or someone uses your information to open new accounts, the service will let you know and help you take the appropriate steps to lock your data down.

- Getting financial help for losses and expenses. Identity theft protection services may offer financial assistance to help you pay for the cost of recovery and help you pay for some or all of the losses you suffer as a result of the identity theft.

- Keeping an eye on your credit report. Identity theft protection may also let you monitor your credit report, often with all three bureaus, so you always know where you stand.

Identity theft protection is not perfect for everyone. Here are some of the disadvantages of using identity theft protection:

- Can be expensive. Identity theft protection costs can range from service to service up to around $50 per month.

- May not cover all associated costs. This protection typically only gives you financial assistance for recovering from identity theft. It may not give you money to help you recover from cash losses resulting from fraudulent purchases or unauthorized account use.

- Won’t prevent theft. Identity theft protection helps you monitor your information and may assist in recovering your identity if it’s stolen. But it can’t prevent identity theft from happening.

If you’re interested in identity theft protection, compare different services before you sign up. If you’re already getting many of the features for free through a service you already use, it may not be worth the investment.

How to choose between credit monitoring and identity theft protection

Both credit and identity monitoring services can help you protect your sensitive information and help you ensure that your finances are in good shape.

If you’re primarily concerned about keeping tabs on your credit score and ensuring the accounts on your credit report are accurate, working with a credit monitoring service will likely be a better choice.

But identity theft protection may be the best choice if you’re looking for comprehensive protection against multiple types of identity theft and want to keep an eye on your credit report.

Consider the following as you make your choice and start shopping for services:

- Your budget. Prices for both credit monitoring and identity protection can vary. Be sure to shop around and compare the plans you’re interested in.

- The features offered. Different services may offer different features. Consider the types of features you want and tailor your search to services offering those features.

- The reputation of the service provider. Not all credit monitoring services or identity theft protection companies are as helpful as they claim. Be sure to research each provider’s reputation before you make your choice.

Remember, the best credit monitoring services and identity theft protection companies are ones that stand behind their services. They should be willing and able to help you resolve issues as they happen and should have a track record of helping others like you in the past.

Best practices for protecting your identity and credit

Though working with an identity theft monitoring or credit monitoring service can help you keep tabs on your credit and your finances, there are things you can and should do to keep yourself safe.

Keep these tips in mind to help you reduce your risk of identity theft and credit fraud:

- Use strong, unique passwords for all accounts and two-factor authentication for accounts that offer it as an added layer of security.

- Be cautious when sharing sensitive information online or over the phone.

- Shred sensitive documents like bank statements, tax returns and other financial information.

- Monitor your financial statements regularly and report errors as soon as you see them.

- Dispute any inaccuracies or fraudulent activity with the credit bureaus as well as your bank, credit card issuer or lender as needed.

These efforts can make your credit monitoring and identity theft protection services even more effective and make it possible to better protect your information.

Safeguard your financial well-being with Lexington Law Firm

Staying on top of your credit report and making sure all transactions are ones you approved can go a long way toward helping you keep your identity safe. But working with a credit fraud protection and identity theft monitoring service can help you keep your information even more secure. Learn about our service and see how we can help you protect your financial reputation.

Credit monitoring vs. identity theft FAQ

Can I rely on free credit monitoring services?

You can use free credit monitoring services to track your score and monitor your credit accounts. But these free services may have noticeable limits For example, many free services only show your credit report from two of the three credit bureaus. For more comprehensive information, you may want to try a paid service.

Is identity theft protection worth the cost?

It depends on your situation and your concerns. If you’ve been the victim of identity theft or know that your data was part of a data breach, investing in identity theft protection can give you peace of mind.

How do I choose an identity theft protection provider?

Look for a provider that has a good reputation and offers the types of services you’re interested in. You may need to shop around and compare plans with several providers to find the best fit for your needs.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.