In today’s complicated world, financial planning can be difficult for anyone. As a person living with disability or taking care of someone with one, you have an entire additional level of concerns and needs to deal with.

This comprehensive guide is full of helpful advice and information on personal finances for individuals with disabilities. It will help you to get organized, plan ahead and make the most of your circumstances. There are a vast number of helpful services and programs out there, and using our guide, you can easily find them. Read on to learn more, or click through the menu below to find out what you’re interested in.

- Hidden costs of living with a disability

- Maximizing your earning potential

- Getting insured

- Making large life purchases

- Supporting children with disabilities

- Paying for college for students with disabilities

Hidden costs of living with a disability

When you are living with a disability, there can be many obvious costs, such as medicines, medical services and assistive devices. But there are also many hidden costs that can adversely affect your life. These costs may not be obvious to others, but they can have a major impact on your life — whether or not they are reimbursed by insurance or even recognized as an issue.

- Less-Obvious Costs – Many aspects of everyday life are more expensive for people living with disabilities. For example, a pair of orthotic shoes may cost three times what a pair of standard shoes costs. A diet that minimizes the effects of a problem like diabetes can be much more expensive than a regular diet, even though the foods themselves are not special.

- Hard-to-Quantify Costs – These costs are even less obvious but still can have a major impact. Limited mobility is just one example. If there are locations you can’t access or aren’t friendly toward people with disabilities, you can’t live or work in those areas.

Maximizing your earning potential

As a person living with disability, you likely have higher expenses and face unique challenges in the workplace. This makes maximizing your earning potential important if you want a comfortable life. Fortunately, there are many things you can do to maximize your earning potential and otherwise make your money go further.

The first step is to…

Decide if a job is right for you

The ADA (Americans with Disabilities Act) protects you against outright discrimination, but you still need to meet the basic qualifications of the job.

- Decide if a particular job is right for you – You’ll need to carefully research the specific requirements of the job, then consider your ability to meet those requirements.

- Check the employer’s disability policy – You’ll need to consider a potential employer’s disability policy and your specific circumstances before signing on to a job. Make sure that the policy will meet your needs and that you will be able to comply with the policy as well.

- Consider working remotely or freelance – Many jobs outside the traditional office environment hold potential as well. Whether you are looking for full-time income or to supplement your existing position, home-based jobs such as a writer, medical transcriptionist or call center staff could provide the additional income you need while still accommodating your disability.

- Consider working for the federal government – They actively recruit and hire people with disabilities. They even have a system that can place persons with disabilities directly in positions without enduring the usual competitive process. For more information on working for the Federal Government, visit this Office of Personnel Management page.

Apply for grants and loans

Federal and state governments have grant and loan programs in place to help people with disabilities. These resources can help you with everything from making ends meet to starting your own business. For example:

- Accion – This global nonprofit organization provides financial services and loans to those who would otherwise have difficulties acquiring them, like those with disabilities.

- Special Housing Adaptation (SHA) – Grants for veterans to adapt their home to better accommodate their disability or to buy an already-adapted home.

- Pell Grants – While not specifically targeted at the disabled, Pell Grants can provide significant help toward a college education.

As these three examples show, there are a wide range of programs that can help you with your financial needs. But you need to find and successfully apply for the programs that meet your needs. To start your search for government grants and loans, you want to begin at Benefits.gov. Their Benefits Finder tool makes it easy to search the over 1,200 federal and state benefit and assistance programs.

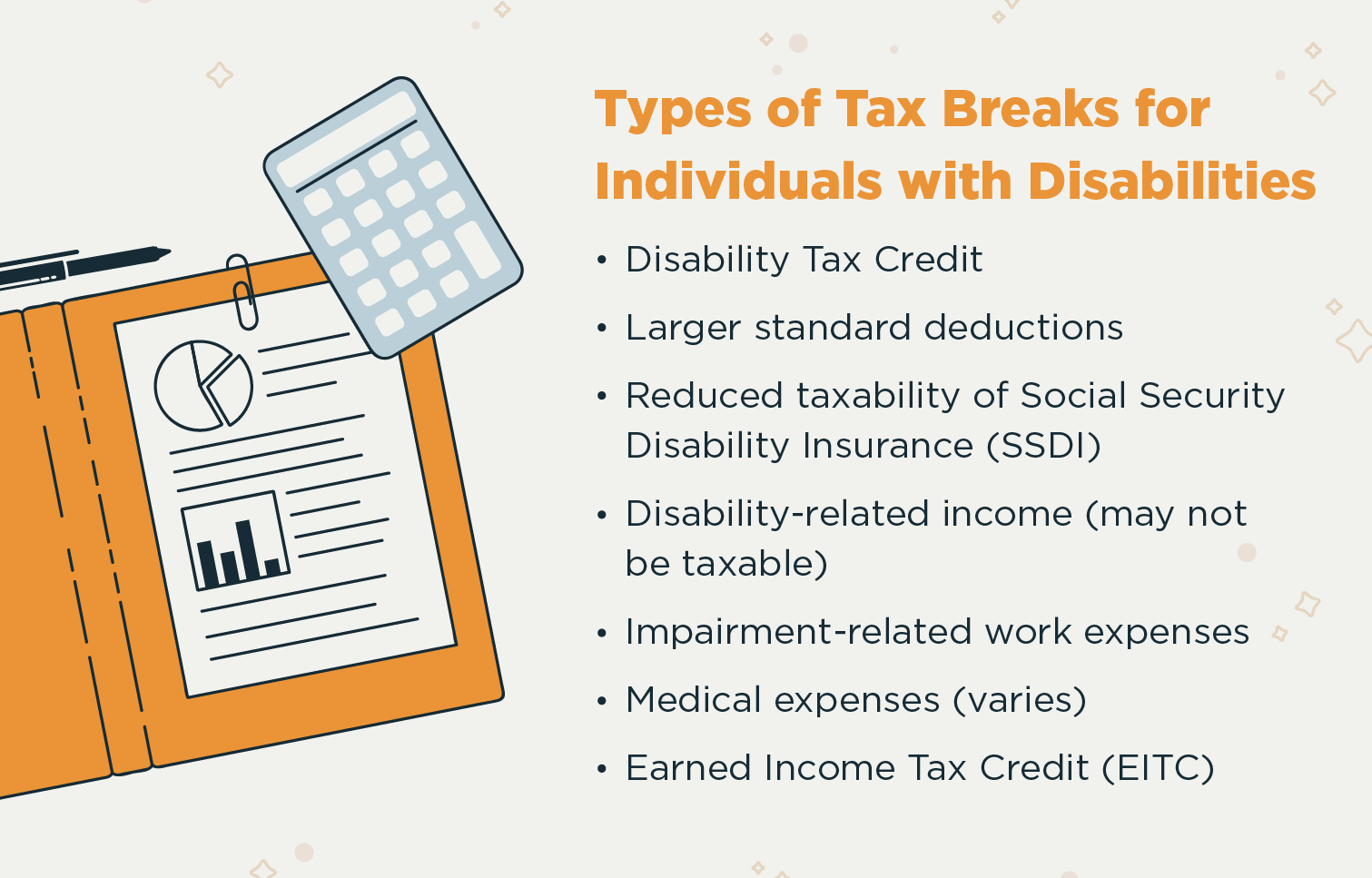

Take advantage of tax breaks

People living with disabilities are entitled to a wide range of tax breaks. Tax law is complicated, and you will need to work with your accountant to take advantage of the possibilities. Here are some of the tax breaks you may be entitled to:

- The Disability Tax Credit – This is available to every citizen and resident 65 or older at any time during the tax year. This tax break also applies to those who are permanently and completely disabled.

- Larger standard deductions for the blind – This is available to individuals who are legally blind. The Internal Revenue Service (IRS) considers legal blindness as a visual field of less than 20 degrees, vision that cannot be corrected to 20/200 with corrective lenses or those who have no eyesight at all.

- Social Security Disability Income (SSDI) – You may qualify for reduced taxability of your SSDI. This, of course, is based on other sources of income you might have, and in some cases your SSDI may not be taxable.

- Impairment-related work expenses – You can deduct impairment-related work expenses. These are ordinary and necessary business expenses that aid you at your place of work. Other expenses that are necessary for you to be able to work would fall under this category as well.

- Medical expenses – These are deductible beyond a certain percentage of income. Medical expenses are considered deductible if they primarily alleviate or prevent a physical or mental defect or illness. On the other hand, they do not include expenses that are merely beneficial to general health, such as vitamins or a vaccination.

- The Earned Income Tax Credit (EITC) – This credit is available to all low-income workers, disabled or not.

- An ABLE account – This is a tax-advantaged savings account for individuals with disabilities and their families. An ABLE account helps individuals save for medical expenses without reducing their eligibility for government benefits.

Remember that each state has its own tax laws that don’t always correspond to the federal laws. You may find that your state provides different breaks than the federal government does. An accountant would be able to help you figure this out.

Take advantage of discounts

Governments, nonprofits and businesses offer a huge range of discounts for people with disabilities. As usual, the trick is finding them. In this case, the first thing to do is simply to ask them if they offer discounts for people with your particular disabilities. Not all organizations that offer disabled discounts publicize those discounts, so it is on you to inquire.

Get aid from online programs – You can also search online for programs that might suit your needs. The local or national chapter of nonprofit organizations that address your disability may be able to point you to appropriate discount programs.

Utilize online websites to find discounts – Sites like Disability-Grants.org offer links to hundreds of discount programs. Some sites like this charge a monthly or yearly membership fee, while others rely on commissions or advertising income for funding. Below are additional sites that can help you find discounts:

There are several different types of discounts these resources can offer. Below are types of disabled discounts you can look for both online and in-person:

- Recreational activities – Many movie theaters, theme parks, zoos and other larger admission activities offer a discount to people with disabilities.

- Utilities – Utility companies may offer discounts on gas, water and electricity to people with disabilities.

- Home modifications – Various organizations from local to the federal level offer assistance paying for home improvement and assistive technology.

- Reading services – Online resources and libraries offer audiobooks and equipment for those with visual or physical impairments.

- Phones – TEDPA offers free amplified telephones to those with hearing impairments.

Note that eligibility requirements for disabled discount programs vary widely. Some programs require documents proving your disabled status, while others will simply take your word for it. Dealing with these programs can be a headache, but the savings can be substantial.

Open a PASS account

The Social Security Administration administers the PASS (Plan to Achieve Self-Support) program. It is designed to help disabled persons return to work and consequently reduce or eliminate their need for government support.

How to set up a PASS account

- Decide on your work goal and find out how long it will take to complete.

- Determine the items and services necessary to achieve your work goal and obtain several cost estimates for those items and services.

- Detail how you will keep your plan’s funds separate from any other money you have. The easiest way to do this is to open a separate bank account for the money you save under your plan.

- Complete all the questions on the form SSA-545-BK, sign it and date it. Make sure that your correct address and phone number are on the form. If your goal is self-employment, you must also submit a business plan.

- Bring or mail the form to the Social Security office.

You can get help in setting up a plan from a vocational rehabilitation (VR) counselor, an organization that helps people with disabilities, Benefits Specialists or Protection and Advocacy organizations who have contracts with the Social Security Administration, Employment Networks involved in the Ticket to Work program or your local Social Security office.

Contact a local SSA office, SSA work site or third parties mentioned above to get a PASS form to complete.

PASS lets a disabled individual set aside money and things he or she owns to pay for items or services needed to achieve a specific work goal. To qualify for PASS, you either need to receive SSI or you could qualify for SSI after setting aside income or resources so you can pursue a work goal.

Getting insured

One common concern for people living with disabilities is getting insurance. Life insurance and disability insurance are particular concerns. Fortunately, having a disability doesn’t automatically prevent you from getting these types of insurance.

Life insurance

Insurance companies consider many factors when deciding whether to offer life insurance to a person. If your health is generally good, and your disability is not severe, the chances are high that you can get coverage through a regular policy. The premiums might be higher than you would like, and there might be restrictions or additional waiting periods, but you would be covered.

Know that you have options even if your applications for coverage are denied by traditional insurers.

- Employer-offered life insurance – Your employer might offer a plan as part of their normal compensation package. Many of these packages automatically accept all employees. Be aware that in this case you will only be covered while you remain employed at the company.

- Guaranteed issue life insurance policy – This might be something you consider as a last option.These plans are offered by some companies, and offer coverage to anyone, regardless of their medical condition or disabilities. The drawback here is that the premiums are likely to be quite high compared to a traditional policy.

Disability insurance

If your disability does not prevent you from working, then you should invest in disability insurance to protect you in case you’re prevented from working for any reason. While the ins and outs of disability insurance can be hard to understand, here are the basics.

The first thing to understand is the difference between short-term and long-term disability insurance.

- Short-term disability insurance is designed to cover you when you will be out of work for a few months. Short-term policies can be expensive, but you can replace them altogether if you have set aside an emergency fund.

- Long-term disability insurance covers you when you are out of work longer. This kind of disability insurance is the most important since you may need to depend on it for years. While you can survive being out of work for a few months, going without a job for years without a support system will hurt your finances.

There are two main ways to get disability insurance: a group plan through your employer or a individual plan you purchase independently.

- Group plans – These offered through employers are usually one-size-fits-all. You’ll need to evaluate your employer’s plan to see if it will work for you or not. If you change jobs, you’ll need to go through the whole process again with your new employer. These plans usually accept all employees automatically and are much less expensive than those you purchase individually.

- Individual plans – These plans are almost always going to be much more expensive group plans. However, they are not tied to a particular employer, so you can change jobs without changing your policy. Individual plans are also more flexible than group plans as far as the terms of the policy. You may be able to customize such a policy to better meet your specific needs.

If you choose a group plan where your employer pays a portion of the premiums, any benefits you receive will likely be considered taxable income. If you choose an individual plan and pay the premiums yourself, any benefits you receive from the plan are tax-free.

Making large life purchases

Making large life purchases can be extra challenging for people with disabilities due to greater expenses and possibly limited income. But there are programs and services out there aimed at helping the disabled do things like buying a home or a car.

Buying a home

The federal government, many states and even some nonprofit organizations offer programs that can help disabled persons buy a home. The benefits they offer range from counseling on the available options in your area to low down payments and reduced interest rates.

Here are some of the major programs available to help you buy a home.

- The Home Ownership Voucher program from the department of Housing and Urban Development (HUD)

- The Fannie Mae Community Home Ready program

- The Department of Veterans Affairs Specially Adapted Housing grant program

- Habitat for Humanity (they sometimes builds houses for disabled people and can help with reduced expenses and accommodative construction techniques)

Buying a car

The ability to drive can be necessary in much of the United States, depending on where you live. This presents a particular problem for persons with disabilities in that they may not physically be capable of driving a standard vehicle. But there are grant and loan programs available to help with this, whether the issue is a lack of money to purchase a regular car or a need for a car that is modified to meet the specific needs of your disability.

Owning a car can also present problems when it comes to eligibility for government assistance. This is an area that you will want to explore with a special needs planner to ensure you get the maximum benefits entitled to you without running afoul of any government regulations.

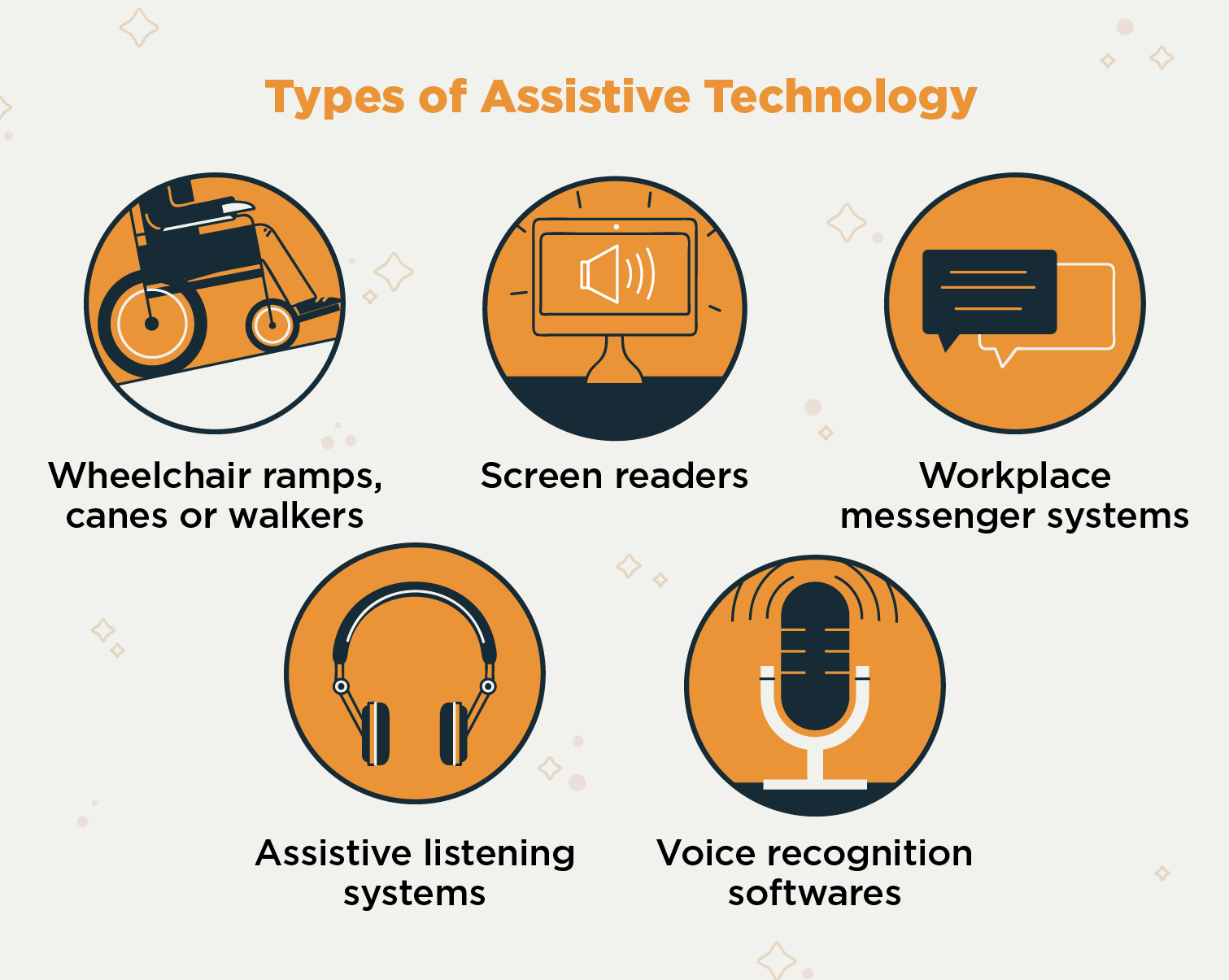

Assistive technology

The Assistive Technology Act of 2004 provides funding to the states so they can provide aid to people living with disabilities. The Act defines an assistive technology device as:

“…any item, piece of equipment, or product system, whether acquired commercially, modified, or customized, that is used to increase, maintain, or improve functional capabilities of individuals with disabilities. (29 U.S.C. Sec 2202(2))”

This definition covers everything from canes and accessibility improvements in your home to medical equipment and technology like hearing aids, voice recognition devices and talking ATMs.

While a wide range of devices covered under the law, each state has its own jurisdiction, making it hard to provide detailed information here. Your best bet is to visit the AT3 Center website and search the program directory for Assistive Technology programs in your state.

Supporting children with disabilities

Providing support for a child with disabilities can be an enormous job, as well as a major financial responsibility. Consult the CDC’s Family Caregivers page for a good overview of the general approach to supporting a child with disabilities.

Much of the information and resources listed elsewhere in this guide can be of use for a child with disabilities, especially when they are older. That said, one area that is particularly important when supporting them is financial planning for their future.

Financial planning for the future

As a caregiver for a child with disabilities, you have to plan for a future where you may not be able to continue providing care. Three tools that you can use to do this are:

- A Letter of Intent

- An ABLE account

- A Special Needs Trust

A Letter of Intent is a document that will help future caregivers care for your child with disabilities if and when you are no longer able to do so yourself. It will usually describe your child’s current situation along with your hopes and dreams for your child’s future. A Letter of Intent can be quite long and detailed, and include additional information about your family and your child.

An ABLE Account is a tax-advantaged way to save for a disabled person’s future medical needs. Starting and funding one for a child greatly increases the chance that money will be available for medical problems in the future.

A Special Needs Trust is a way to pass on resources to your child with disabilities without interfering with their ability to receive government benefits. You give resources to the trust instead of your child. The Trustee of the trust then uses the resources in the trust to provide goods and services to your child.

Because your child doesn’t control the trust and receives no cash from the trust directly, the resources in the trust do not interfere with your child’s ability to participate in other support programs. While you can legally draw up your own trust documents, you will probably want to work with an attorney who has experience creating Special Needs Trusts to ensure that it is set up correctly.

Paying for college for students with disabilities

There are numerous programs and services designed to make sure that students with disabilities can afford to attend college.

Two specific aspects of paying for college you want to investigate early in the process are colleges that provide federal, state and private financial aid for students with disabilities and the best universities and colleges for students with disabilities.

Federal, state and private financial aid

Thanks to the Americans with Disabilities Act (ADA), most colleges and universities offer programs for the disabled. You can contact schools your child is interested in and ask about the aid programs available. Your child’s high school guidance counselor should also be able to help find relevant financial aid programs.

Universities and colleges for the disabled

While most colleges and universities provide some programs for people with disabilities, others go much further. They provide comprehensive programs designed to provide additional support to students with disabilities.

VeryWellHealth.com and College-Scholarships.com both provide extensive lists of these colleges and universities.

While living with a disability can throw obstacles to good financial planning, you have a huge variety of resources available to help you deal with those obstacles. Whether the issue is living within your means, growing your income, paying for big-ticket items like a house or an education (for yourself or your child with disabilities) or providing insurance against disasters, there are public and private resources to help you.