The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Revolving debt is any debt without a set loan amount for a specific amount of time.

“Debt” is a broad term that includes different types of credit accounts. If you want to get a handle on your debt, it’s important to understand each one. Get a head start by learning about the differences between revolving debt and installment debt.

What is revolving debt and how does it work?

Revolving debt allows you to borrow against a line of credit and repay the money over time. Each revolving account has a set limit, but you can borrow repeatedly as long as you have some available credit.

Credit cards are one of the most common types of revolving debt. When you open a credit card, the issuer gives you a credit limit. As long as you don’t exceed the limit, you can use the card over and over again. Then you make monthly payments to reduce your balance.

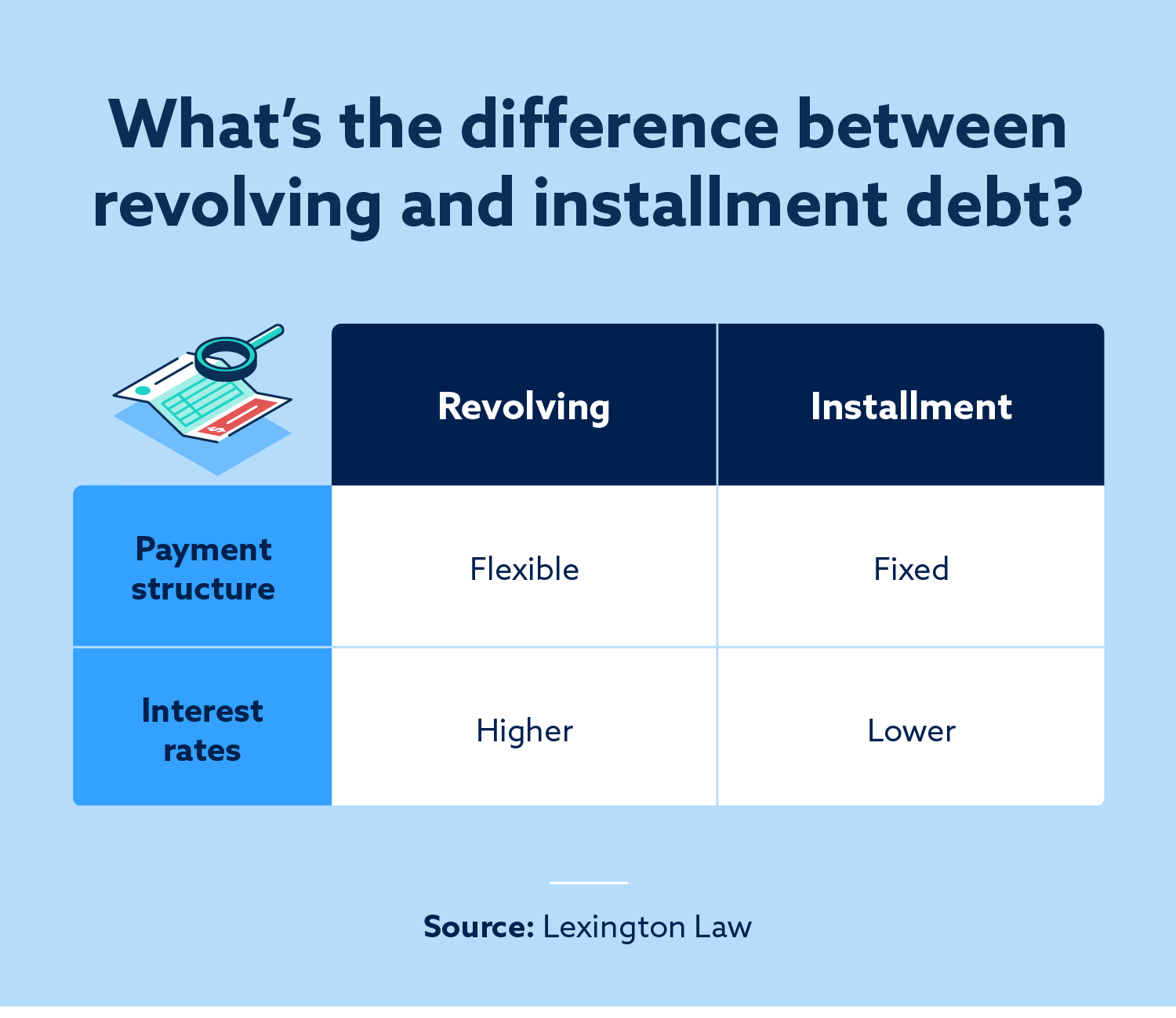

If you have revolving debt, you don’t have a fixed payment each month. Instead, the lender calculates the amount due based on how much you spent during the previous billing cycle. For example, many credit card companies set their minimum payments at 2 percent of your balance, so if you had a balance of $2,000, your minimum payment would be $40. Making a payment increases the amount of credit you have available, which allows you to continue using the card. For example, if you make a $250 payment, your available credit will increase by $250. You don’t have to pay in full every month, but remember that you’ll have to pay interest on your unpaid balance.

Pros and cons of revolving debt

Revolving debt has several pros and cons. On the positive side, revolving accounts allow you to access money when you need it. If you make your payments on time and avoid going over your limit, using revolving debt can help you strengthen your credit profile.

Many credit cards also come with rewards, such as airline miles, bonus points or cash back on your everyday purchases. Responsible card usage may help you earn enough rewards to take a vacation or get free gift cards.

On the negative side, revolving accounts typically come with high interest rates. If you don’t pay your balance in full every month, a high rate increases your total cost of borrowing. Access to revolving accounts may also heighten the risk of overspending. Finally, if you don’t use your credit wisely, a revolving account has the potential to hurt your credit. For example, a single late payment may hurt your credit significantly. Late payments also stay on your credit report for up to seven years, which may make it difficult to qualify for new credit in the future.

Types of revolving debt accounts

As noted earlier, credit cards are one of the most common types of revolving debt. These accounts are also classified as revolving:

- Home equity line of credit (HELOC): A HELOC allows you to borrow against the equity in your home. In the financial world, home equity is the difference between the value of your home and the amount you owe on your mortgage. For example, if you have a mortgage balance of $300,000 on a home worth $500,000, you have $200,000 in equity. HELOCs typically have lower interest rates than credit cards, but you can only access funds during the draw period, which typically lasts for five to 10 years.

- Business line of credit: If you own a business, you may need a line of credit to pay for supplies or meet the demand for your products or services. A business line of credit allows you to finance short-term purchases and pay them back over time.

- Personal line of credit: Personal lines of credit work like business lines of credit, except you use them for personal expenses instead of business expenses. You may want to use this type of revolving debt to take a dream vacation or pay for home renovations.

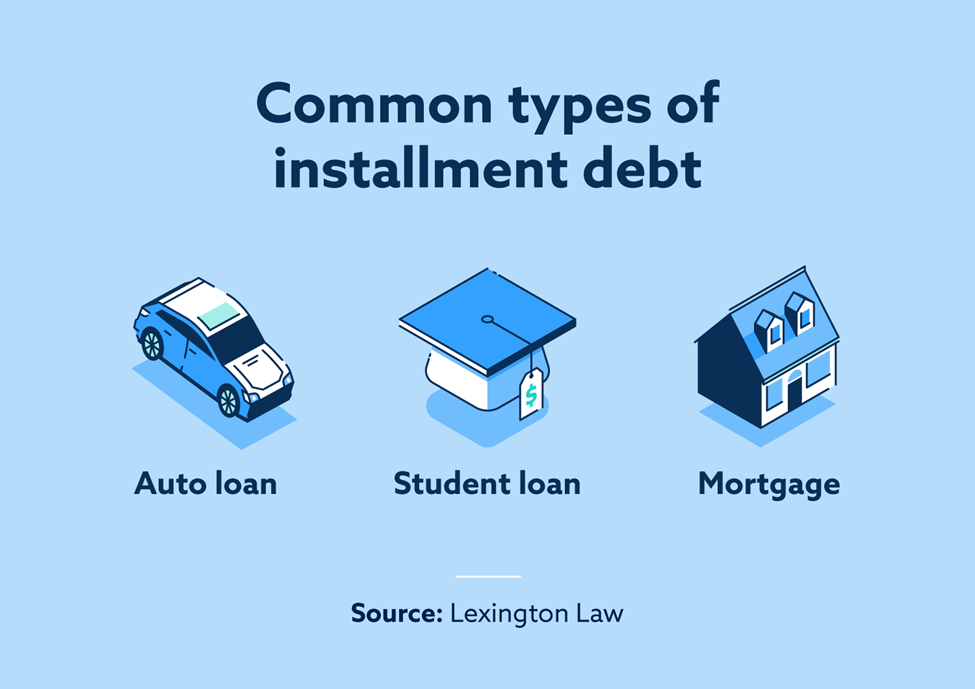

What is installment debt?

Installment debt is a bit different from revolving debt. Instead of making minimum payments based on your spending habits, you make fixed monthly payments. Each payment includes principal and interest, allowing you to pay back the debt over time.

Mortgages, personal loans and auto loans are the most common types of installment debt. With a mortgage, you borrow a large sum of money to buy a home. You usually have 15 to 30 years to pay back the money.

Personal loans and auto loans have shorter repayment terms. For example, your bank may give you 36, 48, 60, 72 or 84 months to pay back an auto loan.

Pros and cons of installment debt

One of the biggest advantages of installment debt is that you get to make fixed monthly payments. This means you’ll know exactly how much you owe each month, making it easier to budget for your expenses.

Installment debt also usually has lower interest rates than revolving debt. For example, the average mortgage interest rate was 7.56 percent in December 2023. In contrast, the average interest rate on bank-issued credit cards was 13.96 percent in March of the same year.

The main disadvantage of installment debt is that it’s less flexible than revolving debt. If you have financial difficulties, you can stop using your credit card or accessing your line of credit until your circumstances improve. With installment debt, you must pay the same amount every month.

Installment debt also requires you to borrow a lump sum. If you’re approved for a $10,000 personal loan, for example, $10,000 is the most you can spend. You don’t get access to additional funds every time you make a payment.

Impacts of revolving debt and installment debt on your credit profile

One of the biggest differences between revolving debt and installment debt is that revolving debt counts toward your credit utilization ratio, a metric that tells lenders how much of your credit you’re using at any given time.

For example, if you’re using $5,000 of your $10,000 credit limit, your utilization ratio is 50 percent. It’s generally recommended that you keep your utilization below 30 percent to demonstrate financial responsibility. If you max out your credit cards or spend up to the limit on a line of credit, you may have trouble qualifying for loans or other types of credit accounts.

Otherwise, both types of debt have similar effects on your credit:

- Payment history: On-time payments improve your credit, while late payments and missed payments have a negative impact. This is true whether you have revolving debt, installment debt or a mix of both.

- Credit inquiries: When you apply for a new credit account, the lender checks your credit report to assess your financial situation. This is known as a hard inquiry. Too many hard inquiries can affect your credit score, so it’s important to apply for new accounts only when you need them.

- Credit mix: The number and type of accounts you have, known as your credit mix, is one of the factors used to determine your credit score. Having a mix of revolving and installment debts may help you improve your credit mix.

- Account age: Your average age of accounts also affects your credit score. If you close a revolving or installment account, it may reduce your average age of accounts, whereas keeping your accounts open for many years can have a positive impact on account age.

Now that you understand the differences between revolving debt and installment debt, it’s time to use your credit wisely and build good financial habits. One thing you can do to improve your credit profile is get copies of your credit reports and make sure there are no inaccurate items hurting your credit health. If you notice any inaccuracies, work with a professional credit repair service to address them.

Note: The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.