The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you overpay your credit card, you won’t lose the money, and your credit won’t take a hit. You’ll just have a negative credit card balance, which you can use toward future purchases, or you can request a credit balance refund.

With so many things to keep track of in your financial life, it can be easy to make an occasional mistake. And while mistakes like a late payment can have negative effects on your credit health, there are other slip-ups that aren’t necessarily a bad thing—and overpaying your credit card is one of them.

If you overpay your credit card, perhaps due to an automatic payment and a manual payment overlapping, there’s no need to worry. You won’t lose the money, and your credit score won’t take a hit. You’ll know you’ve overpaid if you have a negative credit card balance.

What is a negative credit card balance?

A negative card balance means that something has happened to cause your balance to dip below zero. Your first thought may be that something is wrong—but a negative balance means that your credit issuer owes you money.

Common ways negative balances happen

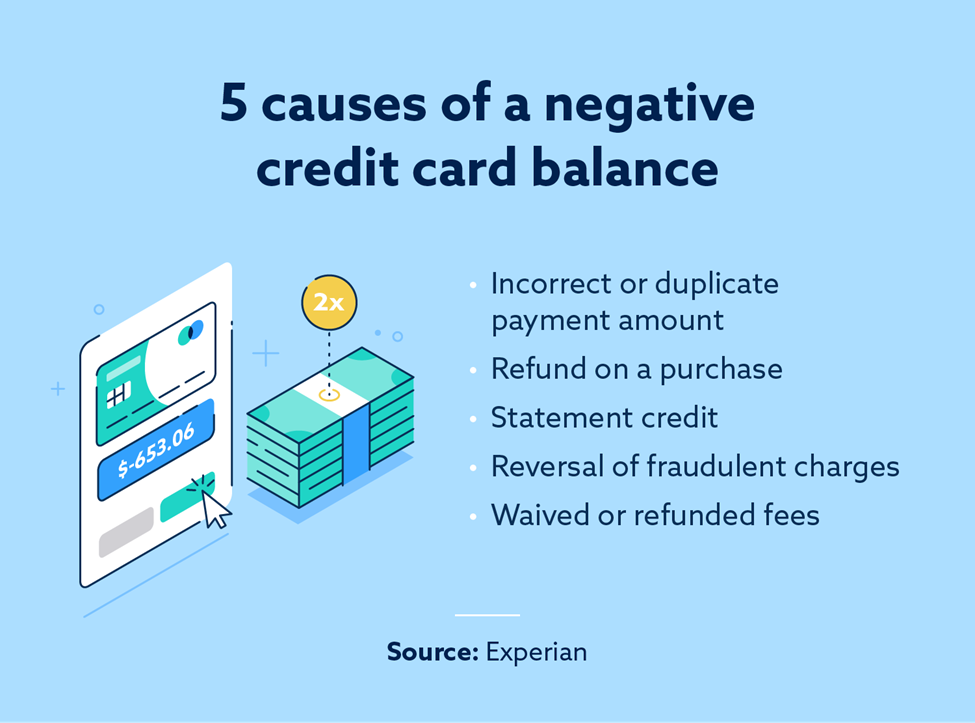

Negative credit card balances are fairly common and are nothing to fret over. If you notice a negative balance, you may wonder what triggered it. Below are five common causes.

- Your manual payments and autopay overlapped. If you manually paid an amount greater than your balance, you would have a negative balance. Alternatively, if you made a payment around the same time that an automatic payment happened, your balance could dip below zero.

- You received a refund on a purchase. If you made a purchase with your credit card and then paid off your full balance, you would show a balance of $0. If you then returned the purchase and received a refund on the card, you would have a negative balance.

- You earned rewards or statement credits. Some credit card companies offer welcome bonuses or cashback rewards in the form of statement credits. If you received credit when your balance was already zero, you would have a negative balance.

- You reversed fraudulent charges. If you were the victim of credit card fraud or someone used your card without authorization, your card issuer would reverse the transaction. This could result in a negative balance, depending on how much was charged and your previous balance. If the fraud is reflected on your credit report, you can address it by filing a dispute.

- You negotiated fees. If you can successfully negotiate with your credit card issuer to waive fees, you may end up with a negative balance if you’ve already paid off those charges.

What to do if you overpay your credit card

No matter the cause of your negative balance, you have two options:

- Do nothing. Any future purchases you make will bring your account back to positive. If you don’t make any purchases on the card after six months, creditors must refund the full negative balance.

- Request a credit balance refund from your credit card issuer. Since a negative balance means the credit issuer owes you money, many people opt to file for a refund to bring their account back to zero.

How to submit a credit refund request

Each credit card issuer has its own policy on how credit balance refunds work, so check with your financial institution for step-by-step instructions.

Typically, you can request a credit refund online, via mail or over the phone. A refund may be issued as cash, check, direct deposit or money order.

The Federal Trade Commission requires creditors to send you a credit refund within seven business days of receiving a written request. If you haven’t heard from them after seven days, follow up to ensure it was issued and processed correctly.

Fraud triggers

While credit balance refunds are usually executed without difficulty, there may be instances where your financial institution is suspicious of fraud. This typically happens if the negative balance is significant—like if you added an extra zero to your payment amount.

Large negative balances are a warning signal of refund fraud or money laundering. To combat this, creditors may freeze your account or even shut it down as a measure of consumer protection. If fraud is suspected due to a mistake, it may cause some inconvenience.

As soon as you become aware of a large negative balance, call your credit card company and explain the mistake. They’ll make your account right again.

How overpaid balances show up on your credit report

A negative credit card balance isn’t bad for your credit. In fact, it doesn’t show up on your credit report at all, so the three major credit bureaus will never know you have a negative balance—it will simply show up as zero.

Perhaps more important than the balance itself is the credit utilization rate. According to FICO®, this plays into the “amounts owed” category of your credit score, which accounts for 30 percent of the total score. When you have a negative balance, your utilization rate is zero percent, which works in your favor—typically, the lower your utilization rate is, the better.

4 tips to prevent overpaying your credit card balance

While there’s virtually no harm in overpaying your credit card balance, it may be a hassle to request a balance refund in the event of overpayment. Also, dealing with potential fraud triggers could prove frustrating. Here are four tips to help you avoid overpaying your credit card balance.

1. Check your statements regularly

Checking your credit card statement and knowing your balance is a great way to ensure you won’t overpay your credit card balance. Carefully review your statement before making a payment and note if there are any discrepancies.

Returns and refunds can also result in overpayment if they come through after you pay off the balance, so make sure you check that for any recent refunds.

2. Set up automatic payments

Automatic payments are extremely helpful—especially for avoiding late fees. Often, you can set up an automatic payment for a specific amount or to pay off the current balance. Just ensure you have enough in your checking account to cover the payment to avoid overdraft.

3. Avoid manual payments right before a scheduled payment

Manual payments that are soon followed by automatic payments can result in an overpayment. If possible, consider waiting until the automatic payment goes through and then pay the remaining balance.

4. Use account alerts

Banking and credit card companies often allow you to set up automatic alerts based on specific criteria. These alerts can come as a text, email or phone notification. You may consider setting up an alert when your card balance reaches a specific threshold.

Negative credit balance FAQ

There tends to be a bit of confusion related to negative credit card balances that may cause people to purposefully overpay in hopes of receiving a benefit. Let’s answer the following commonly asked questions to clear up any misconceptions.

Will overpaying my credit card increase my credit score?

Overpaying has no more impact on your credit score than paying the full balance does. Paying down your credit card to a zero balance is good for your credit, but you won’t see an extra boost by purposefully overpaying because it will still show up as a zero balance on your credit report.

If you’re looking to improve your credit score, try these tips:

- Make all loan and credit card payments on time

- Lower your credit utilization

- Avoid closing old credit cards (even if you don’t use them)

- Open a secured credit card

- Become an authorized user on the credit card of someone with good credit

- Apply for a credit building loan

- Consider sending a pay for delete letter

- Dispute inaccuracies on your credit report

- Include rent and utilities on your credit report

Will overpaying my credit card increase my credit limit?

While having a negative balance may provide a little extra wiggle room for a future large purchase, it won’t increase your actual credit limit. If you have a balance of negative $100 on a card with a limit of $3,000, your official limit is still $3,000—it will just take you a bit longer to reach that limit since you have a $100 credit.

If you’d like to increase your credit card limit, try one of these three options:

- Apply for a new credit card with a higher limit.

- Request a higher limit from your credit card issuer.

- Check to see if your credit card issuer will automatically boost your limit in the future.

Does overpaying my credit card allow me to profit from interest?

Overpaying your credit card isn’t the same as depositing money into an interest-earning savings account. You don’t earn interest on a negative credit balance—the money simply sits there until it is refunded or until purchases bring the account back to a positive balance.

Take control of your credit today

Lexington Law Firm has a team that can help you understand your credit and address any errors that may be negatively affecting it. Lexington Law Firm also offers continuous credit monitoring services to protect you from fraud and credit-related discrepancies. Ready to take control of your credit? Learn how we can help by getting your free credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.