The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Chapter 13 bankruptcy allows you to pay off your debt through restructuring by working with the courts and your creditors on a repayment plan. The repayment plan can last up to five years, and it’s based on how much income you make and other financial factors. Chapter 13 allows you to keep all of your assets if you can successfully confirm an appropriate plan.

Before filing, it’s helpful to know what Chapter 13 bankruptcy is, who it’s for and how to qualify. We include an overview of the process as well as the pros and cons so you can decide if a Chapter 13 repayment plan is the right choice for you.

Table of contents:

- What is Chapter 13 bankruptcy?

- Who can declare Chapter 13 bankruptcy?

- How does Chapter 13 bankruptcy work?

- How does a Chapter 13 bankruptcy repayment plan work?

- How much do you have to pay back in Chapter 13?

- What’s covered in Chapter 13 bankruptcy?

- What are the pros and cons of Chapter 13 bankruptcy?

- What is the Chapter 13 bankruptcy court process like?

- Do you need an attorney for Chapter 13 bankruptcy?

- What is the difference between Chapter 7 and Chapter 13 bankruptcy?

- How does Chapter 13 bankruptcy discharge work?

- How long does Chapter 13 bankruptcy stay on credit reports?

- Repairing your credit after Chapter 13 bankruptcy

What is Chapter 13 bankruptcy?

Chapter 13 bankruptcy is also known as a “wage earner’s plan” because it’s for individuals that have a regular source of income. Filing for Chapter 13 bankruptcy is an agreement you’re making to repay your debts by breaking the debts down into manageable payments. Having a job or provable source of steady income assures the creditors and the court that you’ll be able to make your payments.

When you file for Chapter 13 bankruptcy, you’re able to propose a repayment plan based on your income that will repay the debt within three to five years. The length of time to repay your debts depends on your specific circumstances as well as how much income you make. In order to be approved for the five-year repayment plan, you’ll need to show to the court that there’s a justifiable reason that you can’t repay your debts within three years.

The Chapter 13 bankruptcy definition also states that once you file, it may stop foreclosure proceedings on your house. While you’ll still need to make your regular mortgage payments, the bank may not be able to take your home.

Who can declare Chapter 13 bankruptcy?

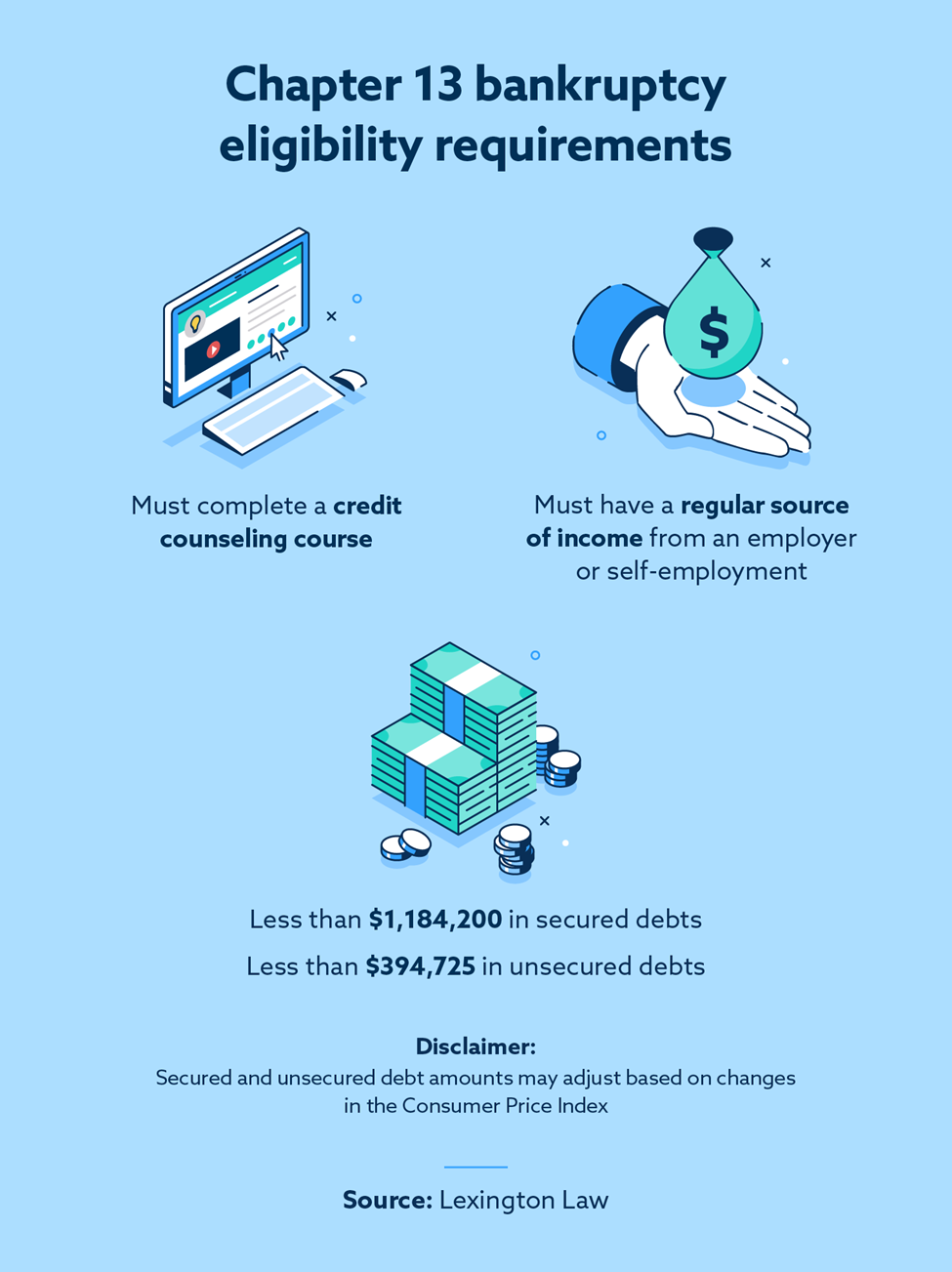

Your eligibility for Chapter 13 bankruptcy depends on how much you owe in unsecured and secured debts. According to the United States courts, your unsecured debts must be less than $394,725, and your secured debts must be less than $1,184,200. It’s also important to note that these amounts can adjust on a regular basis because they reflect the Consumer Price Index.

Now, you may be wondering, “What’s the difference between unsecured and secured debts?” Unsecured debts are typically debts like utility bills, medical bills, personal loans and money you’ve spent using credit cards. These unsecured debts are the ones included in your repayment plan and some of them may be eliminated at the end of your bankruptcy. Secured debts are related to things like your home or a vehicle loan.

In regard to business owners being eligible for Chapter 13 bankruptcy, you may qualify if you’re self-employed or running an unincorporated business. If your business is set up as a corporation or partnership, you’ll need to work with an attorney to find another form of bankruptcy that can work for your situation.

Chapter 13 bankruptcy qualifications

Qualifications for Chapter 13 bankruptcy are in place to ensure that you need to file in order to get back on your feet financially. The eligibility requirements also help the courts ensure that you’re not in too much debt and are capable of making your regular payments in full and on time.

Requirements include:

- You must have a regular source of income

- Secured debts must be less than $1,184,200

- Unsecured debts must be less than $394,725

- You must complete a credit counseling course

How does Chapter 13 bankruptcy work?

The Chapter 13 bankruptcy process can take time, so it is beneficial to know the process before you file. Here are the steps you’ll take when filing.

Step 1: Complete a credit counseling course

Before you start the Chapter 13 bankruptcy filing process, you must take a credit counseling course. This course must be taken through an approved agency within 180 days before filing. A list of approved credit counseling agencies can be found at the Department of Justice website.

Step 2: Work with a bankruptcy attorney

There is quite a bit of paperwork involved when filing for Chapter 13 bankruptcy. While you can file on your own, you’ll have far less to worry about when working with an attorney. When filing, there are laws you must comply with, and a bankruptcy lawyer can help ensure you’re doing everything properly.

Step 3: File a bankruptcy petition with the court

Once you’re ready, you’ll need to file a petition with a court. As soon as you do this, the court sends out what’s called an “automatic stay” to your creditors. This is a court order stopping all calls, letters and other forms of communication from creditors trying to collect on your debts.

Step 4: Submit a repayment plan

Now, the ball is in your court, and you get to submit a repayment plan. This is your plan of action for how the creditors will be repaid. You’ll work with your attorney to look at your income and expenses to see what type of payments you can afford to make. This repayment plan must be submitted within 14 days of filing your petition with the court.

Step 5: Start making payments

The bankruptcy process can take months, but you must start with your repayment plan even if it has yet to be approved by the courts. Within 30 days of submitting your repayment plan, you can start making these payments.

Step 6: Meet with a Chapter 13 trustee

The first time you’ll have to physically go to court is to meet with a trustee. This is typically within three to seven weeks of filing your petition. The trustee will be reviewing your bankruptcy paperwork as well as meeting with your creditors.

Step 7: Attend a confirmation hearing

After the trustee meets with your creditors, you’ll need to attend a hearing where the judge decides whether or not they’re going to approve your repayment plan. If the payment plan is denied, depending on the reason, you may be able to try to file again. (In some jurisdictions you may not have to actually appear in person for this hearing if you use a streamlined process and get the trustee’s permission to submit an order approving your plan beforehand.)

Step 8: Continue making payments

By now, you’re months into the process, and you should have been making payments regularly. If the judge approved your repayment plan, you’ll continue to make these payments for the next three to five years, depending on the decision of the court.

Step 9: Complete a debtor education course

At some point during this process, you’ll also need to take a debtor education course. This is separate from the credit counseling class and also must be done through an approved agency.

Step 10: Receive your discharge

After three to five years of following your repayment plan and meeting any additional requirements from the court, your bankruptcy will be discharged. Also, keep in mind that although you’re done paying, the bankruptcy can stay on your credit report for up to 10 years from the date of filing, but Chapter 13 is typically eight years from the date of filing.

What happens if you can’t afford the Chapter 13 repayment plan?

For individuals who can’t afford a Chapter 13 repayment plan, you’ll need to start looking at other forms of bankruptcy. In many cases where a person can’t afford Chapter 13, they fall back to Chapter 7 bankruptcy.

Remember, one of the main benefits of filing Chapter 13 bankruptcy is that you don’t have to lose any assets. So, if possible, see what you can do to make the payment plan work.

If you begin looking at your financial situation and current income but realize you’re not going to be able to commit to the Chapter 13 bankruptcy repayment plan, you’re not alone. This is more common than you think and why working with a bankruptcy attorney is helpful. Through their experience and knowledge, they may be able to help you make Chapter 13 work for your situation.

Ways to make the Chapter 13 repayment plan work

Before giving up on Chapter 13 bankruptcy due to the belief that you won’t be able to make your payments, there are some additional resources that may be able to help:

- Try debt consolidation: For a fee, debt consolidation firms work with your creditors to combine debts together so you only have to make a single monthly payment. For example, if you have three credit cards that you owe money on, a consolidation firm will work with the credit card companies to put all of those debts together.

- Negotiate a debt settlement: A great option is debt settlement. If you choose to go this route, you can save money by doing this on your own if you think you’re able to negotiate with creditors. In some instances, creditors may be willing to settle a debt for a lower amount than what you owe.

- Look into a hardship discharge: You may also receive a “hardship discharge” from the court should you not be able to make your payments. This happens if the court deems you’ve fallen on hard times that were beyond your control and through no fault of your own, such as the loss of a job or an injury or illness.

How does a Chapter 13 bankruptcy repayment plan work?

When you file your petition with the court, you’re required to submit your payment plan within 14 days. Within the repayment plan, your debts will be split into various categories, such as secured, unsecured and priority claims. Priority claims must be paid in full, and these include taxes as well as fees for filing bankruptcy.

During the filing process, you’ll submit the following, which will help determine the approval of your payment plan:

- Detailed information including the amount, frequency and sources of your income

- A detailed list of your monthly living expenses such as housing, food, transportation, medical costs, etc.

- A list of all of your property

- A list of your creditors and the nature of their claims

This information will determine how much you’ll be able to pay for the repayment plan. For secured debts that are guaranteed by collateral like car and home loans, you’ll need to pay the amount overdue in order to keep the property. Secured debts are then paid with what you’re making from your source of income after living expenses are taken into consideration.

What’s covered in Chapter 13 bankruptcy?

Should your repayment plan be approved by the court, unsecured and secured debts may be covered by Chapter 13 bankruptcy. Once the trustee looks at your income and living expenses and talks with creditors as well, they’ll make the final decision of what’s covered. In order to better understand what’s covered and what you’re responsible for, it’s helpful to know more details about unsecured and secured debts.

Unsecured debts

Unsecured debts may not have to be paid in full as long as you’re able to make the payments based on your projected disposable income. The United States Courts classify disposable income as “income (other than child support payments received by the debtor) less amounts reasonably necessary for the maintenance or support of the debtor or dependents and less charitable contributions up to 15% of the debtor’s gross income.”

In some cases, your unsecured debts may be reduced or even forgiven during the bankruptcy process. These types of debts include:

- Credit cards

- Utility bills

- Medical bills

- Private student loans

- Personal loans

Secured debts

Secured debts are debts to mortgage holders or car lenders and the like that must be paid if you desire to retain the collateral. If you’ve put down collateral and are trying to keep your property, it’s a good indication that this is a secured debt. Some examples include:

- Auto loans

- Mortgage loans

- Life insurance loans

- Secured credit cards

- Pawn shop loans

How much do you have to pay back in Chapter 13?

Filing for Chapter 13 bankruptcy will eliminate some of your unsecured debts, but you’ll need to pay off your secured debts. Secured debts that must be paid are typically debts from lenders or debts associated with taxes, child support or alimony.

In some cases, you may need to pay secured debts back in full. But with your repayment plan, you may have some flexibility on the total amount of the debt that you pay. In some cases, depending on the creditor and the deal they make with the trustee, some debts may be forgiven completely.

What are the pros and cons of filing for Chapter 13 bankruptcy?

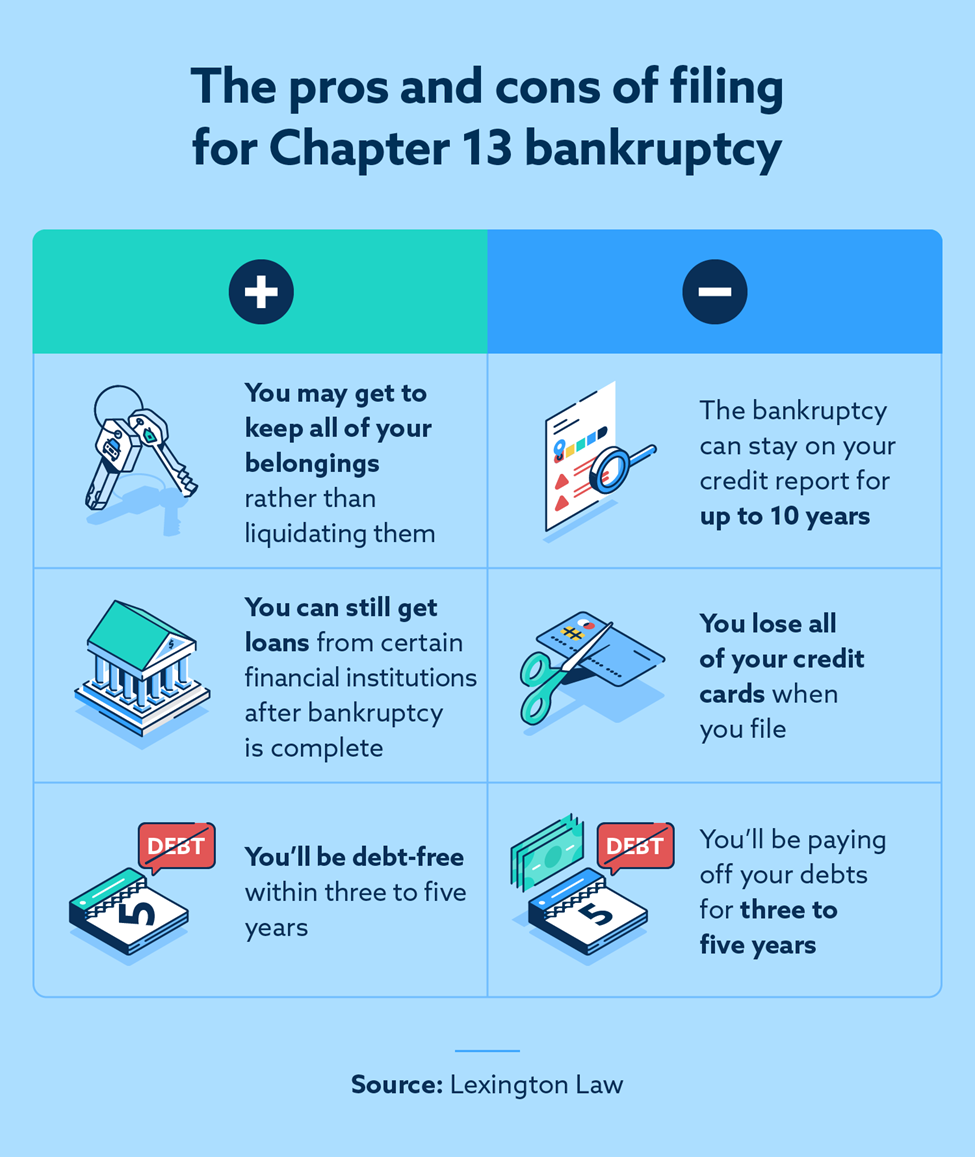

Chapter 13 bankruptcy can be a breath of fresh air because it allows you to make payments that fit within your budget. But it’s important to keep in mind that there are downsides to any form of bankruptcy. Before you make the decision to file for bankruptcy, you should know both the pros and cons of filing because it can affect your financial future.

What are the drawbacks to filing Chapter 13 bankruptcy?

Some of the downsides to filing Chapter 13 bankruptcy to take into consideration include:

- You’ll be paying off your debt for the next three to five years

- Some bankruptcies can stay on your credit report for up to 10 years, but Chapter 13 typically stays on your credit report for up to eight years from the date of filing your petition.

- You lose all of your credit cards

Depending on how you look at it, spending the next three to five years paying off your debt can be a good or bad situation. Some people don’t like the idea that they’ll be paying debts for this length of time and would rather have the debts eliminated.

What are the benefits of filing for Chapter 13 bankruptcy?

Although there are some downsides to filing for Chapter 13 bankruptcy, the process is there to help. Here are some of the ways you may benefit from filing:

- You may get to keep all of your property

- You have the chance to get back in control of your debt

- The process incentivizes financial responsibility

- The required courses will teach you how to better manage your finances in the future

- You can still get loans from certain lenders after your Chapter 13 is complete.

What is the Chapter 13 bankruptcy court process like?

When people ask “What is Chapter 13 bankruptcy like?” they often want to know if they’ll have to go to court regularly. It’s a common misconception that bankruptcy involves going in front of a judge regularly to discuss your case. In reality, you only go to court twice (if that), and much of the process is done outside of the courtroom.

What is a Chapter 13 trustee?

During the Chapter 13 bankruptcy process, you’re assigned a trustee. The Chapter 13 trustee is a bankruptcy administrator whose job is to go through your financial statements and will also meet with your creditors. Ultimately, the trustee will be reviewing your case and will tell the court whether they believe you should be approved for Chapter 13 bankruptcy or not.

What does an attorney do?

A bankruptcy attorney is someone who focuses in bankruptcy law and can assist you throughout the process. Not only will your bankruptcy attorney help you collect and gather all of your financial information, but they’ll also advise you throughout the process and will file the bankruptcy paperwork with the courts as well. While they do come at a cost, they’re often worth it.

What do you do when filing?

When you’re filing for Chapter 13 bankruptcy, your main job is to be as transparent and responsible as possible. Filing for Chapter 13 bankruptcy is telling the courts and your creditors that you’re going to make your payments on time and in full. Should you choose to work with a bankruptcy lawyer, it’s important to not hide anything and allow them to help you ensure the bankruptcy process is as smooth as possible.

Do you need an attorney for Chapter 13 bankruptcy?

It’s highly recommended that you work with an attorney throughout the bankruptcy process. As you’ve already learned thus far, a Chapter 13 bankruptcy can be detailed and sometimes complicated. While working with a bankruptcy attorney isn’t mandatory, it’s typically a good choice for the majority of people. Bankruptcy attorneys specialize in bankruptcy law, and they can help guide you through the process and try to ensure that you settle on a repayment plan that works for your situation.

One of the most important reasons for working with a bankruptcy lawyer is that they can help keep you out of trouble. Not disclosing certain assets or information during the bankruptcy process can be considered bankruptcy fraud, and it’s a felony.

According to Cornell Law School, nearly 70 percent of bankruptcy fraud involves not disclosing assets. By working with an attorney, you’ll have someone there for you to help you make sure you don’t miss anything during the filing process that could be seen as fraudulent.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

Before making the decision to file for bankruptcy, there are some key differences between Chapter 7 and Chapter 13 bankruptcy.

Some of the main differences include:

- Chapter 7 bankruptcy may require you to liquidate some of your property to repay creditors, but you can keep all or most of your property with a Chapter 13 repayment plan.

- Chapter 13 bankruptcy involves a repayment plan while Chapter 7 removes your secured debt completely.

- With Chapter 7 bankruptcy, a trustee evaluates your property for liquidation, but with Chapter 13 bankruptcy, a trustee mainly evaluates your eligibility.

Although there are some key differences, there are some aspects of Chapter 7 and Chapter 13 bankruptcy that are similar. These similarities include:

- Both forms of bankruptcy take months to complete the process through the court.

- During both Chapter 7 and Chapter 13 bankruptcy processes, you’ll be assigned a trustee.

- You can significantly benefit from working with a bankruptcy attorney when filing for either Chapter 7 or Chapter 13 bankruptcy.

How does Chapter 13 bankruptcy discharge work?

In order to receive a Chapter 13 bankruptcy discharge, you must make all of your scheduled payments for the three- to five-year duration. If you’re required to pay other unsecured debts like child support or alimony, these payments must be made as well. Once discharged, the court will order that you’re no longer responsible for the remaining balances of your secured debts.

How long does the Chapter 13 bankruptcy process take?

From the time you initiate the process, you’ll typically have an answer regarding your approval within about three months. This is another benefit of filing Chapter 13 bankruptcy vs. Chapter 7, because the Chapter 7 process can take twice as long. But once the court aspect of bankruptcy is complete, you’ll make payments toward your debts for the following three to five years before you’re discharged.

How long does Chapter 13 bankruptcy stay on credit reports?

If you’re approved for Chapter 13 bankruptcy, the bankruptcy can stay on your credit reports for eight years after the petition was filed. During this time, it may be more difficult to buy a vehicle, a home or other purchases that involve a lender. Bankruptcy can affect your ability to get new credit cards as well. If you do need a loan during this time, you can research “high-risk” lenders, but keep in mind that they often loan with higher interest rates.

Repairing your credit after Chapter 13 bankruptcy

Having to file for Chapter 13 bankruptcy is something that more people do than you may think. Once the process is over, it’s time to think about repairing your credit to ensure that you have a solid foundation for a stable financial future.

At Lexington Law, we have professional consultants who are here to help you with our credit repair services. To learn how we can assist you with your credit after bankruptcy, contact us today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.