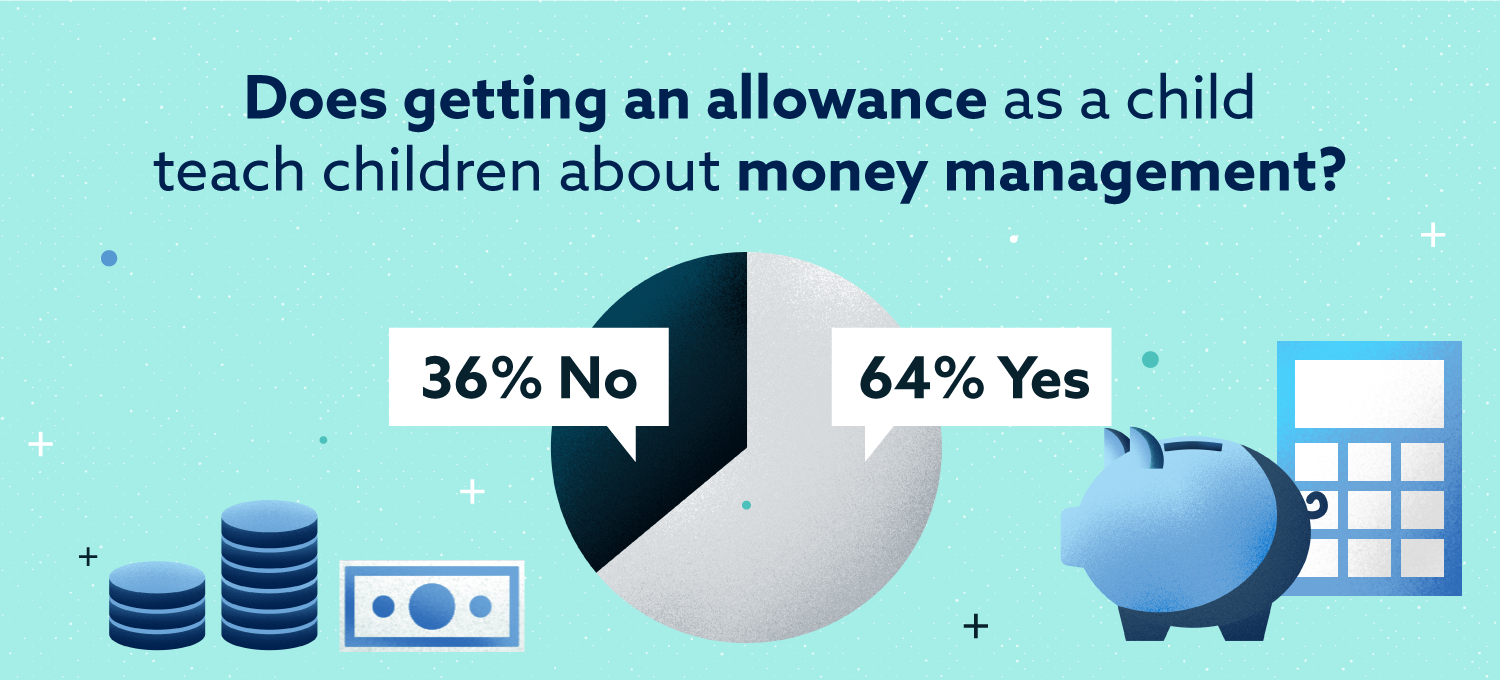

Sixty-four percent of Americans all agree that allowances teach kids about money.

For many Americans, managing their finances is a struggle. In fact, we found in a previous survey that most Americans don’t have a savings goal and two in five have less than $1,000 in savings. In another study, we learned that most Americans could not pass a basic financial literacy quiz.

Americans’ lack of financial knowledge often translates to poor financial habits. It makes you wonder how things might turn out if Americans start learning about money earlier, like when they start earning an allowance.

Allowances are one of the first times that most Americans probably handle their own money, so how much do they really help? We surveyed 2,000 Americans to see if they thought allowances make a difference and when kids should start earning.

Key Findings:

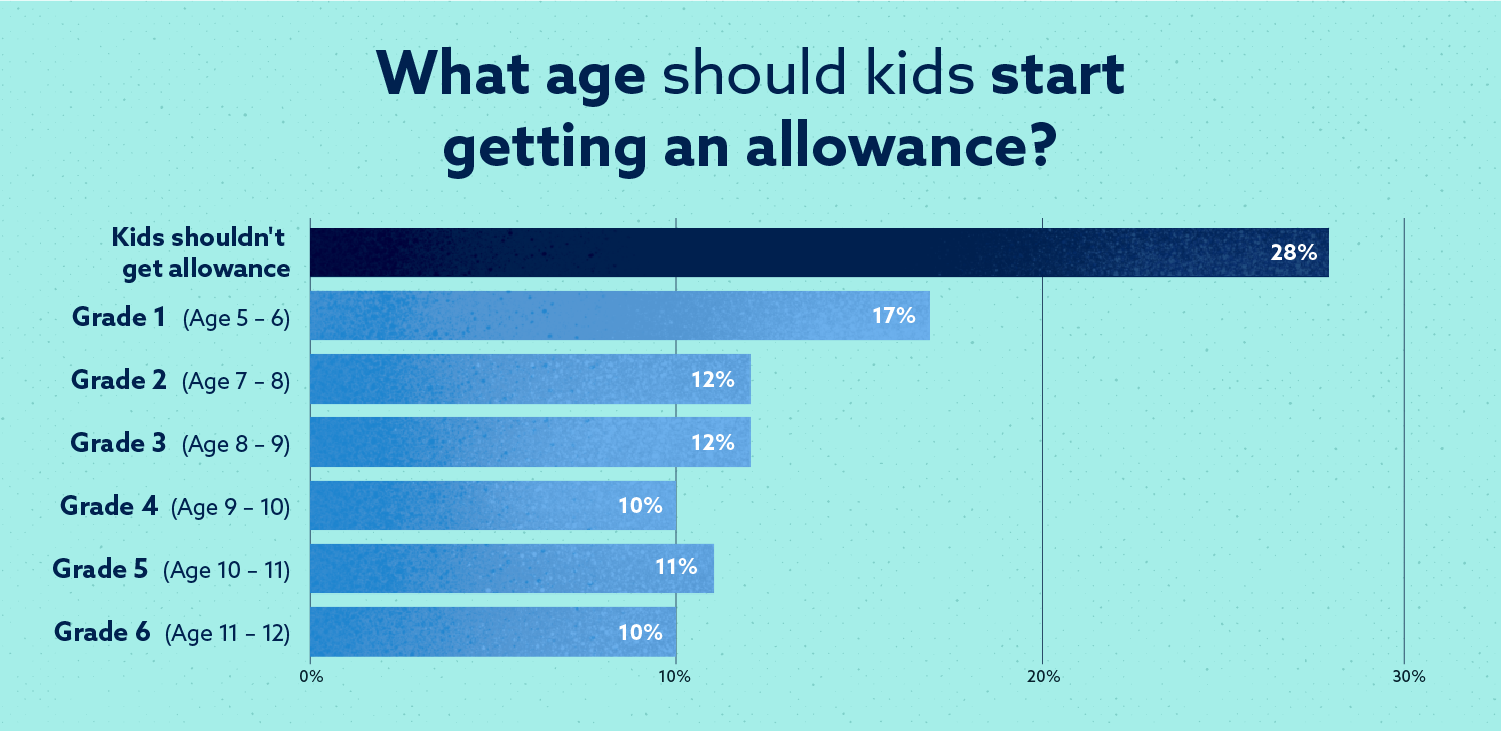

- More than 1 in 4 Americans believe kids shouldn’t get an allowance

- Nearly three-quarters of Americans believe getting an allowance teaches kids about money management

More Than a Quarter of Americans are Anti-Allowance

Twenty-eight percent of Americans we surveyed weren’t fond of the idea of giving kids allowances at all. This attitude may reflect in the total allowance kids receive. A recent Finder survey found that kids receive an average of $17 a week for allowance.

Regardless, many more Americans are still pro-allowance. However, the age kids should start receiving an allowance is where opinions differ.

Most Americans Still Believe in Allowances, but Can’t Agree on When to Start

Americans have different opinions about when kids should receive allowances. In our findings, close to 17 percent of respondents felt that kids should start getting an allowance as early as age five or six. A handful of studies actually agree with the idea of starting earlier rather than later.

A study published in the Journal of Consumer Affairs finds that kids are capable of learning about savings as early as age five. The study also found children who grew up with a savings account were more likely to accumulate more savings and other things as young adults.

Science Daily reported on a study published in the Journal of Family Issues that recommends teaching kids about money management at a younger age when stakes are lower. This study found that early learning helps kids develop good financial habits before living on their own.

Despite having split feelings about when they should start, many Americans believe that allowances are a viable way to teach money management to kids.

Most Americans Believe in Allowance as a Teaching Tool

Sixty-four percent of Americans all agree that allowances teach kids about money. However, experts agree that giving allowance alone isn’t enough to fully teach kids about money. Kids need guidance to understand bigger concepts like saving and spending.

In an interview with the Atlantic, Arizona State University psychologist Suniya Luther isn’t opposed to allowance but says that kids should understand that certain chores should be done because it keeps the household running and not solely because they’ll receive a payment.

Robert Gauvreau, CPA and partner at Gauvreau and Associates says allowances are a great tool to introduce finances, but we need to take the steps necessary to effectively teach children.

“We have to go above just providing an allowance and help them understand how the entire spectrum of finances work, how things could go wrong, and how best to prepare for their financial futures,” he said.

A few things he recommends include:

- Educate them about how money is earned through a job and how there are government obligations such as taxes that need to be paid from that money.

- Introduce the idea of making financial decisions such as retirement savings or saving for a home renovation and the importance of saving first before committing to financial obligations.

- Understand credit (credit cards, loans, student debt, etc.).

- Discuss high-dollar items, how to pay for them and the costs associated with maintaining them (such as a home).

- Discuss the importance of personal savings and how this can provide security for any future tough financial times.

Financial literacy is important for the entire family, especially if any member has fallen on difficult times. If you need help understanding your credit report, learn how our credit repair services can help you work toward your credit score goals.

Methodology

This study was conducted using Google Surveys. The sample consists of no less than 2,000 completed answers. Post-stratification weighting has been applied to ensure accurate and reliable representation of the total U.S. population ages 18 and older. The survey ran online August 2019.

Learn more about Google Surveys’ methodology.