Filing for bankruptcy won’t clear most tax debts, but it can clear some. Income tax debt that’s at least three years old may qualify, as long as your tax return was honestly filed at least two years before declaring bankruptcy. You must also pass the 240-day rule.

If you’re struggling with tax debt, you may have heard that bankruptcy can help—but is it true? Does bankruptcy clear tax debt? Can you file bankruptcy for IRS debt? What about state debt?

The short answer is not usually, but sometimes. If certain conditions are met, you may be able to clear income tax debt with bankruptcy. Other tax debts such as tax fraud penalties, sales tax or trust fund taxes won’t be eligible.

Here’s what you need to know.

Table of contents

- Can you file bankruptcy on taxes?

- Bankruptcy will not clear federal tax liens

- What type of bankruptcy is best?

- Tackling tax debt without bankruptcy

Can you file bankruptcy on taxes?

While bankruptcy will not clear (meaning, discharge) most tax debts, it can for some. If you have back taxes owed to the IRS that you cannot pay, bankruptcy may be an option.

To qualify for discharge, you must meet the following requirements:

- The debt must be income tax. This includes federal or state income taxes.

- The debt must be at least three years old. In other words, if you file for bankruptcy in April 2022, tax debt from 2019 that was due in 2020 could be eligible for discharge, along with any older tax debts.

- You did not evade taxes or file a fraudulent return. Unlawful returns immediately disqualify you from receiving a discharge. This includes actions like using a false Social Security number.

- You filed a tax return at least two years before declaring bankruptcy. This includes on-time returns, returns properly filed with an extension, and late filed returns, so long as the taxing authority has not filed a forced return for you.

- You pass the 240-day rule. The tax authority assessed the tax debt at least 240 days before you file for bankruptcy. Keep in mind that while the above requirements generally apply, they aren’t the only factors that play into tax discharge. Local court jurisdictions may have additional requirements for discharge.

What tax debt won’t be cleared with bankruptcy?

While bankruptcy can sometimes clear income tax debt, it won’t clear the majority of tax debts. You will still be held liable if you owe any of the following:

- Tax fraud penalties

- Payroll taxes

- Taxes incurred after filing

- Trust fund taxes

- Sales tax

You must repay any tax debts, including any interest, late fees or other penalties incurred. Depending on your circumstances, you may be able to set up a repayment plan.

Additionally, bankruptcy will not clear tax liens. Liens give the IRS or other taxing authority a claim on your assets. When it comes to tax liens and bankruptcy, the benefits are minimal.

Bankruptcy will prevent authorities from taking a bank account, taking your wages or repossessing your home to repay debts, but it will not clear your liability. You will still need to repay your debts to clear the tax liens.

Tax liens can cause frustrating hurdles for debtors. For example, to sell a home with a tax lien on it, you’ll need to make enough profit from the sale to pay off the lien. If you can’t pay off the lien, you cannot sell the home unless you get the permission of the taxing authority that filed the lien

What type of bankruptcy is best for tax debt?

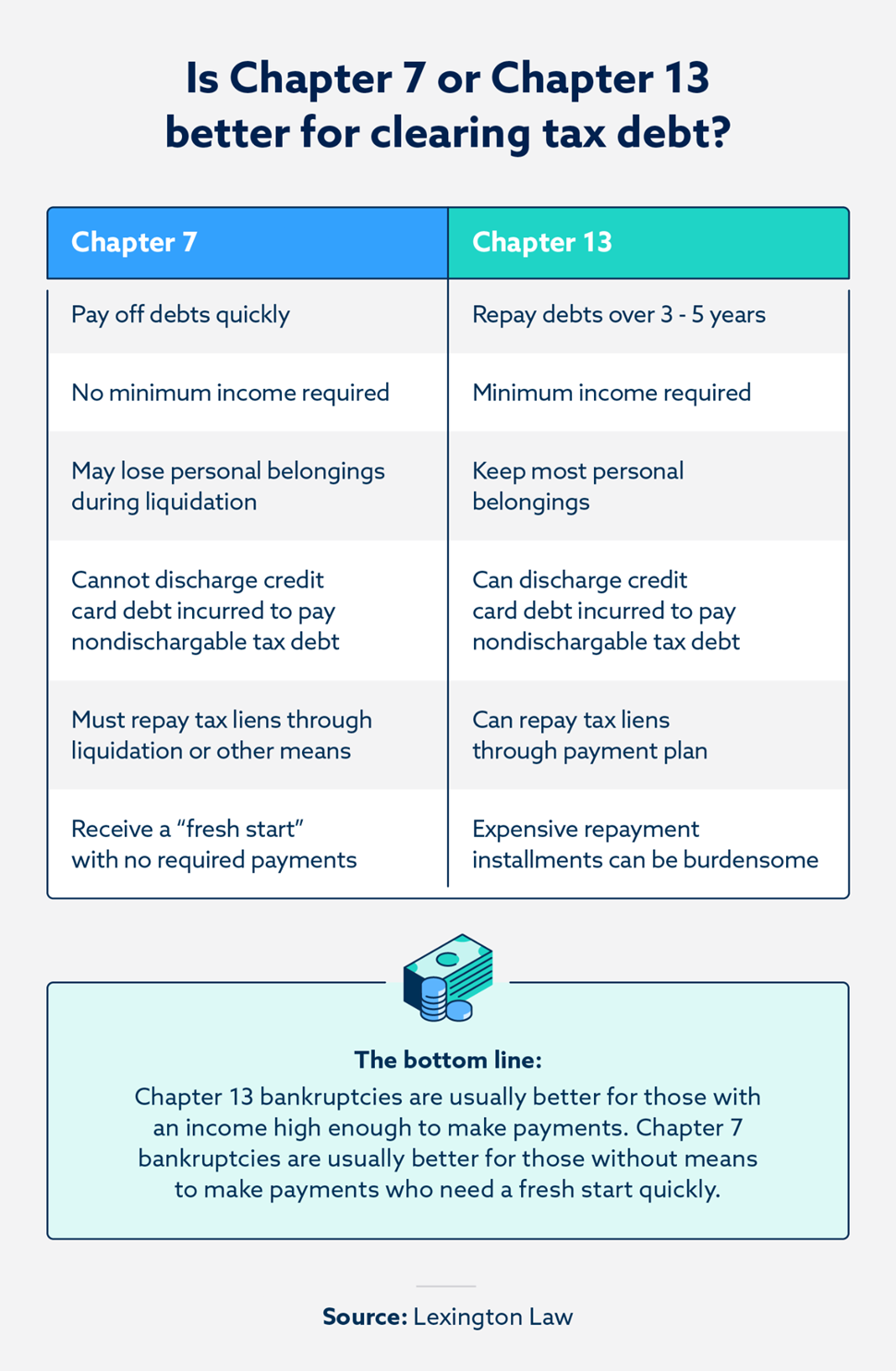

You can discharge qualifying tax debts through any type of bankruptcy, including Chapters 7, 11, 12 or 13. Chapters 11 and 12 bankruptcies apply to corporations and family farming operations, respectively. Most individuals will file for bankruptcy through Chapter 7 or Chapter 13.

So, when it comes to Chapter 7 vs. Chapter 13 bankruptcies, which is best for tax debts? This largely depends on your situation. Here are some main considerations.

Chapter 7 bankruptcy and tax debts

A Chapter 7 bankruptcy is often known as a “fresh start bankruptcy.” Under a Chapter 7 bankruptcy, all your nonexempt assets are liquidated in order to pay off creditors. All remaining dischargeable debts are then cleared.

You are still liable for nondischargeable debts in Chapter 7 bankruptcies, like taxes you incur after filing. However, liquidating your assets and avoiding payment on dischargeable debts can provide the funds needed to pay off these debts.

If you have remaining nondischargeable debt, you may feel tempted to pay it off with a credit card and request the resulting credit card debt be cleared. Unfortunately, this will not work. The resulting credit card debt will also be considered nondischargeable under Chapter 7.

If you need to pay off your debt quickly, a Chapter 7 bankruptcy may be the right option since it does not require a repayment plan. Just remember not everyone qualifies for a Chapter 7 bankruptcy—your income must be low enough to pass the bankruptcy means test.

Chapter 13 bankruptcy and tax debts

Chapter 13 bankruptcies are sometimes known as “wage earner’s bankruptcies,” since they benefit those with a regular income. Unlike a Chapter 7 bankruptcy, you will need a minimum income to file Chapter 13.

Under a Chapter 13 bankruptcy, you work with a trustee to create a repayment plan. You will often repay most, but not all, of your debts over three to five years. Any remaining dischargeable debt is then cleared.

Since you address debt through repayment installments rather than liquidation, you usually get to keep most of your personal belongings under a Chapter 13 bankruptcy. However, missed payments can open you back up to collections.

The biggest benefit of a Chapter 13 bankruptcy is that it allows you to repay federal tax liens as part of your repayment plan. You may even be able to negotiate partial repayment with a debt settlement lawyer. Once you repay the lien, you can then sell or trade the asset as you please to pay off even more debt.

Additionally, Chapter 13 bankruptcies allow you to discharge credit card debt you incurred to pay off nondischargeable taxes. This means you can essentially clear all tax debt that you’re not able to repay during your three to five year plan.

Tackling tax debts without bankruptcy

Since bankruptcy is not likely to clear most tax debts, it’s worth looking into alternative methods that can help. If you can’t pay your taxes, here are a few options worth considering.

- IRS payment plan: You can apply to set up short-term (180 days or less) or long-term payment plans with the IRS. This provides a repayment period similar to a Chapter 13 bankruptcy, but without the bankruptcy fees or hit to your credit.

- IRS offer in compromise: With an offer in compromise, you make a deal with the IRS to pay back only part of your debt. You can make payments either as a lump sum or in periodic installments. If you make the required payments, the IRS will forgive the agreed-upon portion of your debt.

- Innocent spouse relief: If your spouse filed taxes erroneously without your knowledge, you may qualify for relief through the Innocent Spouse Program. This would relieve you of the associated tax liabilities, penalties or interest.

- Take out a loan: Depending on how much you owe and the current IRS interest rate, you may benefit from reorganizing your debt through a loan. If the loan terms provide you with a lower interest rate, you may choose to pay off your tax debt with the loan.

If you need help tackling your tax debt, consider getting professional advice. And if you need assistance with your credit after going through a bankruptcy, you can look into credit repair options that may help you.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.)