The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A flexible spending credit card is similar to a regular credit card, except you have a variable credit limit. This limit changes based on your income, credit score and payment history. It allows users to potentially go over their regular credit card limit if the purchase meets specific requirements. The card issuer will approve or deny the overspending purchases.

First, the user’s regular spending habits are analyzed, and then information such as their recent payment history and income are considered to decide if the purchase is acceptable. This is very different from a regular credit card that has a set limit. When users try to go over a standard credit card’s limit, they’re often denied the purchase and charged a fee.

A flexible spending credit card is not related to a flexible spending account (FSA) in any way, so don’t be confused about that. While the terms are similar, FSAs are saving accounts related to healthcare costs and insurance.

Flexible Spending Cards vs. No Preset Limit (NPSL) Cards

A “no preset limit” credit card (NPSL) has no stated limit attached to the credit card. In actuality, there is a limit, but that number is never shared with the cardholder. Only some NPSLs report the card limit to credit bureaus.

A flexible spending card does have a stated limit that the cardholder is aware of and that limit is reported to credit bureaus.

Both credit cards allow the user to go over their credit limit without penalty. Additionally, both kinds of cards carry some uncertainty with them. With a flexible spending card, you might not be certain that charges above your limit will be approved unless you’re confident you’ve been maintaining good credit card behavior. And with an NPSL, you never know your limit, so you’re uncertain when you’ll max it out.

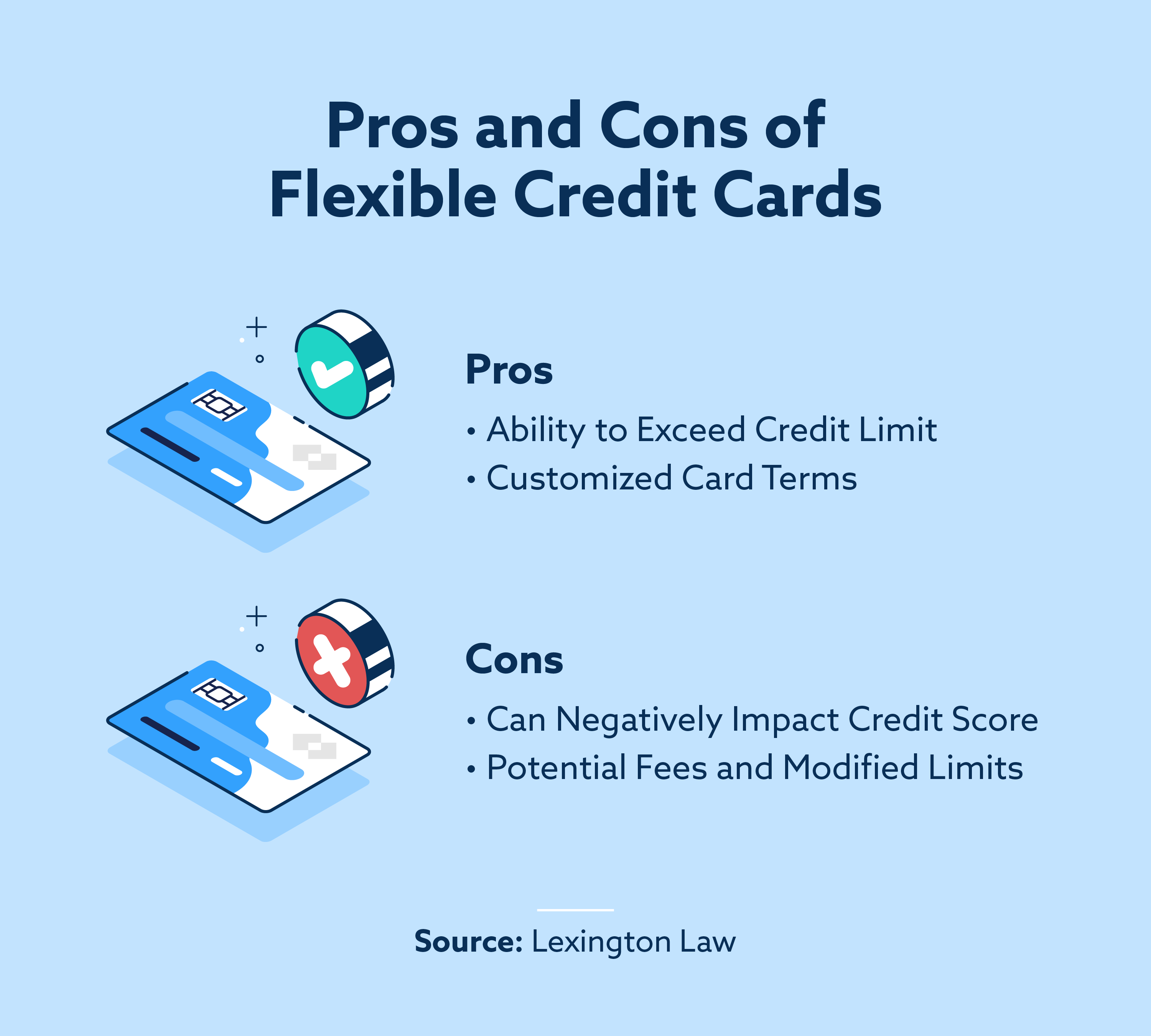

Pros of Flexible Spending Cards

You Can Go Over Your Limit

With a typical credit card, you can’t go over your limit but you do get charged a fee for trying to do so. A flexible spending card lets you go over your limit (if you’ve been making frequent payments and maintaining a steady income). This is great for individuals who find themselves purchasing big-ticket items every couple of months. Rather than trying to get approved for a credit card limit increase, your flexible card lets you make the large payments when they occur.

Card Terms Are More Customized

How your flexible spending card works for you will depend on you. If you are responsible and both pay off your card every month and don’t consistently overspend for your income bracket, your occasional big purchases will be approved.

Conversely, if you start to be irresponsible with your flexible spending card, the issuer will stop approving purchases over your limit. That’s because the issuer studies your shopping habits, payment history and income to determine if you can afford to go over your limit.

Overall, a flexible spending credit card offers more customized card terms. Many people don’t want to go through the hassle of increasing their credit limit every time a big purchase comes up. Additionally, some people recognize that having a high credit limit might be too tempting. The flexible card option allows the credit card to be there as a contingency plan. You can go over when needed, but you don’t have to most of the time.

Cons of Flexible Spending Cards

You Need to Understand the Fine Print

Some of the fine print might take you by surprise. For example, these types of cards will analyze your situation every time you go over your limit. That means that just because you were approved to go over your limit before doesn’t guarantee it’ll happen the next time. Additionally, there may be fees and automatically modified limits you may want to watch out for.

Your Credit Score Might Be Affected

Unfortunately, there’s a strong possibility that a flexible spending card will negatively impact your credit score. This mostly stems from how your card’s limit is reported to the credit bureaus.

First, this type of card can impact your credit utilization ratio. Credit utilization accounts for almost one-third of your credit score. This ratio looks at how much credit you use versus how much is available to you. Ideally, you want to keep your credit utilization ratio at 30% or lower.

As flexible spending cards usually do not report the credit limit to credit bureaus, it can harm your credit score. That’s because it looks like you’re using a lot of credit without the bureau knowing your limit. For example, if you’re spending $2,000 on your flexible card when you have a limit of $10,000, that’s a decent credit utilization ratio at 20 percent. However, the credit bureau doesn’t know your limit, so it’s being recorded that you’re spending $2,000 without the benefit of the $8,000 buffer.

Alternatively, maybe your flexible spending card does report the limit to the credit bureau. In this case, if you spend way over your limit—even though it’s allowed by your card—the bureau will ding you for it. The bureau doesn’t distinguish between going over on a traditional credit card and a flexible credit card; it just sees someone that went over their allowed limit.

It’s essential you check your credit score once a month to stay on top of how your card impacts you. Note that a flexible spending credit card is sometimes reported in the “Other Debt” section of your credit report.

Where to Get a Flexible Spending Credit Card

You can get a flexible spending credit card from most major financial institutions. However, this type of card isn’t just given out to anyone. It’s typically reserved for people with an excellent credit score and a good financial track record.

If you like a card and its terms but don’t want the flexible limit, you can sometimes decline the flexibility and request a hard credit limit. However, note that if you do this, you may not be able to reverse the decision.

If you ever notice that your credit card is suddenly listed as “flexible spending” in your account, you should immediately contact your card provider for more information. This occasionally happens, but it’s not something you just have to accept. You can ask for the card to be reverted to a hard-limit traditional credit card.

Be Smart With Your Card

No matter what kind of card you have, you should always be careful with your credit cards and how you use them. Always try to keep a low credit utilization ratio, and always pay off as much of your balance(s) as you can every month. You especially want to do this because you don’t want to accrue interest. Interest on credit cards can range anywhere between 15 and 24 percent. If you’re irresponsible with your card and miss payments, make late payments or max out your card, it can impact your credit score. And if you have a low credit score, it can affect your ability to get a mortgage, car financing, student loans and more. By being smart with your credit cards, you’re showing financial institutions that you can be trusted with money. To learn more about credit and credit repair, check out Lexington Law’s resources today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.