The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Your credit score tells banks, lenders, landlords and even some employers a lot about your financial situation and responsibility. But, according to TransUnion®, 45 million Americans are either credit underserved or credit unserved, meaning they lack a credit history and a credit score. If you’re one of them, figuring out how to start building credit for the first time is essential. Below, we explore a few credit-building strategies you may want to use.

Key takeaways:

- Your credit score acts as a snapshot of your financial health and helps lenders, landlords and even some employers to decide if they want to work with you.

- Becoming an authorized user or opening your own credit card can help you build your credit history and improve your credit score over time.

- Checking your credit report with each of the three credit bureaus can help you understand where you stand and make smarter financial decisions.

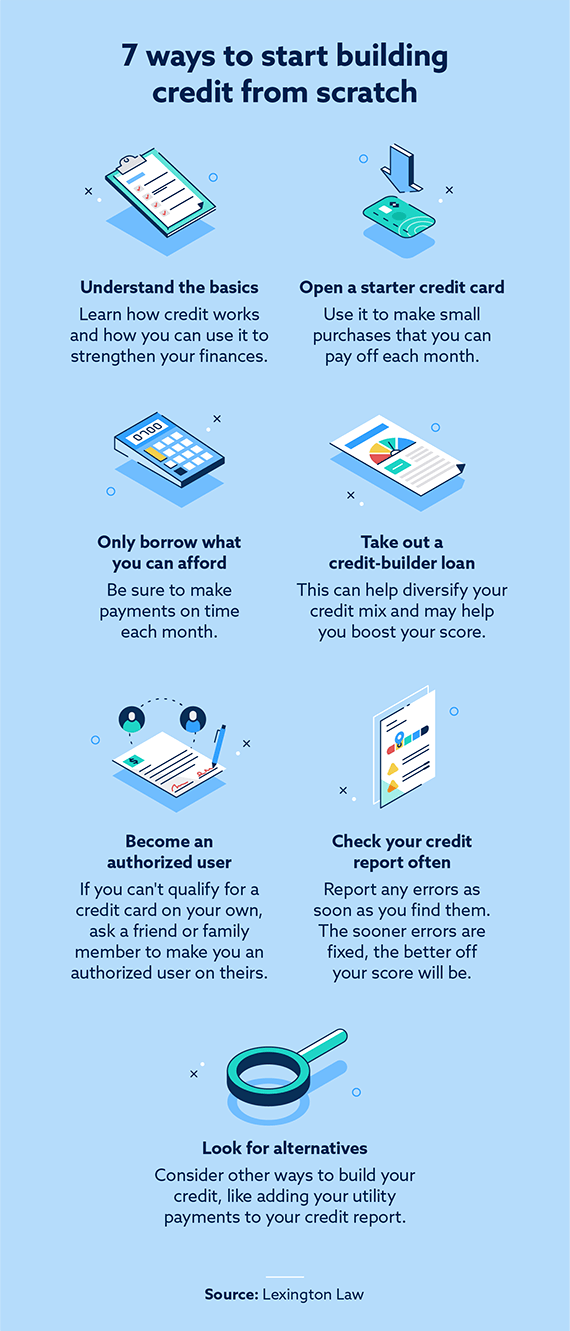

1. Understand the basics of credit

Before you can start building good credit, you need to understand the basics of credit and how it works. Credit refers to any loan or credit card that you may take out. It represents a promise between you and your chosen lender or credit card provider. They promise to lend you money or give you a credit card, and in exchange, you agree to repay what you borrow.

When you make payments on time and in full, you’ll build your credit history and start to see your credit score go up. There are different types of credit scores, but the most common one is the FICO® credit score.

The FICO scoring system looks at your payment history, how much debt you have, how much you’re charging on credit cards relative to the credit limit (known as your credit utilization) and other similar factors. Your lenders and credit card issuers should report this information to the three main credit bureaus during each billing cycle.

When you’re on top of your payments and aren’t maxing out your cards, you’ll likely build good credit. If you’re late consistently or miss payments, max out your credit cards or borrow more than you can afford to repay, your credit score could drop.

Once you understand the basics of credit, you can start building your credit history and improving your credit score.

2. Apply for a starter credit card

Starter credit cards are designed for individuals with poor credit histories or no credit histories, and they’re available from most banks and credit unions. These cards typically have low credit limits, making it harder for you to borrow more than you can afford to repay.

Some starter credit cards may be secured credit cards. These cards are backed by a cash deposit that you make and have a credit limit equal to that deposit amount. If you make payments on time and in full, you can keep using your credit card without issue. If you miss a payment or can’t repay the credit card, your security deposit will cover it. Keep in mind that you’ll still be charged interest on those late or missed payments, and if you carry a balance from month to month, you’ll be charged interest, too. This fee can add up over time.

These cards can be easy to qualify for, even if you don’t have a credit score. However, their low limits may make it hard to use them for bigger purchases.

If you’re still a student, you may be able to qualify for a student credit card. These cards are often unsecured credit cards, so you won’t have to make a cash deposit. But the credit limit you’re eligible for may be small as well.

3. Become an authorized user

If you don’t want to take on a credit card of your own or you don’t qualify for one, you could ask a trusted friend or family member to make you an authorized user on their credit card. As an authorized user, you can make purchases and build your credit score on a card someone else qualified for. Ultimately, the credit card owner (your friend or family member) is responsible for making monthly payments, so you’ll need to work out an agreement on how you’ll repay them for what you purchase.

The benefit of becoming an authorized user is that you’ll still build your credit score over time without having to take on a credit card of your own. However, your credit score could take a hit if the primary cardholder misses payments or maxes the card out.

4. Take out a credit-builder loan

If you don’t have a proven credit history, you may be able to use a credit builder loan to build your credit. These are small loans designed to help you establish a credit history by making regular on-time payments until you repay the loan in full.

Unlike traditional loans, you won’t receive the money you borrow upfront. Instead, your lender (typically your bank or credit union) will deposit the money in a savings account. Once you repay the loan in full, you’ll gain access to the money in that account and can use it however you see fit.

These loans can have lower rates than credit-building credit cards, making them ideal for borrowers who want to avoid high interest payments.

5. Use credit responsibly

Using credit responsibly can help you create a strong credit history and improve your credit score over time.

Here’s how you can become a responsible credit user:

Strengthen credit history

Establishing or strengthening your credit history is the first step in using your credit responsibly, and the easiest way to do that is to pay bills on time and in full each month. To stay on top of payments, enroll in autopay whenever possible and let your credit card company, lender or other service provider debit the payment out of your bank account automatically.

Worried about spending more than you should? Limit what you use your credit card for. For example, you could use your credit card to pay for a streaming service and set up autopay for that one bill. This will help you pay the card off in full without putting you at risk of spending more than you should.

Keep your credit utilization low

Your credit utilization ratio refers to the amount of credit you’re using on your card relative to the card’s limit. By keeping it low and not maxing out your cards, you’ll strengthen your credit history over time. Most financial experts recommend keeping your credit utilization ratio below 30 percent.

Try committing to only using your card for purchases you know you can repay in full and have already budgeted for, like the streaming service mentioned above. Once you have a history of making on-time payments, you can ask your credit card issuer for a credit limit increase. The higher your credit limit is and the smaller your outstanding balance is, the lower your credit utilization will be.

Mix up your credit types

Credit mix plays an important role in your credit score and your credit history. Rather than just taking on a number of credit cards, you may find it beneficial to apply for other types of credit. Personal loans, auto loans and credit-builder loans can all improve your credit mix.

Credit cards are considered revolving debt that you can use and repay until you close the card. Personal loans, auto loans and credit-builder loans are types of installment loans that let you make set payments each month until the end of the loan’s term or until you repay the loan in full. Having a combination of the two types may boost your credit score.

6. Look for alternative ways to build credit

Here are a few alternative ways to build credit if taking on a new loan or opening a credit card doesn’t meet your needs.

Add alternative data to your credit profile

Credit bureaus are willing to consider alternative credit data when determining your credit score and establishing your credit history. You may be able to add utilities, rent payments, cell phone bill payments and other recurring expenses to your credit profile.

As long as you make payments on time and your utility provider, landlord or cell phone company reports those on-time payments to the credit bureaus, you’ll build your credit history and boost your score over time.

Consider cash-flow underwritten credit cards

These credit cards let you charge certain monthly bills like streaming services, internet bills and other similar services without having to undergo a credit check. The card issuer will instead look at your total income and bank account activity to determine if you’re eligible for the card and how much they’re willing to lend you.

As you make payments on time, the card issuer reports those payments to the credit bureaus, helping you establish your credit history.

Qualify based on foreign credit history

If you recently immigrated to the United States, you won’t have an established credit history in the country. However, if you have a strong credit history in your home country, you may be able to use that history to qualify for loans or credit cards.

Once you start making payments and using your lines of credit or loans responsibly, you’ll build your credit history in the United States. It’s a way to put your good financial habits to work in your new home. Major credit card issuers like Chase, Capital One and American Express all issue cards to qualifying immigrants.

7. Monitor your credit regularly

Get in the habit of checking your credit score and your credit report regularly. This will help you monitor your score over time and track your improvements. If you have a bad credit score and keep working on your financial habits, you’ll be able to track your progress and see improvements so you can stay motivated.

Tools like Credit.com make it easy to check and monitor your credit score for free. AnnualCreditReport.com lets you check your credit report from each of the three major credit bureaus for free on a regular basis, so you can monitor your report for errors. If you find any errors, you can dispute them with the credit bureaus. If those errors are fixed, your score might go up.

Ready to start building your credit?

Figuring out how to start building credit for the first time can feel overwhelming, but as long as you keep these strategies in mind, you’ll be well on your way to establishing a good score. For a view of where you stand, get your free credit assessment today to see your credit score and a short summary of your credit report.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.