The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Yes, paying your credit card early can raise your credit score.

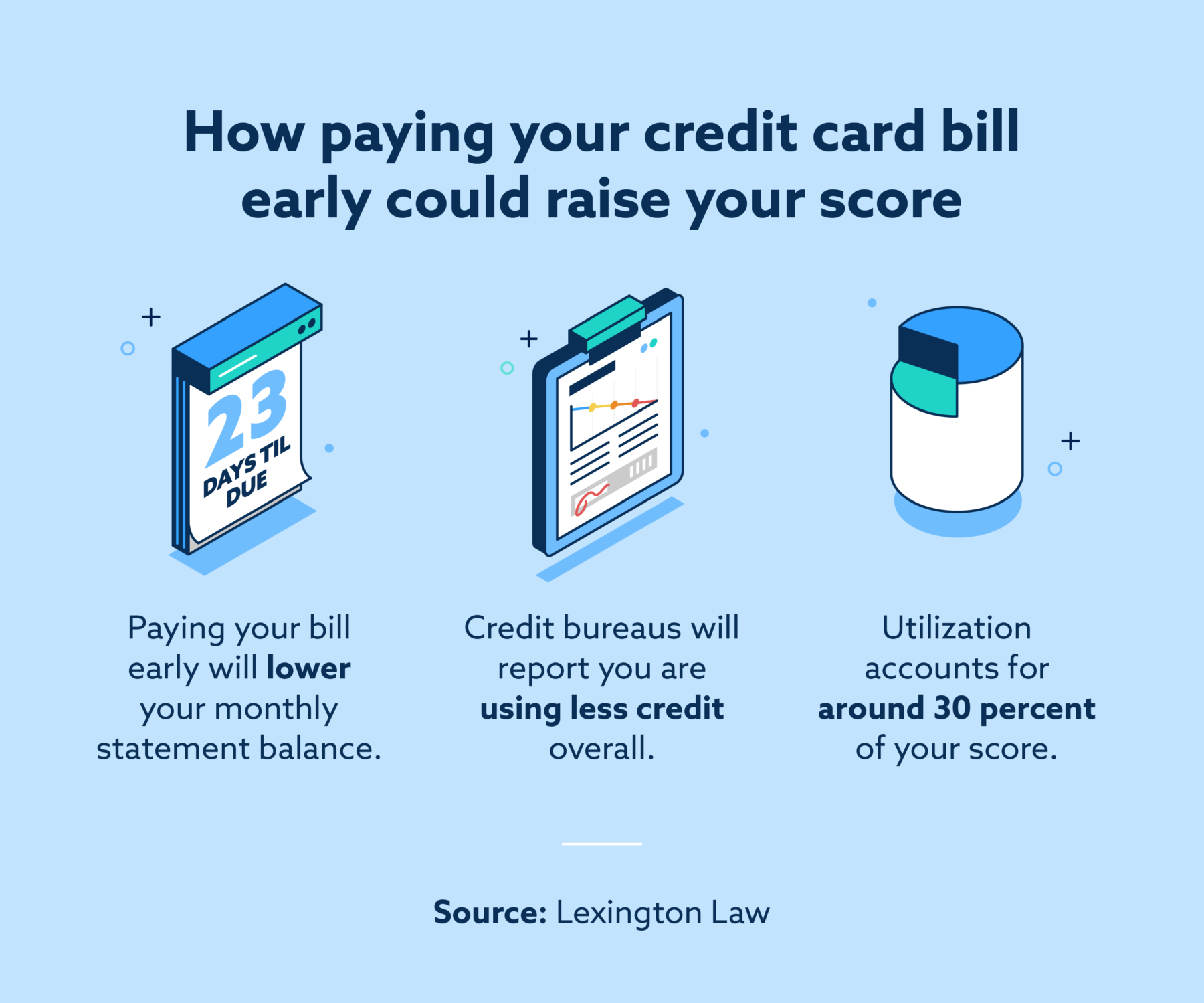

Paying your credit card early can raise your credit score. After your statement closes, your credit card issuer reports your balance to the credit bureaus. Paying your bill ahead of time lowers your overall balance, so the bureaus will see you using less credit in total. Since utilization makes up around one-third of your credit score, paying your card early can have a positive overall effect.

However, paying your credit card bill early may work differently if you carry a balance on your card each month. Instead of paying your next statement early, you’re actually making an extra payment on your previous balance. Therefore, you’ll likely still need to pay the minimum amount on your next statement, or your payment could be considered late.

In most cases, paying your credit card bill early is a good idea—and it can have a positive impact on your score.

Read on to learn more about how paying your card early affects your score.

How paying your credit card bill early can help your credit score

Paying your credit card bill early may increase your credit score, since the overall debt that gets reported to the credit bureaus is likely to be lower.

To understand how paying a bill early could raise your score, you need to understand two things: the factors that make up your score and how your credit issuer reports to the credit bureaus.

Your score is calculated based on several factors, and two of them are relevant to paying your bill early: credit utilization and payment history.

- Payment history makes up around 35 percent of your score, and simply put, paying your bill early means that you aren’t paying it late. Late payments can have a major negative effect on your score, so paying your bill on time or early will help boost your score.

- Credit utilization accounts for around 30 percent of your score, and it represents how much of your available credit you’re actually using. As a general rule, you should aim to use one-third of your credit or less. For example, if you have a total credit limit of $9,000, you’d want to keep your balance below $3,000.

The credit bureaus—TransUnion®, Experian® and Equifax®—are responsible for keeping track of your credit history. They receive all of their information from lenders, like the financial institution that issued your credit card.

After your monthly statement is issued with your balance, you have a grace period before the payment is due—typically around 21 days. During that time, your credit card provider will report your balance to the credit bureaus. If you pay your balance before your statement closes, the total listed balance will be lower, so the credit bureaus will see your overall utilization as lower, which could increase your score.

That said, your particular situation may change how early payments work, so you’ll want to make sure you understand your billing cycle and balance before making early payments.

Is it ever bad to pay your credit card early?

While it is never bad to pay your credit card bill early, the benefits you receive from doing so may vary depending on your circumstances.

For example, if you carry a balance on your credit card every month, you may need to adjust how you handle early payments. While it is a myth that carrying a balance on your card improves your score, there are reasons you may have lingering credit card debt nonetheless.

If you do carry a balance on your card each month, keep the following in mind:

- Your early payment may not count as your minimum payment. If you have a balance from a previous month, you can’t make an “early” payment toward your next statement. Instead, you’re making an extra payment, so you’ll still need to make a minimum payment after your new statement is issued.

- You may not save money on interest and fees by making an early payment. Depending on how your credit card issuer calculates finance charges on your previous balance, your early payment may not reduce your interest or fees by much or at all. For example, if you’re charged based on average daily balance, simply paying at the end of the month may not help much.

All that said, it’s still usually a good idea to pay down your credit card debt if you have the funds available to do so. You may not see an immediate score increase if you have a substantial balance, but over time, you’ll build the financial habits that can help you eliminate debt and begin making on-time—or early—payments consistently.

When is the best time to pay your credit card?

The best time to pay your credit card bill is before the payment is late. While you may benefit from paying your bill early, you’ll definitely see negative effects if you pay your bill late.

Paying early keeps your payment history intact and may help lower your overall utilization, while paying your bill more than 30 days late will likely lead to a negative item on your credit report. And if you neglect to pay long enough, your account could get sent to collections.

If you do start paying your credit card bill early, you’ll want to begin checking your credit report regularly to see how your balance is being reported to the credit bureaus. Over time, you should see your utilization drop and your credit score increase.

While sifting through your credit report, it’s important to keep an eye out for inaccurate information like fraudulent accounts, incorrect negative items or factual mistakes. Any of these inaccurate items could be lowering your credit score. Fortunately, it’s possible to dispute these items on your report and repair your credit score.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.