Green investing is investing in companies or funds committed to protecting the environment.

The popular slogan “reduce, reuse, recycle” is a basic conservation principle that entered the global lexicon in the 1970s. The decade most synonymous with the disco scene also saw the beginning of mainstream conservation efforts — marked by progress like the formation of the Environmental Protection Agency, legislation on resource conservation and the inaugural Earth Day celebration.

Today the phrase is ubiquitous, as a growing number of people are taking it upon themselves to effect change in the name of sustainability. One of the many ways to do this is by changing consumption behaviors. Many consumers are making purchasing decisions in part by the environmental reputation of the manufacturer. The Shelton Group has been monitoring trends like this for over a decade through their annual Eco Pulse Report, and as of 2017 nearly half of Americans (45 percent) want to be regarded as someone who buys eco-friendly products — a change occurring mostly over the past three years.

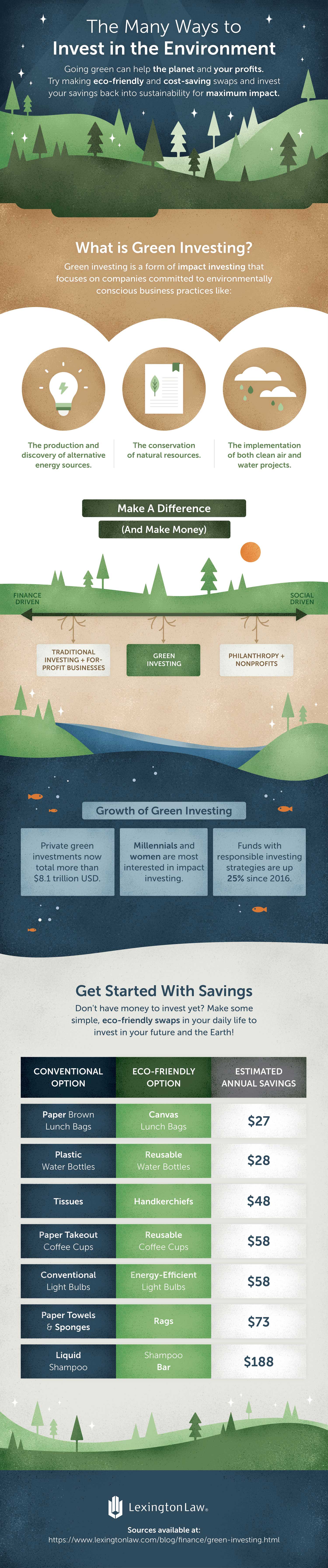

Committing to sustainable shopping and making eco-friendly swaps may seem cost prohibitive, but when you break down the lifetime cost-benefit, it’s undeniably better for your wallet, and the Earth, to go green. A lesser discussed way to effect change is green investing — investing in companies or funds committed to protecting the environment. By investing in companies or funds committed to protecting the environment, you’ll not only be contributing to the greater good, but you’ll be growing your savings at the same time.

We’re in the middle of a cultural shift when it comes to sustainability. Every day more socially responsible investment platforms are becoming available to help conscious consumers invest their savings. The definition of green investing is broad, so it’s important for the investor to do their research to ensure that the funds they’re supporting meet their personal definition of “green.” Socially-conscious investing isn’t just another passing fad — it’s a movement that’s here to stay.

Sources: Pantheon Enterprises | Investopedia | Green Foresters | US SIF | The Nest | Ethical Markets | Stockchoker